-

Recent analysis reveals that Bitcoin’s trajectory is poised for upward movement, driven by significant metrics that highlight accumulation trends among large investors.

-

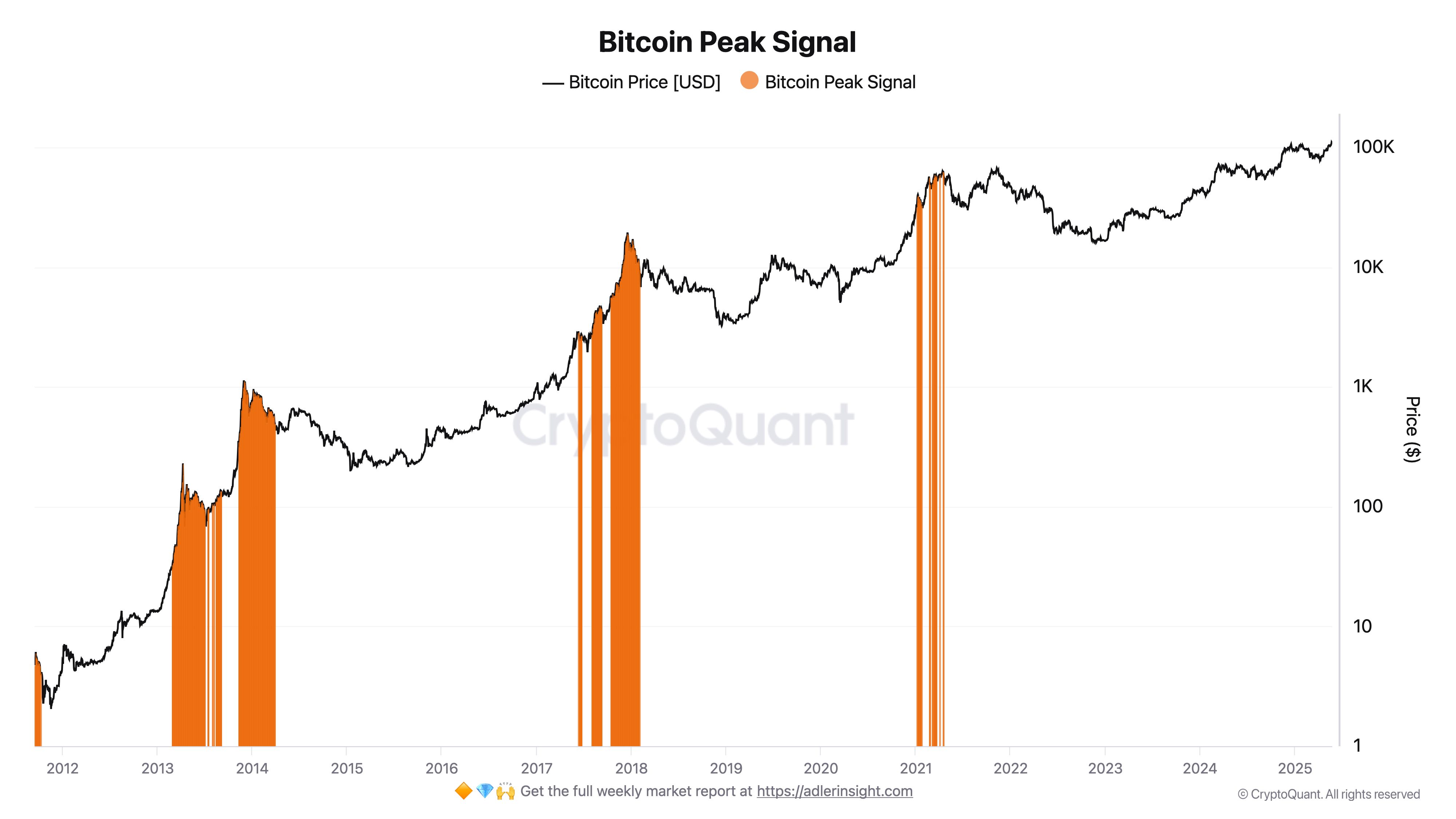

Amid these developments, analysts project that the current BTC cycle peak may unfold in the fall of 2025, presenting opportunities for strategic investment.

-

“The market is responding to underlying bullish signals,” noted crypto analyst Axel Adler, shedding light on these recent trends.

This article explores the bullish sentiment surrounding Bitcoin as analysts signal potential price increases ahead, focusing on key market metrics.

Bitcoin’s Bullish Indicators Signal Future Uptrend

Recent analyses point toward a robust bullish sentiment for Bitcoin, driven largely by intricate movements among large holders, often referred to as “smart money.” A surge in accumulation rather than liquidation has emerged, as large investors seemingly absorb retail sell pressure. This dynamic suggests a potentially fruitful phase for long-term holders, particularly as the market cycles indicate an estimated peak in late 2025.

The Role of Major Metrics in Predicting Trends

Analyst insights underscore the importance of tracking key metrics to gauge market sentiment. For instance, the advanced net UTXO Supply Ratio—an indicator of how Bitcoin is held or moved—showed substantial absorption of profits among the larger player base without whipping up panic selling among retail investors. Conversely, the market price remains below historical extremes, suggesting room for future appreciation.

Source: Axel Adler Insights

Market Sentiment Underneath the Surface

A deeper analysis of the current sentiment shows two intertwined factors contributing to the bullish outlook: negative exchange net flow and a declining Taker Buy-Sell Ratio. Negative exchange net flow suggests that Bitcoin is being accumulated rather than sold, while a falling Taker Buy-Sell Ratio indicates that more aggressive sellers have recently dominated the market. This behavior further validates the idea of retail de-risking as profit-taking activities commence.

Source: CryptoQuant Insights

Conclusion

In conclusion, the current market dynamics indicate a positive outlook for Bitcoin, with smart money accumulating amidst retail selling. While volatility remains a constant reality in crypto markets, the absence of large inflows to exchanges suggests that panic selling is unlikely. Bullish indicators are strengthening, with the potential for strategic gains as the market continues to evolve. Investors should closely monitor these developing trends to navigate the shifting landscape of the cryptocurrency market effectively.