Crypto Market Loses $1 Billion as Israel Reportedly Attacks Iran

The crypto market lost $1 billion in liquidations after Israel reportedly struck Iran, triggering sharp drops in Bitcoin, Solana, Pi Network, and more.

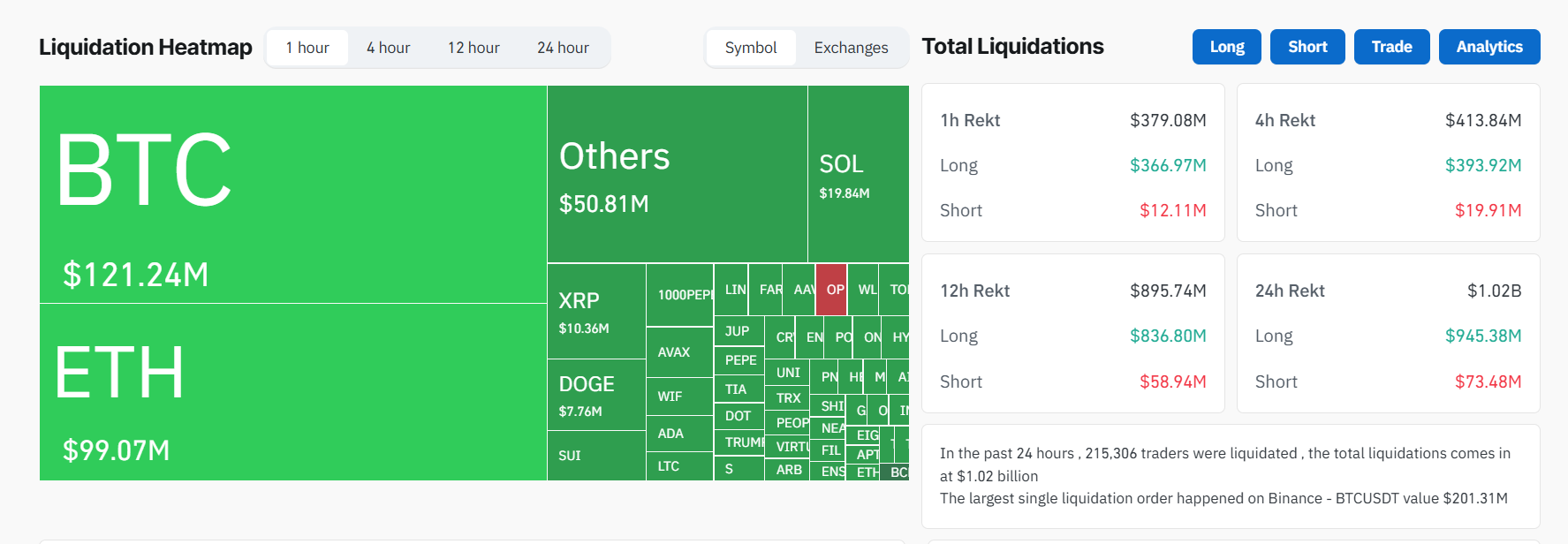

According to confirmed reports, Israel has launched a ‘pre-emptive strike’ on Tehran and declared a state of emergency. This rapid escalation of the conflict drove mass liquidations in the crypto market.According to Coinglass data, nearly $1 billion has been liquidated from the crypto market in the past 24 hours, with most of the liquidation taking place in the last hour. The overall market is down by 8%.At the time of this report, Bitcoin had nosedived from $108,000 to $103,500. However, altcoins have suffered the harshest blow.

Crypto Liquidation Heatmap. Source:

Coinglass

Crypto Liquidation Heatmap. Source:

Coinglass

Since the first reports of Israel’s strike, Pi Network dropped a staggering 16% within an hour. Solana and Cardano have also dropped 5%.

Earlier on Thursday, BeInCrypto reported that any escalation in the Iran-Israel conflict would have a significant impact on the crypto market due to FUD.Banking giant JP Morgan earlier said that an Israel-Iran war would drive oil price and almost double US inflation to 5%.

BREAKING: US stock market futures fall sharply after loud explosions are heard in Iran’s capital, Tehran.Sirens are also now sounding across Israel. pic.twitter.com/yncMMGjFnx

— The Kobeissi Letter (@KobeissiLetter) June 13, 2025

Tomorrow’s stock market reaction and further progression of the conflict will be pivotal for the crypto market’s direction.This is a developing story.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)