Bitcoin Price Dips Below $95K Before FOMC Meeting

- Bitcoin tests $95,000 support ahead of FOMC.

- Market eyes $92,000 as a potential floor.

- Mixed altcoin signals amid Bitcoin correction.

Bitcoin’s dip is pivotal as Fed discussions could alter crypto market trends, reflecting investor sentiment.

Bitcoin is trading at approximately $94,407 after falling below the $95,000 threshold. This market jitter occurs as investors await Federal Reserve indicators from the upcoming meeting. Past precedents of FOMC meetings have shown similar volatility. Reuters Business updates on financial news .

“Bitcoin $BTC is testing support at $95,000. If this level breaks, a pullback toward $92,000 could be next.” —Ali Martinez, Crypto Analyst

Analysts like Ali Martinez and Michaël van de Poppe highlight potential price movements, predicting a pullback towards $92,000 if support fails. The volatility aligns with historical trends from past FOMC deliberations.

The cryptocurrency market exhibits mixed reactions, with Bitcoin’s decline countered by some altcoins showing resilience. Tokens like HYPE and AAVE maintain bullish outlooks despite overall market corrections.

FOMC meetings are known to induce fluctuations due to their influence on monetary policy. Bitcoin’s current support at $95,000 is critical, with the potential to drop to the $91,500-$92,500 range if breached. Zero Hedge discusses market volatility.

Financial experts suggest that outcomes of interest rate discussions could significantly sway market sentiment this year. Historical data supports a heightened volatility pattern around these economic indicators. Visit the Lead Lag Report for economic analysis.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

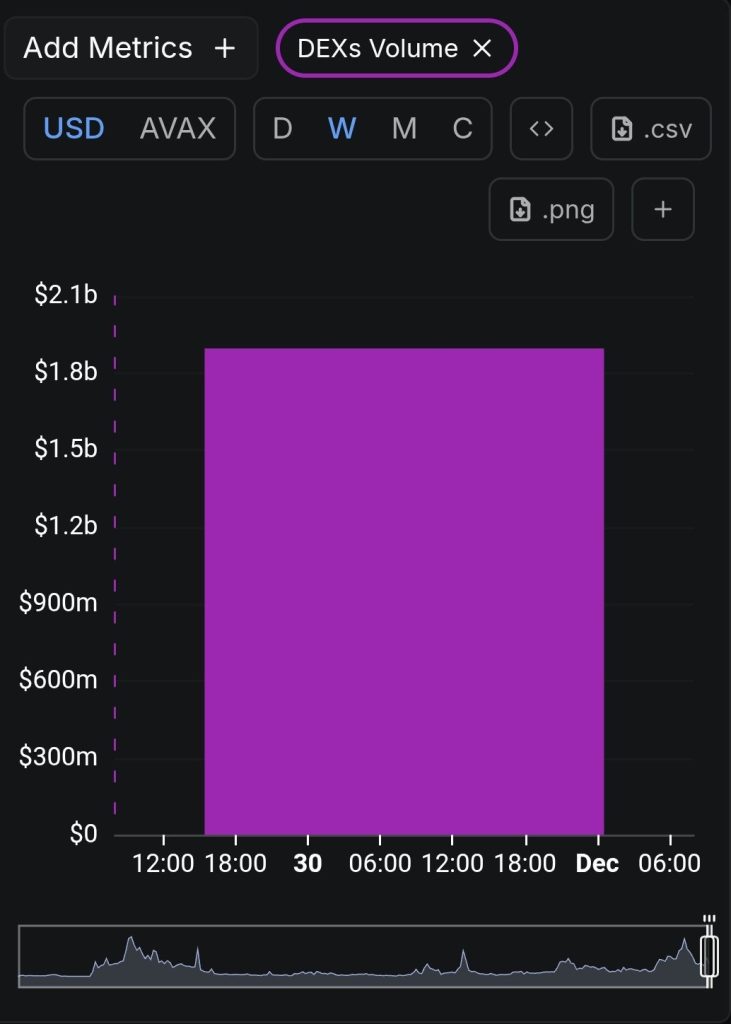

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak