Mobius Token Smart Contract Hack on BNB Chain Drains $2.15 Million

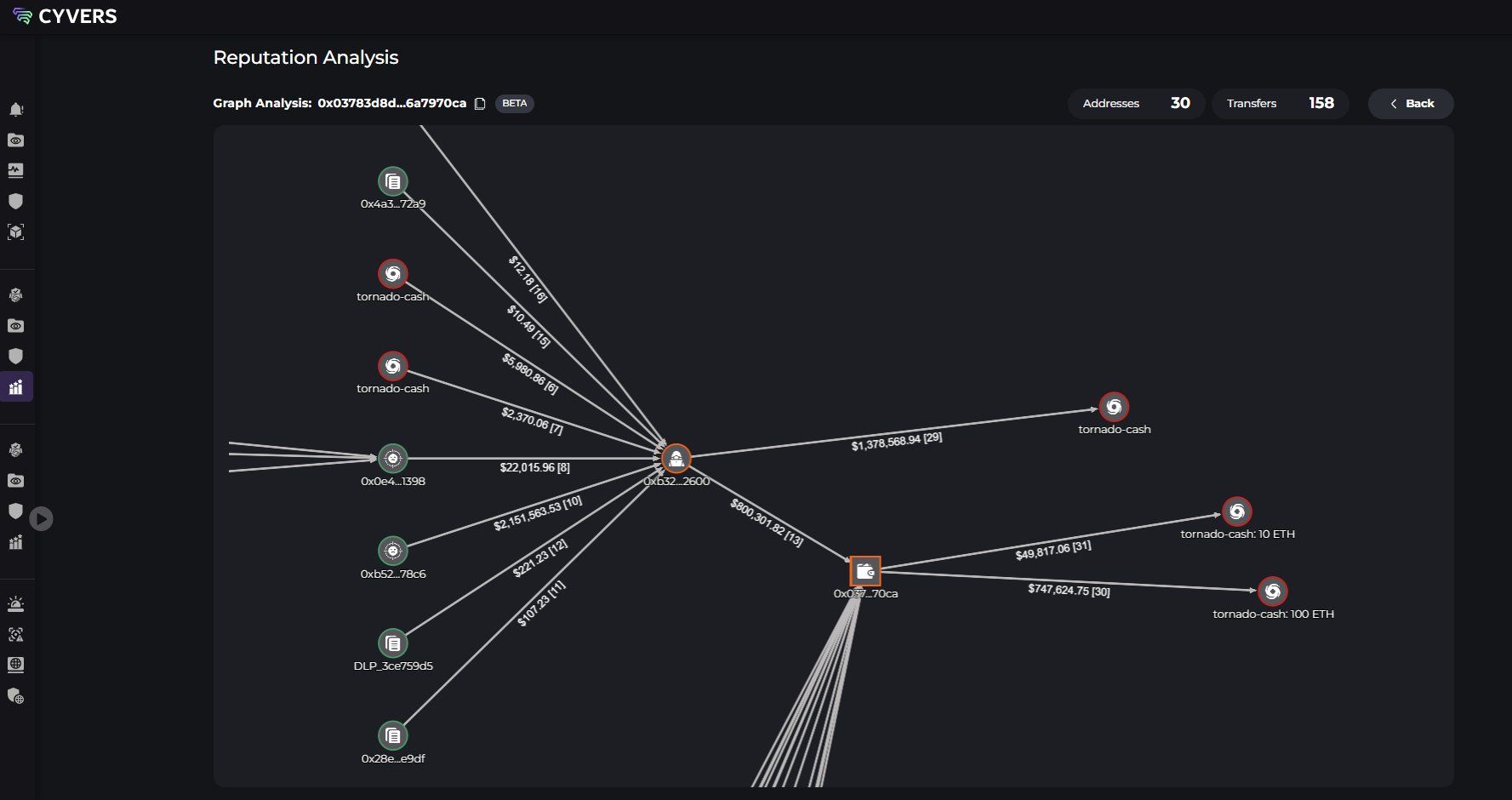

The Mobius attacker used Tornado Cash to obscure the stolen fund flows, making recovery efforts difficult.

