Understanding Market Expectations Through Historical Crypto TrendsSpotting Market Bottoms with the ‘Buy the Dip’ QueryGoing Against the Crowd with BT

Expectations are a powerful force in shaping financial markets. Yet, they can also be your worst enemy if yours fall into the same category as most. It’s common for the market to move in the opposite direction from what most participants anticipate, and contrarian traders are typically the ones who most commonly come out on top in volatile markets. Recognizing this, Sanbase analyzes user discussions across all major crypto channels, offering a data-driven perspective on the current sentiment and expectations within the crowd.

With Santiment’s tool, you can assess how collective expectations have matched up with actual market movements in the past. This not only provides valuable context but also helps in forecasting potential future changes by recognizing familiar patterns.

As you explore the tool’s graphs, you’ll encounter key metrics such as and . These powerful market indicators both offer insight into the intensity and focus of market conversations, as well as reveal how the subject matter of these conversations transition between topics.

In this article, we’ll explore the primary queries within the tool, helping you gain a comprehensive understanding of market participants’ expectations and how these sentiments play out over time.

Spotting Market Bottoms with the ‘Buy the Dip’ Query

Tracking the frequency of "buy the dip" mentions on social channels helps gauge market sentiment. Spikes in these mentions signal investor optimism, often after temporary rebounds that may still lead to further declines. Low volume of conversations surrounding ‘buying the dip’ reflects fear and can indicate potential buying opportunities. High volume reflects an overly eager crowd that is not yet fearful, meaning the market dip is likely to continue longer. Monitoring this trend with Sanbase provides valuable insights for timing market entry points.

Going Against the Crowd with BTC Price Expectations

Analyzing social chatter about Bitcoin’s future price reveals valuable sentiment signals. Widespread predictions of unrealistically high prices indicate market greed and often precede price pullbacks. In contrast, frequent talk of extremely low prices reflects fear and can signal a potential market bottom. Tracking these patterns with Sanbase helps identify shifts in sentiment for more informed trading decisions. We recommend adjusting the thresholds of these round number price mentions to consistently be around 10-15% above the current market value of Bitcoin, and 10-15% below.

