Bitcoin ETF inflows hit $5.2b as all-time high fuels institutional demand

In May, key trends in crypto centered on institutional interest in Bitcoin and Ethereum ETFs, driven by positive regulatory developments.

Strong inflows into Bitcoin (BTC) and Ethereum (ETH) exchange traded funds coincided with Bitcoin reaching a new all-time high in May. According to a Binance Research report , released on June 5, crypto markets remained resilient despite volatility triggered by uncertainty around U.S. trade policy.

Heightened volatility led to nearly $1 billion in liquidations following the trade agreement between the U.S. and the U.K. An additional $183 million in liquidations occurred after the U.S. announced a tariff pause on the European Union.

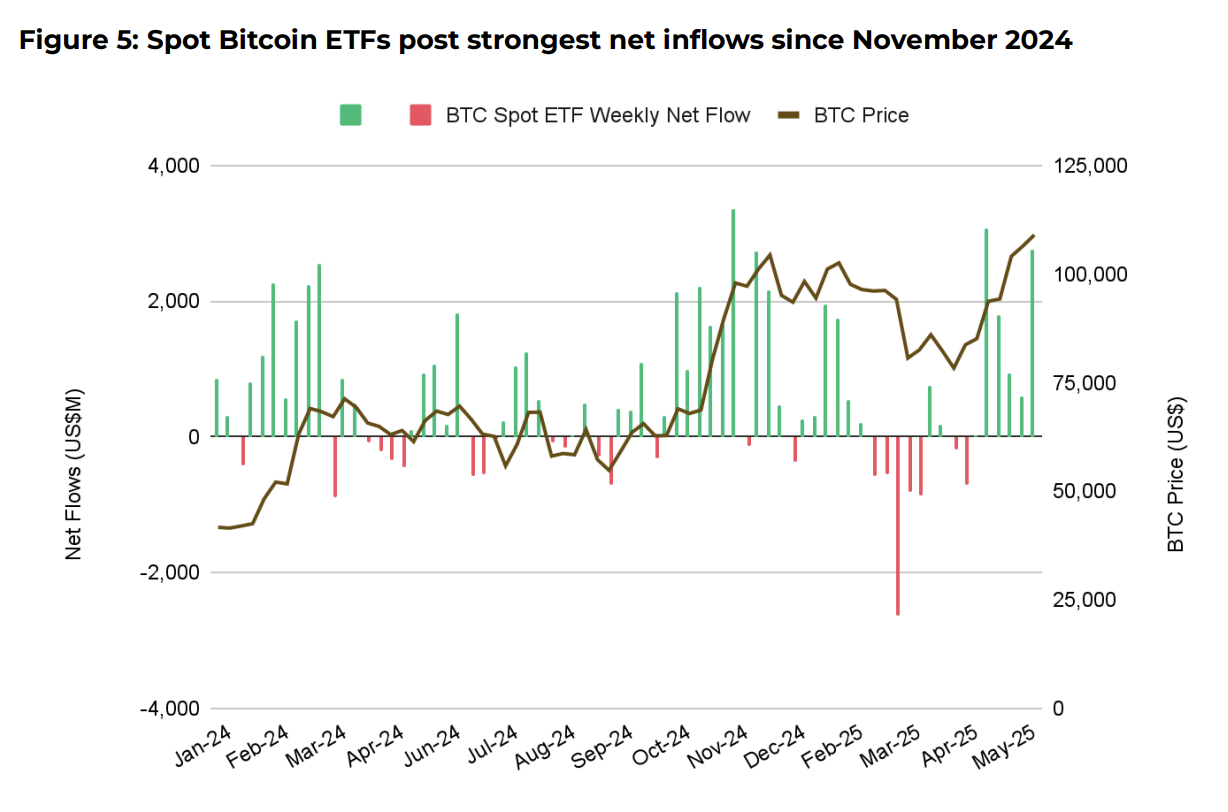

Despite the large volume of liquidations, interest in Bitcoin ETFs remained robust. These products attracted $5.2 billion in net inflows, the highest level since November 2024. Notably, these inflows coincided with Bitcoin hitting its all-time high of $111,970 on May 22.