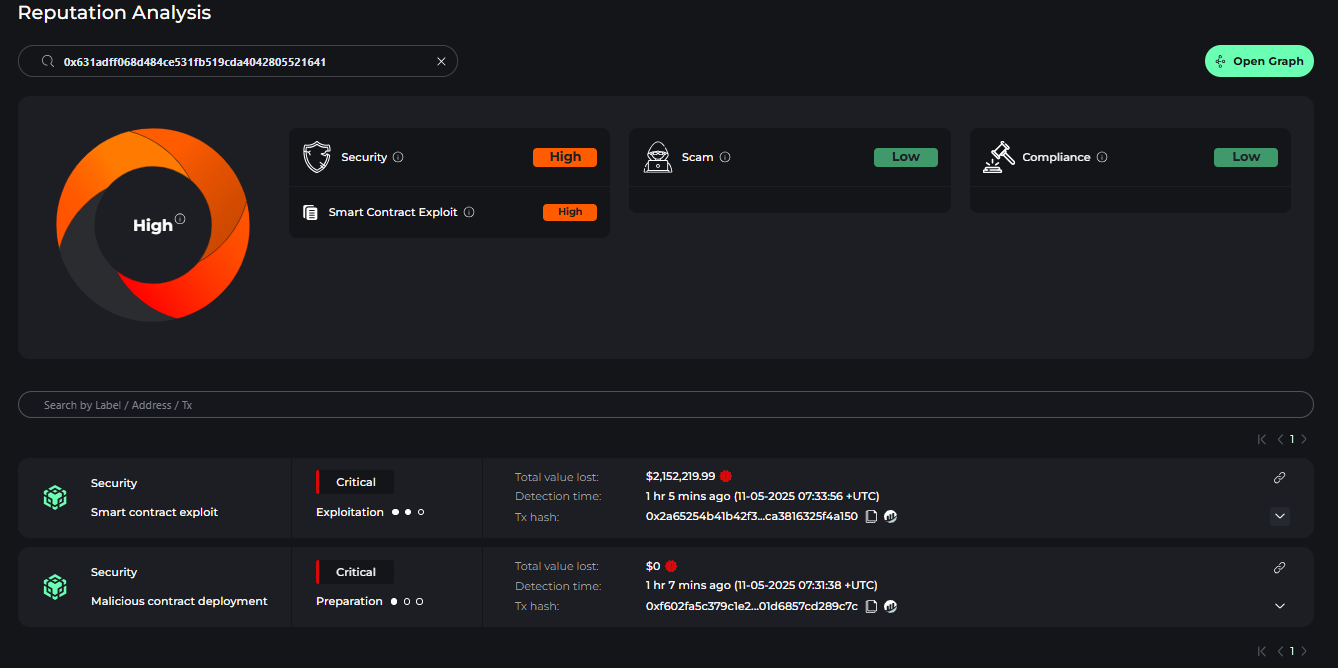

A critical vulnerability in the Mobius Token (MBU) smart contract on BNB Smart Chain has led to a $2.15 million loss, adding to the growing list of crypto-related exploits in 2025. Mobius is a lesser-known project within the BNB ecosystem.

The attack, confirmed by Web3 security firm Cyvers on May 11, involved a malicious hacker who took advantage of a flaw in the MBU minting mechanism.

Mobius Attacker Moves Fund Through Tornado Cash

According to Cyvers, the incident began at 07:31 UTC when a wallet (0xB32A5) deployed a rogue contract. Just two minutes later, another address (0x631adf) initiated a series of suspicious transactions.

Using only 0.001 BNB, the attacker minted 9.73 quadrillion MBU tokens and quickly exchanged them for stablecoins, netting $2.15 million. In the same process, the attacker also gained an additional 28.5 million MBU tokens.

After the exploit, the stolen assets were moved to Tornado Cash, a popular protocol that anonymizes transactions.

Mobius Attacker Fund Flow Through Tornado Cash. Source:

Cyvers

Mobius Attacker Fund Flow Through Tornado Cash. Source:

Cyvers

The method and speed of the exploit point to a calculated move to evade tracking and asset recovery. This incident further highlights the persistent vulnerabilities facing smart contract-based systems.

Meanwhile, this Mobius hack makes it the latest victim in a wave of blockchain exploits that have resulted in the loss of around $2 billion across various platforms, including Bybit.

Funds Drained from Mobius. Source: Cyvers

Funds Drained from Mobius. Source: Cyvers

BNB Chain Activity Surges

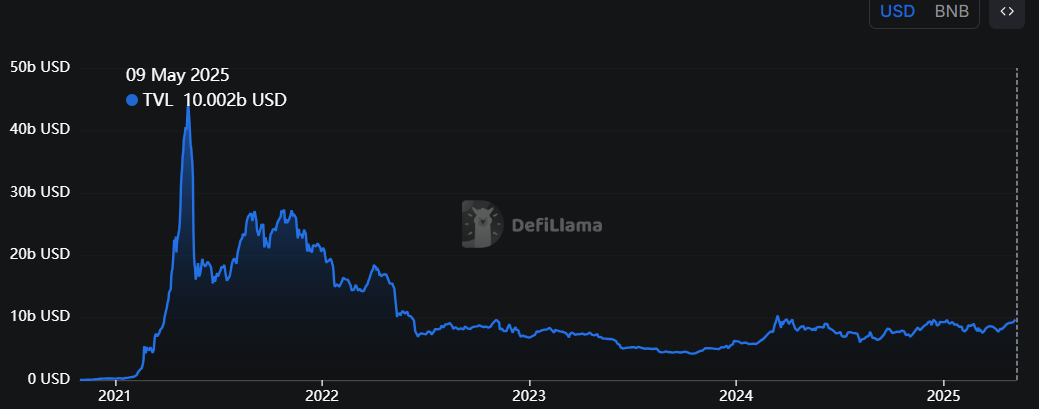

Despite isolated incidents like the Mobius breach, BNB Chain is witnessing a significant resurgence in user and developer activity. Over the past months, the network has reemerged as a top contender in the DeFi space.

Data from DefiLlama shows that the total value locked (TVL) on BNB Chain has surpassed $10 billion, reaching a three-year high. However, it is still significantly below the 2021 all-time high of more than $40 billion.

BNB Chain TVL. Source:

DeFillama

BNB Chain TVL. Source:

DeFillama

BNB Chain also recently claimed the top spot in the decentralized exchange (DEX) sector, outpacing both Ethereum and Solana.

Market observers noted that the network’s growth is fueled by fresh institutional interest, an increase in DeFi participation, and strong demand for on-chain assets.

Moreover, the momentum can also be partly attributed to Binance’s continued influence and Changpeng Zhao’s renewed focus on the blockchain network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.