Analysis: Institutions like BlackRock and Citigroup are driving RWA tokenization into practical application, with Ethereum remaining the main platform

Recently, several institutions such as BlackRock and MultiBank are advancing RWA (Real World Assets) tokenization projects. BlackRock plans to create a blockchain-based digital ledger technology (DLT) share class for its $150 billion Treasury Trust fund to record investors' holdings on the blockchain. Citibank is exploring digital asset custody, and Franklin Templeton has tokenized a money market fund on a public blockchain. RedStone co-founder Marcin Kazmierczak pointed out that these developments indicate that tokenization has moved beyond theoretical discussions and into practical applications by market leaders. Currently, Ethereum remains the main platform for RWA tokenization due to its advantages in ecosystem, developer support, and infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

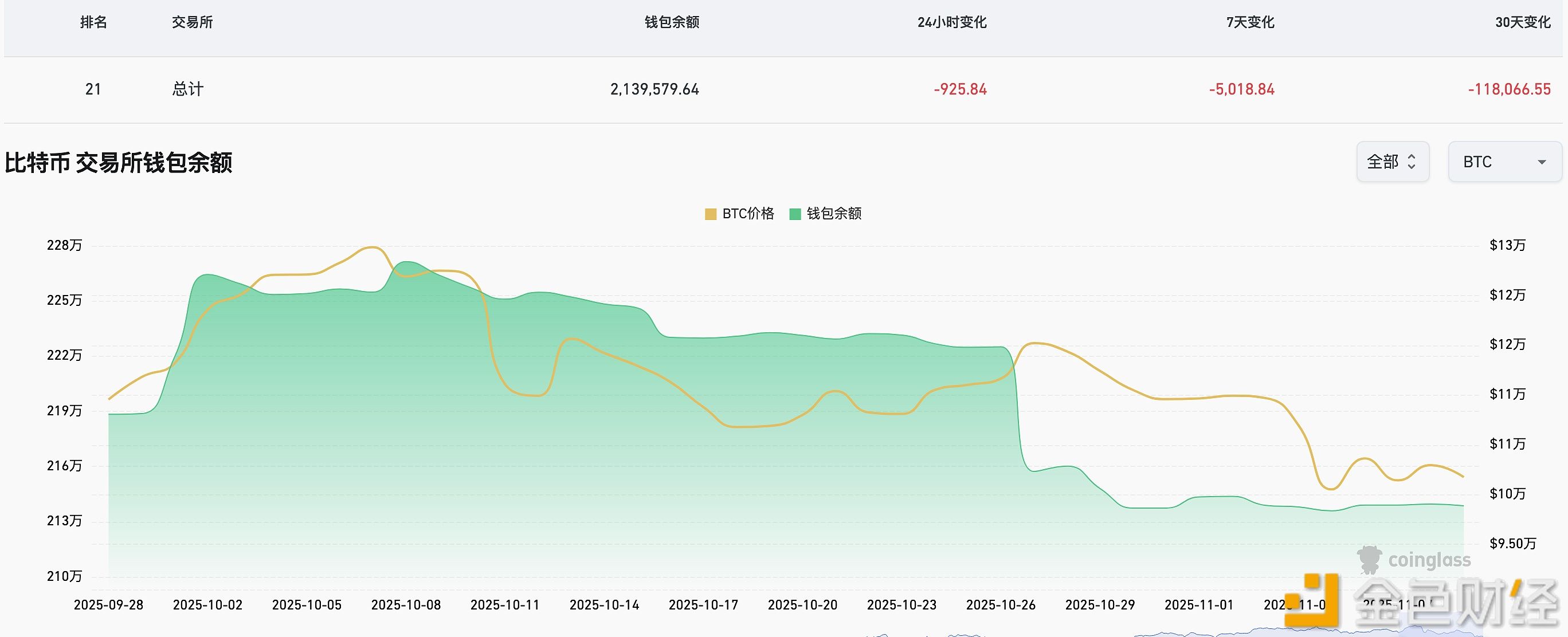

In the past week, 5,018.84 BTC have flowed out of CEX platforms.

RootData: VANA to unlock tokens worth approximately $4.57 million in one week

Analysis: Altseason Signals Hidden in Weeks of Bitcoin Dominance Weakness

Trump Media & Technology Group lost $54.8 million in Q3 and currently holds over 11,500 bitcoins