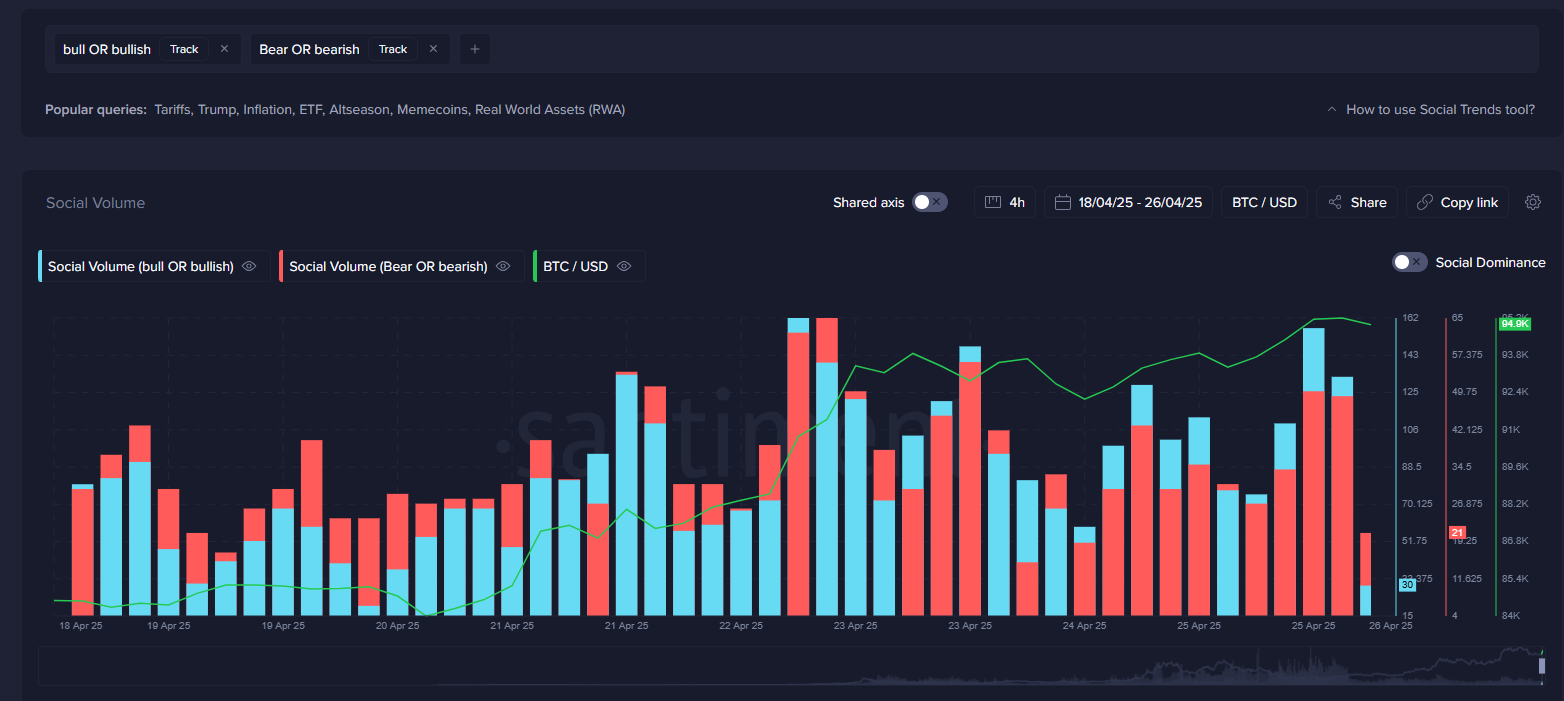

Analyzing Crowd Mentions of Bear or Bull Market

Monitoring how often the crypto community references a "bull market" or "bear market" provides essential insight into prevailing market sentiment. A sudden surge in mentions of a "bull market" typically signals growing optimism, which can sometimes indicate the market is becoming overheated and due for a correction. Conversely, an increasing volume of "bear market" discussions often reflects heightened pessimism and anxiety, which can suggest the market is approaching or has reached a bottom.

