Huma Finance Unveils Tokenomics, Allocates 5% Airdrop

Huma Finance steps into the PayFi spotlight with bold tokenomics and a 5% HUMA token airdrop, despite mixed community reactions. Backed by major VC funding, the protocol targets real-world impact in crypto payments.

Huma Protocol, a platform in the emerging PayFi sector, has officially announced its tokenomics and Season 1 airdrop plan for the HUMA token.

The project has attracted attention from numerous venture capital firms, as the PayFi sector is considered highly promising. However, the current market context shows that retail investors pay less attention to traditional airdrop formats.

Huma Finance Airdrops 5% to Users

PayFi combines instant payments with decentralized finance (DeFi), using blockchain technology to enable fast, efficient, and cost-effective financial transactions.

Huma Protocol aims to lead this trend by integrating DeFi with real-world assets (RWA). The team designed the HUMA token to serve both utility and governance purposes, and encourage community participation to ensure long-term benefits for stakeholders, including users, liquidity providers (LPs), partners, and developers.

Huma Protocol revealed its Season 1 airdrop plan, allocating 5% of the total HUMA supply (500 million tokens) to loyal users. However, many have commented that this allocation seems quite low.

“5% for season 1 airdrop is too less,” Investor CryptoStalker said.

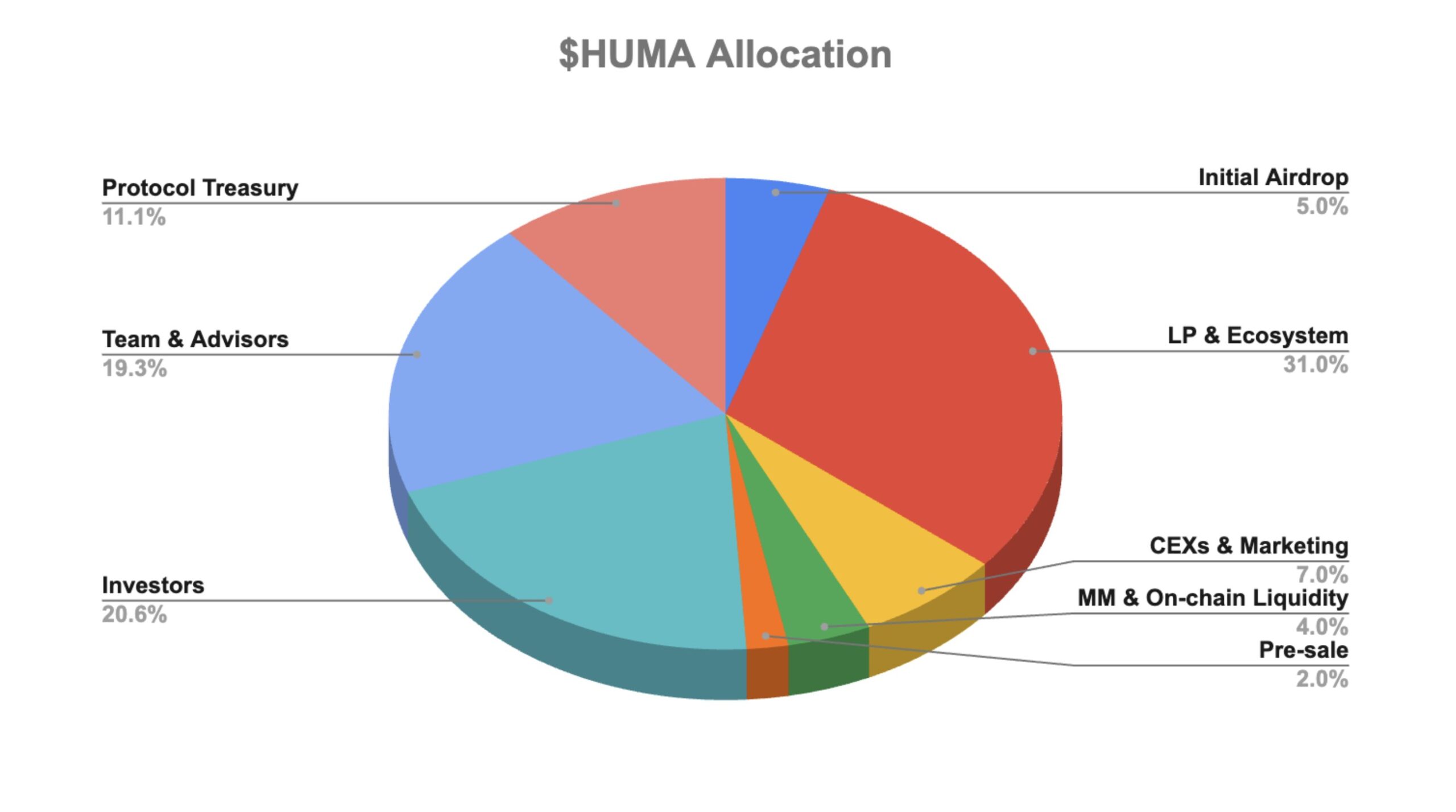

Huma Finance’s Tokenomics. Source:

