Analysis: The Current Bitcoin Rally is Led by Institutions, While Retail Investors Remain Cautious

Coindesk analyst Aoyon Ashraf stated that Bitcoin reached an all-time high this week, primarily driven by institutions, with retail investors almost "absent" from this rally. A quick search for "Bitcoin" as a keyword on Google Trends reveals that the search frenzy seen during the 2021 bull market is now completely absent.

Although there was a brief wave of retail enthusiasm during the U.S. presidential election, when a rapid Meme coin frenzy briefly ignited market sentiment, that wave of enthusiasm has long since faded. Despite Bitcoin breaking through $111,000 this week to reach an all-time high, Meme coin prices quickly fell, and retail enthusiasm cooled accordingly.

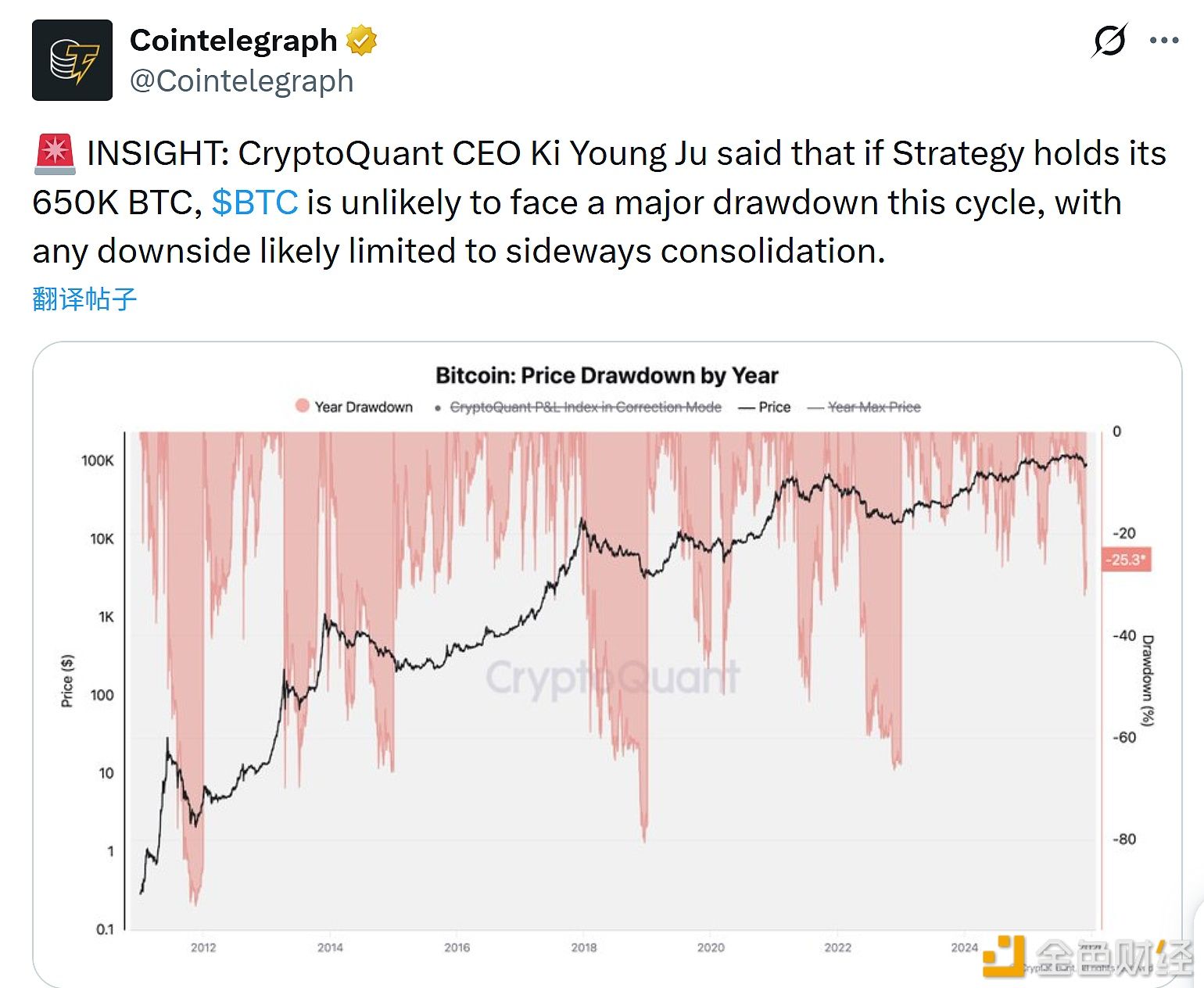

Even though Bitcoin has reached an all-time high, traders remain cautious, as evidenced by lower funding rates and increased short positions. The current market sentiment shows a trend towards more sustainable trading behavior, which could pave the way for long-term gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WisdomTree launches the first fully staked Ethereum ETP backed by stETH

Aster releases roadmap for the first half of 2026, with Aster Chain mainnet to launch in Q1

Data: Strategy Bitcoin monthly purchase volume plummeted from last year's peak of 134,000 to 9,100.