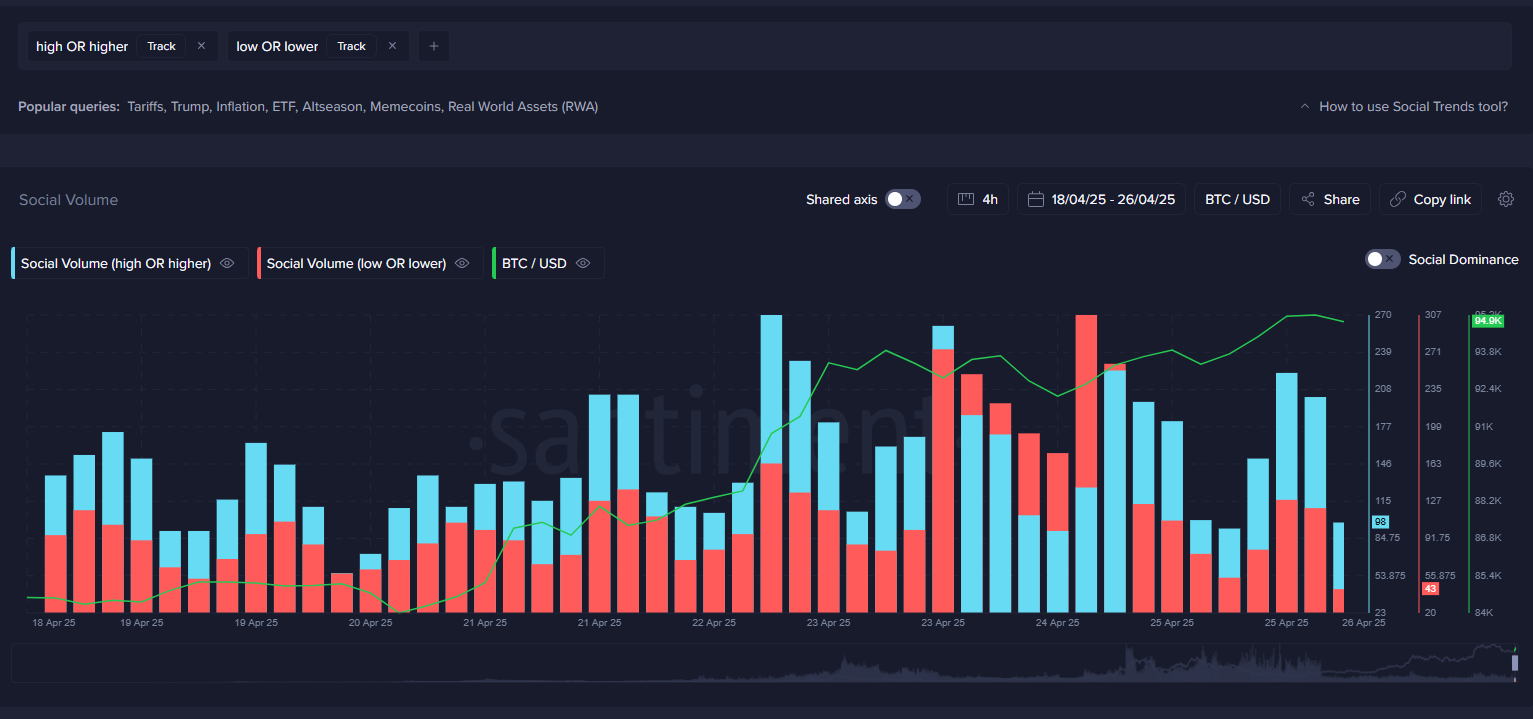

Analyzing Mentions of "Higher" or "Lower" in Price Discussions

Tracking how often traders and market participants mention that prices will go "higher" or "lower" offers valuable clues about market expectations. A spike in conversations predicting that prices will move "higher" often signals growing optimism and bullish sentiment, which can sometimes precede a period of correction as the market becomes overconfident. On the other hand, an increase in mentions of prices moving "lower" tends to reflect rising pessimism or fear, which can point to an oversold market and a possible rebound.