Huma Finance.

Huma Finance’s Tokenomics. Source:

Huma Finance.

Despite the criticism, the Huma Foundation emphasized that this is just the beginning. The Foundation has planned a second airdrop, allocating 2.1% of the total supply, roughly three months after the token generation event (TGE).

Additionally, the total HUMA supply is capped at 10 billion tokens, and the initial circulating supply will be 17.33%.

Token distribution includes:

- 31% for liquidity providers and the ecosystem,

- 20.6% for investors,

- 19.3% for the team and advisors,

- 11.1% for the protocol treasury.

Furthermore, the release schedule will continue until the end of 2029. Tokens assigned to the team and investors will be locked for 12 months, followed by a three-year vesting period.

HUMA Token Release Schedule. Source:

Huma Finance.

HUMA Token Release Schedule. Source:

Huma Finance.

Allocations for LPs and the ecosystem will decrease by 7% each quarter. These rates may be adjusted through protocol governance.

Huma Finance Faces Both Potential and Challenges

Huma Protocol is expanding as PayFi gains traction. As governments develop crypto- and stablecoin-friendly policies, crypto-based payments could emerge as a mainstream alternative to traditional systems.

“Web2 has a lot of problems, and a centralized payment network is one of them. Slow transactions, high charges, and no user control. But now there’s a solution. Huma Finance is the first PayFi network, which aims to accelerate global payments with instant access to liquidity anywhere and anytime.” Investor Niels remarked.

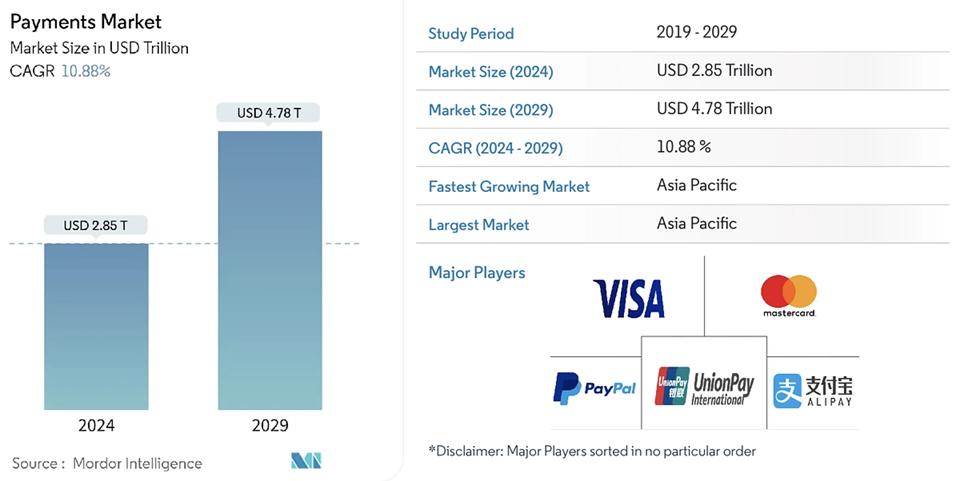

According to a Coingecko report referencing research from Mordor Intelligence, the global payment funding market is anticipated to reach $2.85 trillion in 2024 and grow to $4.78 trillion by 2029.

Payment Market Size Prediction. Source:

Mordor Intelligence

Payment Market Size Prediction. Source:

Mordor Intelligence

“This massive growth highlights the urgent need for scalable, efficient, and accessible financial infrastructure—exactly what PayFi aims to deliver,” the report noted.

Because of this, first movers like Huma Protocol enjoy a competitive advantage. The project has raised over $46 million from investors such as Haskey Capital and Circle.

However, current market conditions have failed to give Huma strong initial momentum. Low airdrop allocations and shifting user interest, driven by newer models like Binance Alpha, have made traditional airdrops less appealing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.