SUI Price Remains Optimistic As 7-Week-Long Death Cross Nears End

SUI has dipped over 10% following a strong rally, but market indicators such as the RSI and nearing golden cross suggest bullish momentum may not be over. Investors are watching for a bounce-back above key levels.

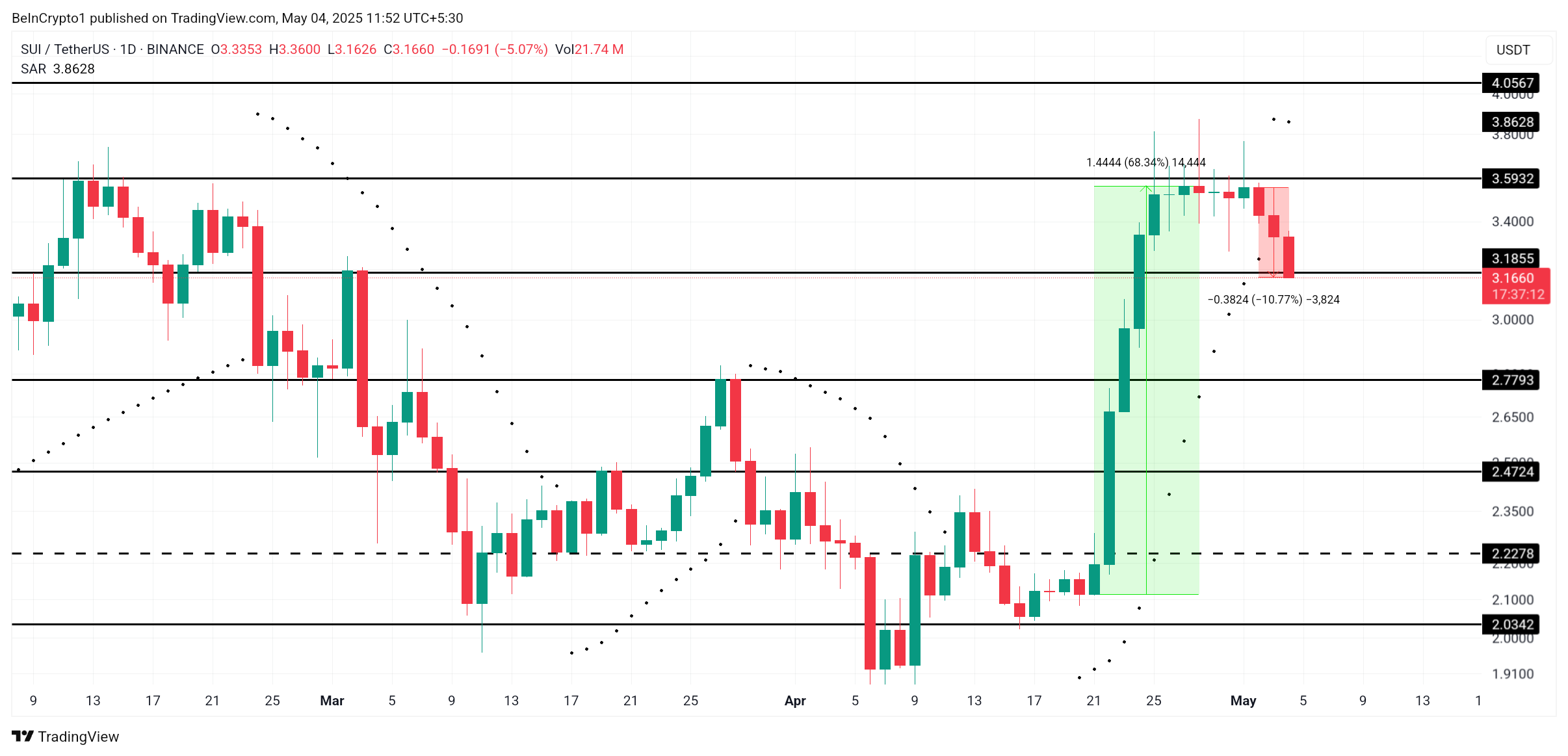

After soaring nearly 70% in recent weeks, SUI has faced a swift correction, shedding 10% of its value over the past three days. Despite strong bullish momentum pushing the altcoin into the spotlight, the sudden pullback hasn’t rattled investors.

The broader outlook for SUI remains intact, with on-chain metrics and market indicators signaling that this drop may be nothing more than a cooldown.

SUI Investors Can Rejoice

The 50-day exponential moving average is on the verge of overtaking the 200-day EMA. This near-crossover suggests SUI could soon witness a golden cross — a strong technical signal indicating a shift in long-term momentum.

Should the crossover complete, it would mark the end of SUI’s death cross that began seven weeks ago.

Such a shift would likely encourage renewed buying pressure. A golden cross often precedes significant rallies, and with SUI’s price having gained nearly 70% prior to the recent drop, bullish sentiment appears far from fading.’