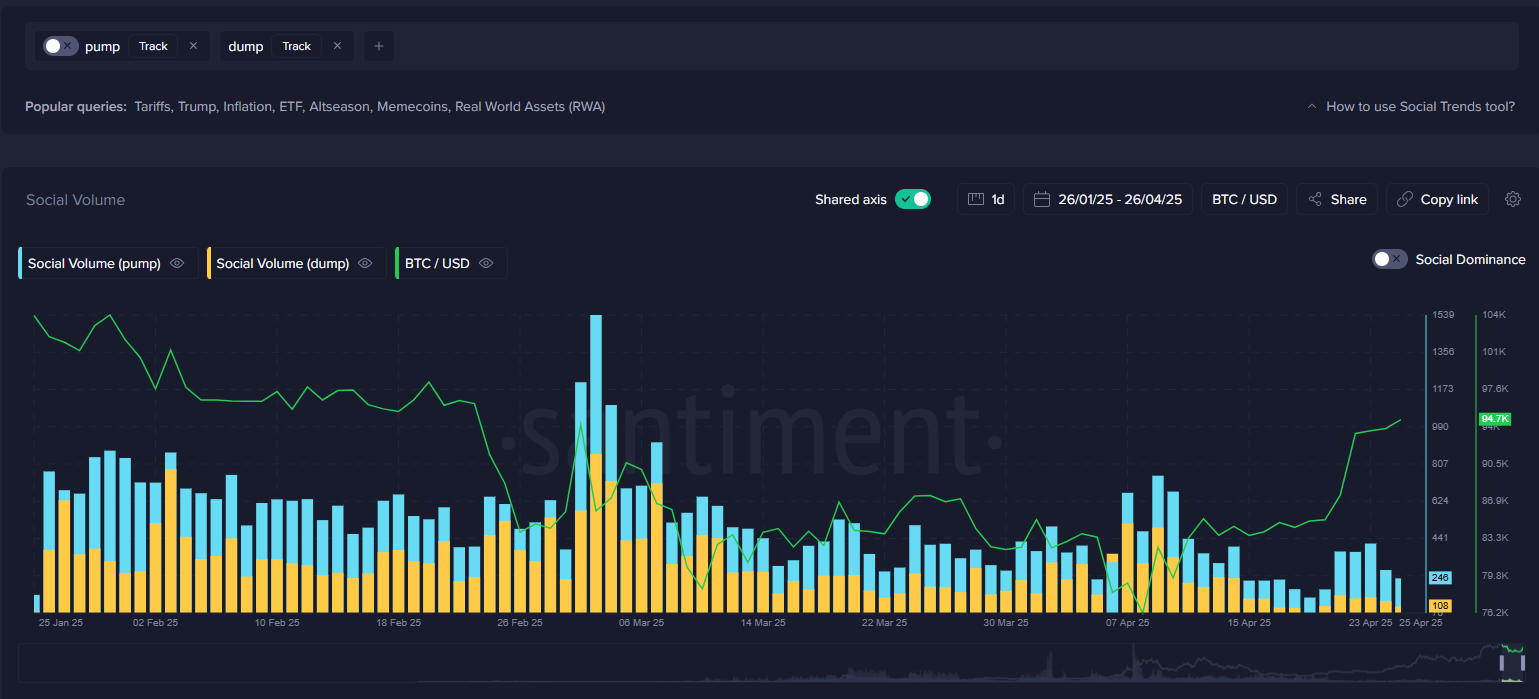

Analyzing Mentions of "Pump" and "Dump" in Market Discussions

Monitoring how frequently the crypto community uses terms like "pump" or "dump" can offer critical insights into crowd behavior and short-term market sentiment. A sudden increase in mentions of a potential "pump" often signals heightened excitement and speculative interest, which can sometimes lead to rapid price surges followed quickly by corrections as enthusiasm fades. Conversely, a rise in "dump" discussions tends to indicate growing anxiety about potential price drops, often surrounding fears of sell-offs or manipulation.

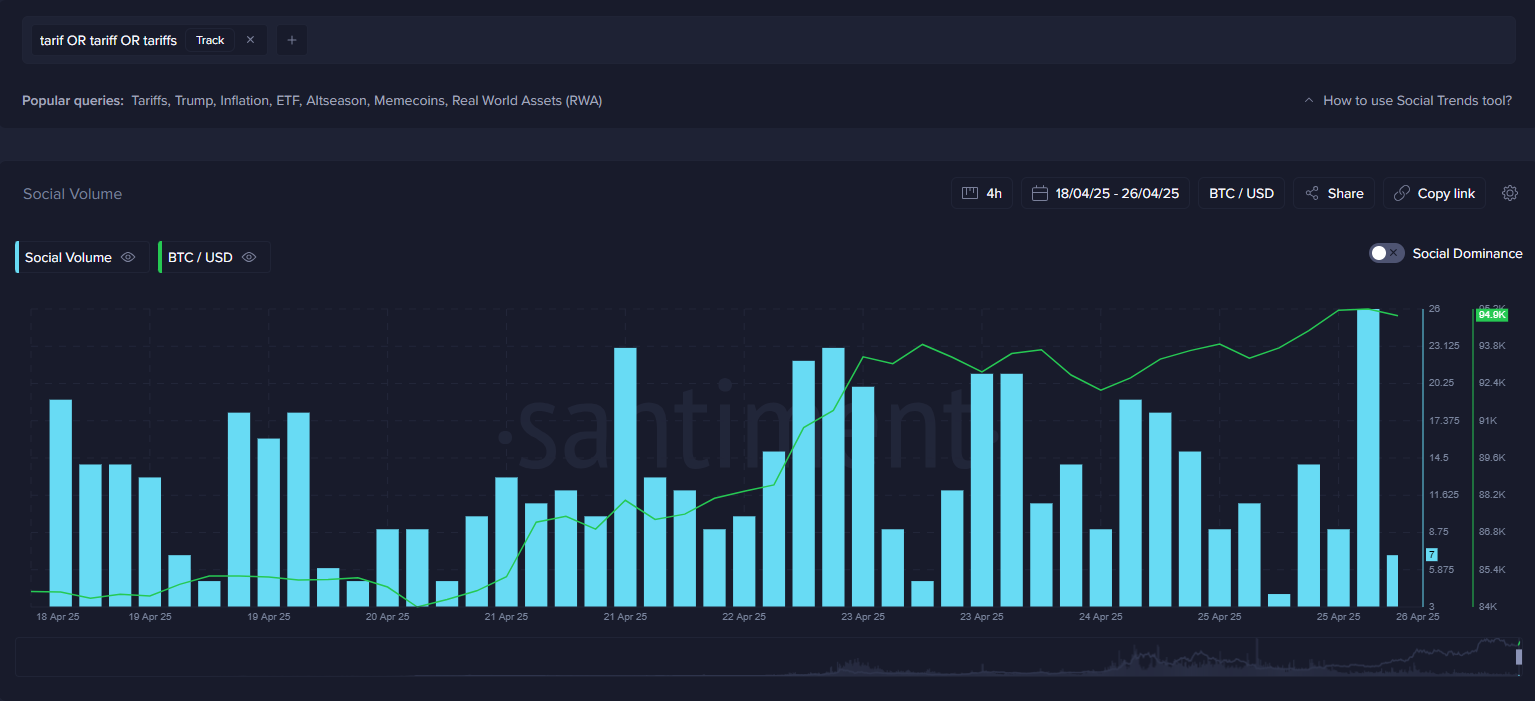

Tariffs

In 2025, Donald Trump introduced tariffs that rocked traders’ opinions about both stock and crypto markets. For the most part, tariffs are discussed at a high frequency whenever there are new developments or changes to countries’ policies on tariffs. These policy changes often coincide with a shift in market direction. Therefore, you can likely find profitable trades by buying if tariff discussions spike while markets had been declining, or selling if tariff discussions spike while markets had been rising.

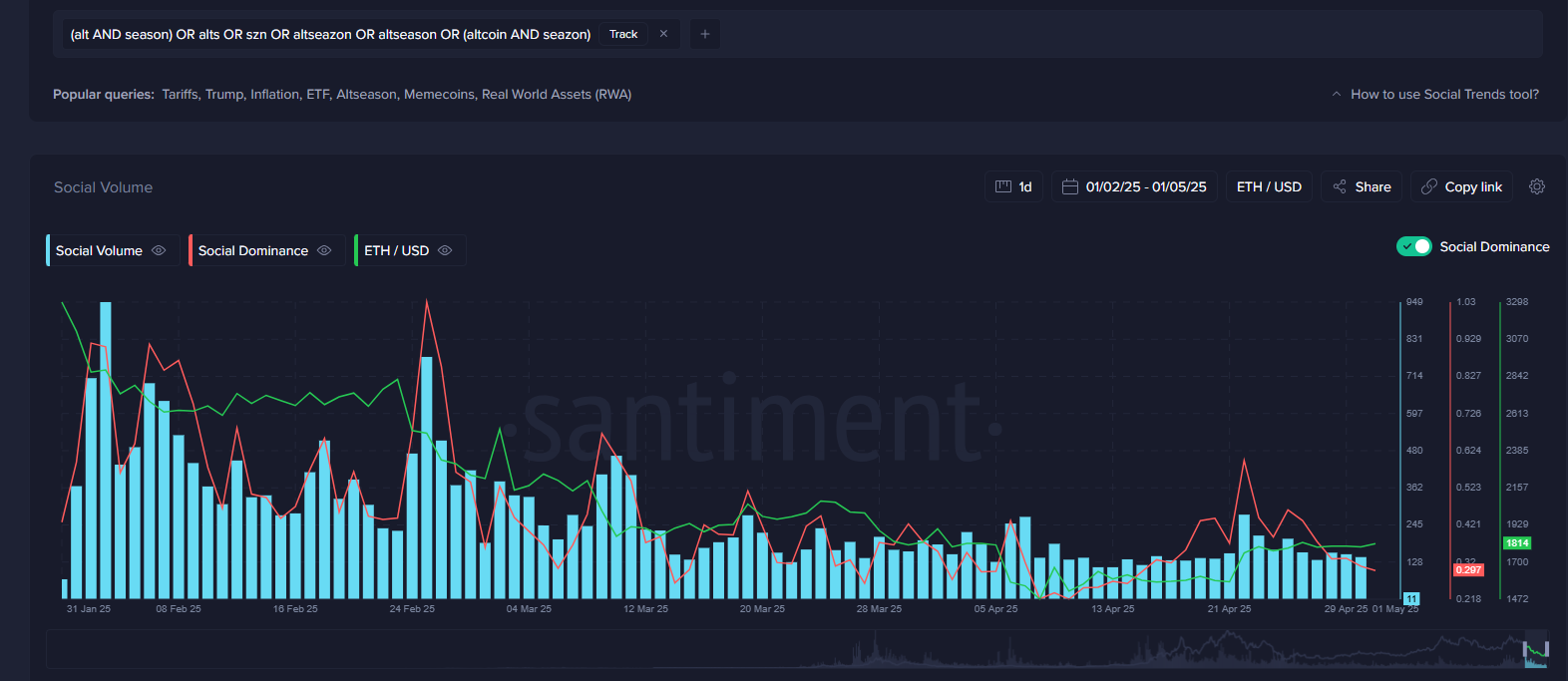

Altseason

When traders begin to become enthralled with altcoins, this is often a reflection of greed or overconfidence in the markets. And if altcoins have been on a prolonged rally, you may see a spike in the term “altseason”. This means that traders are confident enough that the current altcoin rally will continue. Since markets historically move the opposite direction of the crowd’s expectations, you can interpret spikes in “altseason” as a bearish one in almost all cases.

Conclusion

By leveraging tools like , investors and analysts can move beyond guesswork and gain a data-backed understanding of market sentiment. Analyzing custom keyword frequencies on the Social Trends page not only sheds light on current expectations but also equips you to recognize trends and anticipate possible market shifts. Ultimately, incorporating these insights can lead to more informed and confident decision-making in the dynamic world of crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%