Stablecoins Surpass $250 Billion as Global Regulatory Advances

- Stablecoin capitalization exceeds US$250 billion

- US and Hong Kong laws accelerate use of stablecoins

- DeFi and TradFi boost dollar-pegged stablecoins

The total market capitalization of stablecoins has reached a historic $250 billion, according to data from CoinGecko. The amount represents a significant consolidation of these digital assets, with emphasis on dollar-backed stablecoins, which total approximately US$245,5 billion. USDT, issued by Tether, leads the way with US$153 billion in capitalization, followed by Circle's USDC, with approximately US$60,9 billion.

— Paolo Ardoino 🤖 (@paoloardoino) May 31, 2025

For Hank Huang, CEO of Kronos Research, this milestone represents a watershed moment. “Crossing $250 billion marks a turning point. Stablecoins are no longer experimental, they are essential,” said the executive.

Experts attribute this growth to increasing regulatory clarity and the integration of stablecoins into decentralized finance (DeFi) applications. Nick Ruck, director of research at LVRG, noted that these factors have driven the global adoption of these stablecoins.

In the United States, the Senate recently passed the GENIUS Act (Guidance and National Innovation for US Stablecoins), establishing strict criteria for issuers. The proposal requires full backing in dollars or liquid assets, annual audits for issuers with capital above US$50 billion, and specific regulations for foreign entities operating in the country.

In parallel, Hong Kong passed its own legislation on May 21, creating a mandatory licensing system for fiat stablecoin issuers. The move broadens the legal framework for operations in the Asian region and reinforces the legitimacy of the sector.

Regulatory progress has also attracted traditional financial institutions (TradFi). Major banks such as JPMorgan, Bank of America, CitiGroup and Wells Fargo are reportedly evaluating a joint stablecoin project, according to market sources.

Meanwhile, the DeFi ecosystem continues to expand. Data from DefiLlama shows that the total value locked has surpassed $113 billion. Last month, trading volume on decentralized exchanges (DEXs) accounted for 25% of all spot transaction volume, surpassing previous highs.

Hashed CEO Simon Kim noted that “this demonstrates a clear paradigm shift from centralization to decentralization.” Huang also foresees changes in the current dominance of stablecoins. “The stablecoin sector is poised for rapid expansion, with the market potentially doubling in size by 2026,” he added, highlighting the potential rise of new issuers, including bank tokens and the recently launched Donald Trump-aligned USD1.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go?

XRP News Today: Ripple Moves 65M XRP as Market Remains Under Pressure

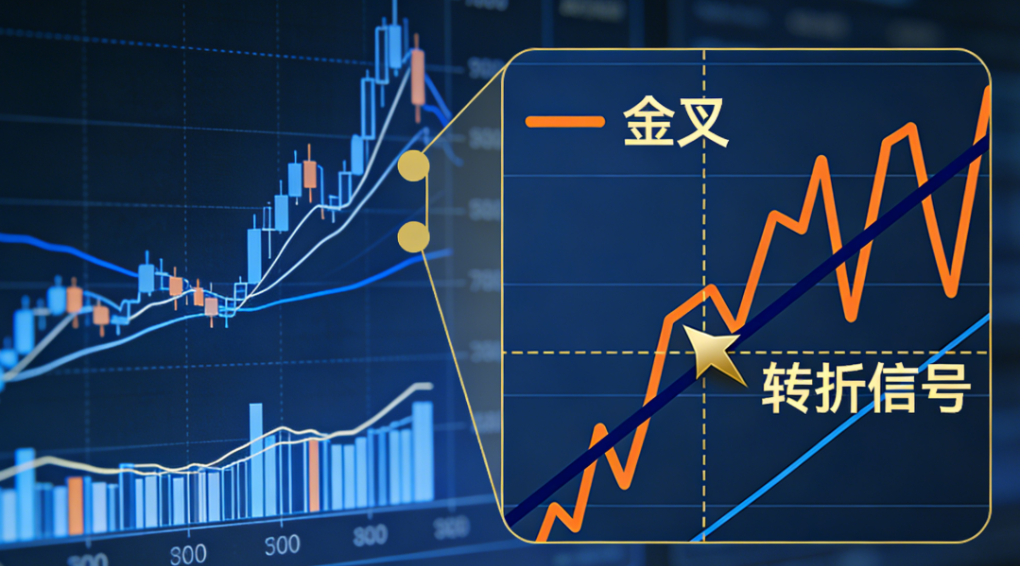

A rare "golden cross" appears, signaling a technical turning point for the US dollar