SUI EMAs. Source:

TradingView

SUI EMAs. Source:

TradingView

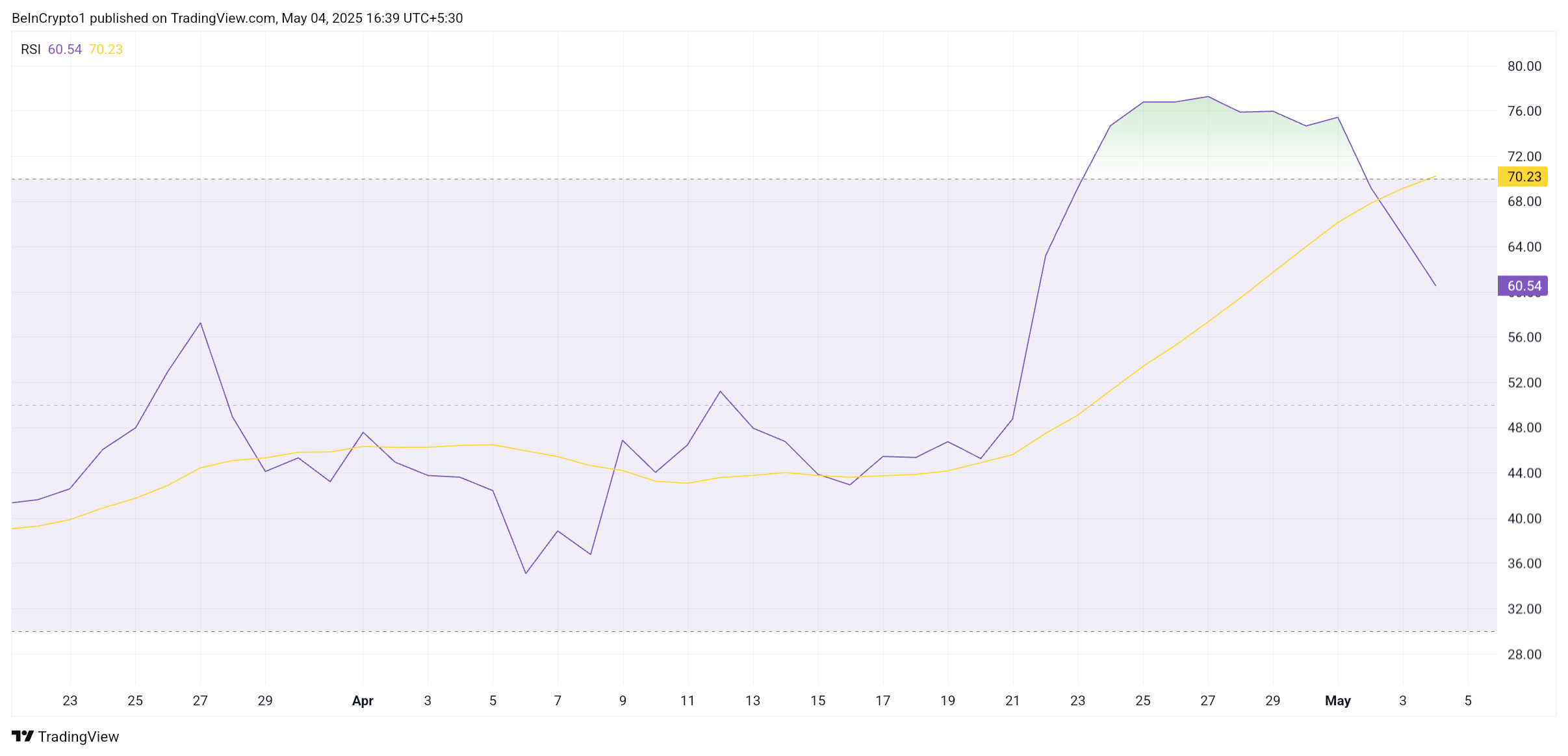

SUI’s relative strength index (RSI) recently breached the overbought threshold, triggering a cooldown as traders took profits. This RSI dip corresponded with the 10% price drop, signaling that the asset was temporarily overheated and needed to stabilize.

Despite the retreat, the RSI remains within bullish territory, hovering just below the overbought zone. This means that while the rally has paused, the overall trend remains intact, and further gains may be on the horizon if buying volume increases again.

SUI RSI. Source:

TradingView

SUI RSI. Source:

TradingView

SUI Price Aims At Bouncing Back

At press time, SUI is trading at $3.16, having slipped below a key support level during the last 24 hours. The 10.77% decline stems from the altcoin’s failure to breach the $3.59 resistance level, compounded by a general market cooldown. Still, the correction is viewed by many traders as temporary.

The broader indicators continue to reflect bullish conditions. The nearing golden cross, resilient RSI, and strong upward momentum all hint that SUI could soon reclaim $3.16 as support. If momentum returns, the asset might retest $3.59 and potentially break past it, resuming its prior recovery path.

SUI Price Analysis. Source:

TradingView

SUI Price Analysis. Source:

TradingView

However, delays in recovery could change the script. Should SUI fail to reclaim $3.16 soon, the altcoin risks slipping further. A failure to breach $3.39 or secure support at $3.18 could send the price tumbling toward $2.77, potentially invalidating the bullish thesis and signaling a trend reversal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage