XRP Whale Activity Surges With Billions in Binance Deposits Per Day

XRP whales are depositing their assets on Binance in a huge pattern, 0.2 billion to 6.9 billion tokens per day. The exchange is currently the industry leader in XRP deposits.

Some analysts have hypothesized that growing optimism about XRP ETFs is helping fuel these trends. Even if full approval may be months away, progress still has downstream impacts on the XRP market.

XRP Whales Head to Binance

The crypto community is very optimistic about an XRP ETF, which has been fueling some bullish behavior. New data suggests a useful barometer to measure market dynamics: XRP whale activity on Binance.

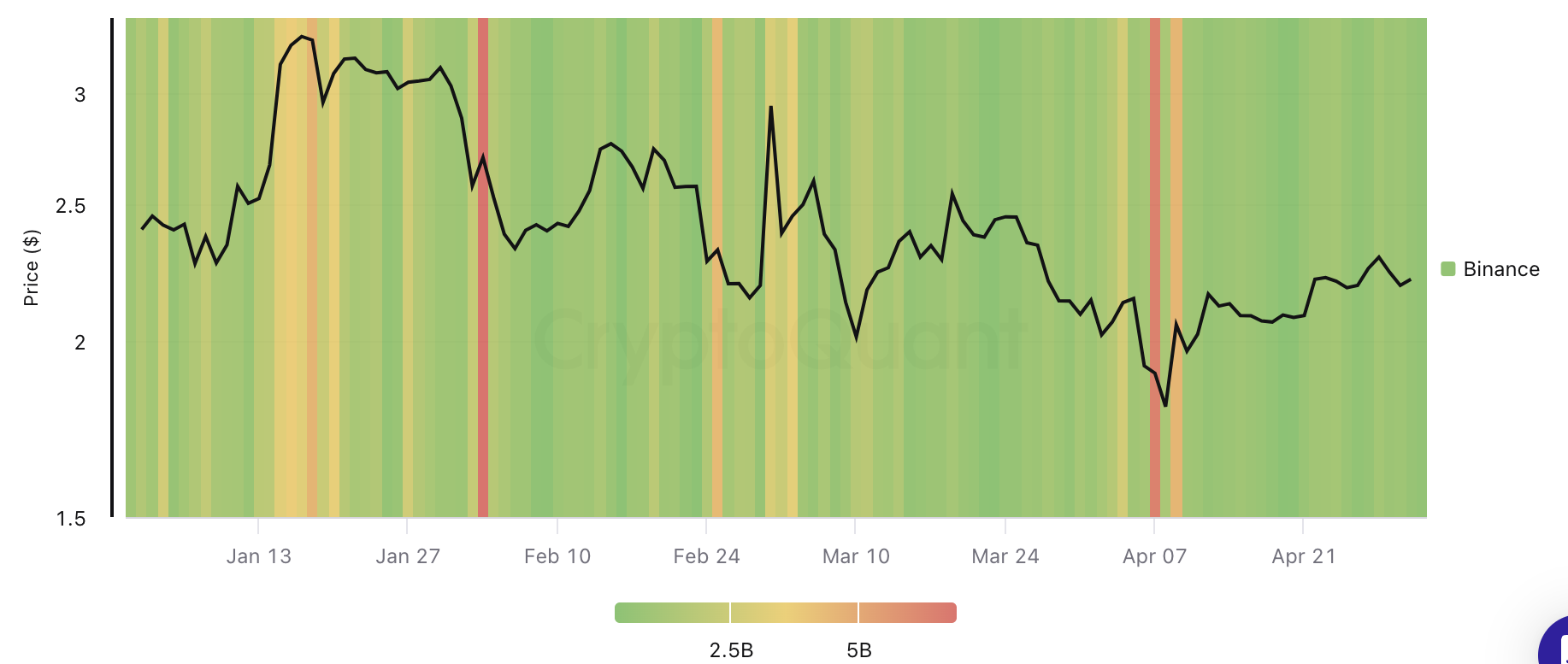

According to analysis from CryptoQuant, Binance is currently the largest recipient of heightened XRP whale activity. These traders aren’t just betting on the market but moving it in a consistent pattern.

And yet, the XRP deposits continue, even though it can cause the price to sink:

“Whale XRP deposits into Binance tend to indicate inflection points for the price of XRP. For example, the price of XRP bottomed out between Apr 7-9 as inflows of XRP spiked from 1.2 to 6.9 Billion. Likewise, the price XRP found a local top early in March as whale deposits increased from 0.7 to 2.9 Billion XRP,” claimed Julio Moreno, Head of Research at CryptoQuant.

In early March, XRP whales reached unprecedented activity, possibly indicating an upcoming distribution phase. Earlier today, newer data showed that these high-volume traders purchased more than 900 million XRP tokens in April.

XRP exchange trading volume is spiking all around.

This heightened activity can have a deleterious effect on the price of XRP, but that may not matter in the long run. These traders can actually move the XRP market, and that knowledge is part of their calculations.

Even though the XRP ETF recently saw some setbacks, the bigger picture still looks optimistic.

Even if the ETF does receive approval, there are still concerns that it might have limited market appeal. After all, Bitcoin ETFs currently occupy around 90% of that market sector.

Nonetheless, these whales show a significant level of optimistic sentiment for XRP’s future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Following Significant Network Update and Growing Interest from Institutions

- ICP's 30% price surge follows a November 2025 network upgrade introducing Caffeine, an AI tool for Web3 development, boosting on-chain AI integration. - Institutional adoption grows via partnerships like HashKey-Kraken, while ICP's DeFi TVL hit $237B, though DApp engagement fell 22.4% in Q3 2025. - Experts highlight Caffeine's accessibility benefits but caution over missing technical upgrades in scalability and storage, raising questions about long-term viability. - Competition from Ethereum and Solana ,

Is Wall Street starting to doubt the potential of AI?

Federal Reserve Strategies and Solana’s Price Rally: An Analysis of Macro Influences on Cryptocurrency Markets

- Fed's 2025 rate cut pause and dovish policy injected liquidity, boosting crypto demand including Solana (SOL). - Solana's 3,800+ TPS, $10.3B DeFi TVL, and institutional ETFs ($417M raised) highlight its technical and capital appeal. - Despite 20% price correction, Solana attracted $421M inflows in late 2025, showing institutional demand resilience. - Proposed Fed gold-for-bitcoin policy and Trump-era pro-growth signals amplify crypto's macroeconomic relevance.

Bitcoin’s Price Rally in November 2025: A Turning Point for Institutional Investors?

- Bitcoin's November 2025 surge to $145,000 sparks debate: institutional adoption or speculative frenzy masking structural fragility? - Macroeconomic stability and $72M+ infrastructure investments (e.g., Galaxy Digital in Canaan) signal maturing institutional strategies, contrasting ETF outflows and leveraged liquidations. - Regulatory clarity via U.S. spot Bitcoin ETFs (BlackRock, Fidelity) creates legitimacy but exposes crypto to traditional finance dynamics amid $1B+ ETF outflows. - Anchorage Digital's