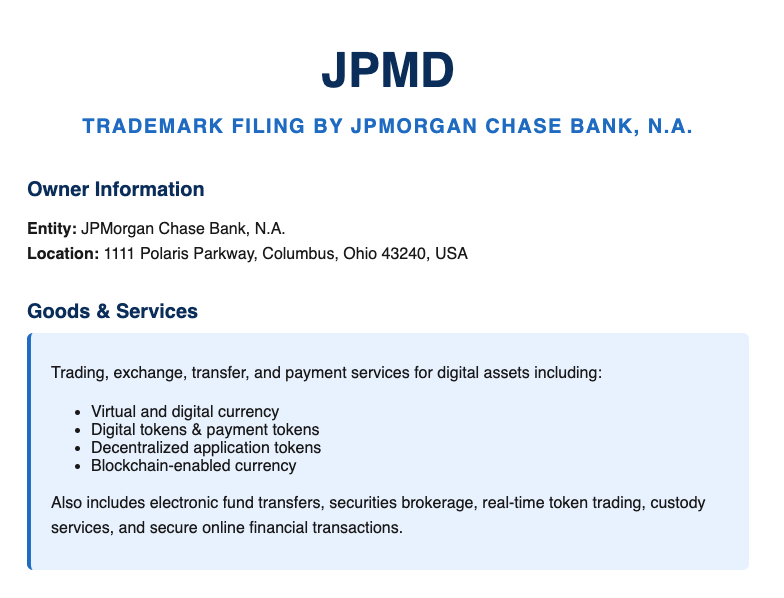

JPMorgan Chase, the largest bank in the U.S., has filed a new trademark application that hints at launching a digital currency or stablecoin named “JPMD.” According to the filing, JPMorgan plans to offer a wide range of digital asset services, including trading, transferring, and payment functions using virtual currencies. The services will cover digital tokens, payment tokens, decentralized app tokens, and blockchain-based currencies.

The trademark also includes financial operations like electronic fund transfers, real-time token trading, securities brokerage, and digital custody services. In short, JPMorgan appears to be building a comprehensive platform for secure online digital asset management.

This move suggests that JPMorgan is getting ready to issue a stablecoin, a kind of cryptocurrency that doesn’t fluctuate as much in value as coins such as Bitcoin. Stablecoins are typically collateralized by real money such as the US dollar, and they are good for running daily transactions.

Experts believe this could be part of JPMorgan’s plan to improve its digital services and make financial transactions faster and cheaper. If launched, JPMD could help both regular users and big companies move money more easily using blockchain technology.

This isn’t JPMorgan’s first move into blockchain. The bank previously launched JPM Coin, a digital token used internally for moving funds between institutional clients. This move could put JPMorgan in direct competition with other players like PayPal, which launched its own stablecoin PYUSD , and Circle’s USDC.