Monthly net inflows for Bitcoin and Ethereum ETFs | Source: Binance Research

Monthly net inflows for Bitcoin and Ethereum ETFs | Source: Binance Research

ETF inflows were largely supported by positive regulatory momentum. In the U.S. Senate, the GENIUS Act gained traction, proposing the first stablecoin regulation framework in the country. The report also cited growing regulatory support for stablecoins in Hong Kong.

DeFi outperforms Bitcoin: Binance Research

Among ETF products, BlackRock’s iShares Bitcoin Trust (IBIT) led the field, attracting nearly 100% of the total net inflows in May. In contrast, Grayscale’s GBTC saw $320 million in net outflows, indicating a potential winner-takes-all trend.

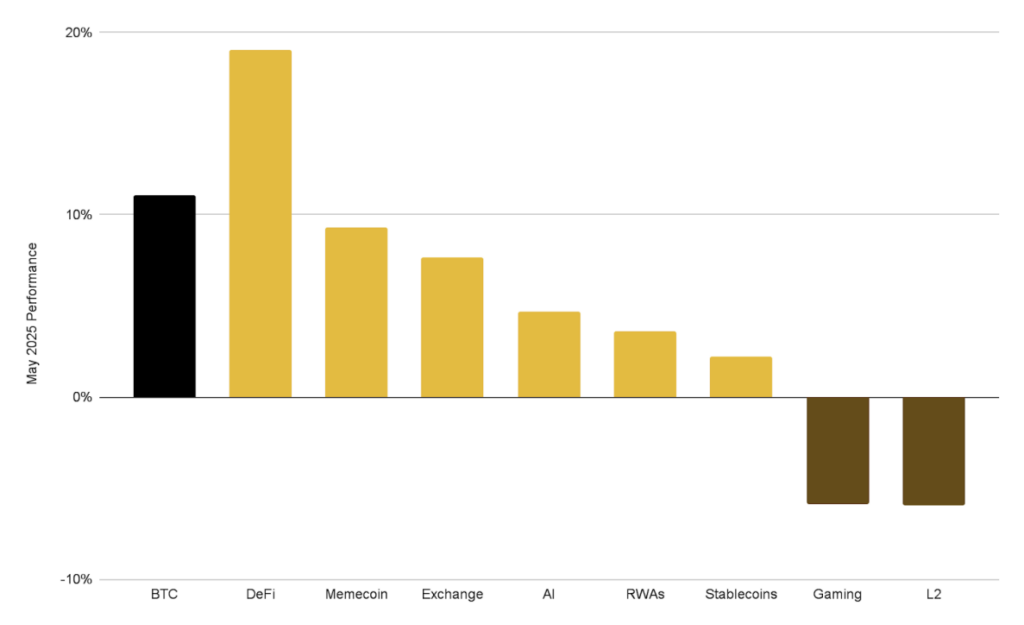

DeFi was the only major sector to outperform Bitcoin in May, recording 19% growth versus BTC’s 11.1% gain. Additionally, total value locked in DeFi protocols reached its highest level since early February.

Performance of major crypto market segments in May | Source: Binance Research

Performance of major crypto market segments in May | Source: Binance Research

Bitcoin also experienced a surge in demand from corporate treasuries. As of May, 116 public companies held 809,100 BTC. Bitcoin’s all-time high, along with favorable regulatory developments, has intensified corporate interest. Companies like Trump Media reportedly invested billions in BTC to enhance investor appeal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Planck (PLANCK) in the Innovation, AI and DePIN Zone

Buy PLAI,Get 100% fee rebate in PLAI!

Bitget to support loan and margin functions for select assets in unified account

Bitget launches cross margin trading for BGB/USDT and BGB/USDC