-

Solana’s impressive metrics suggest a robust future as it stands out in the competitive world of cryptocurrency.

-

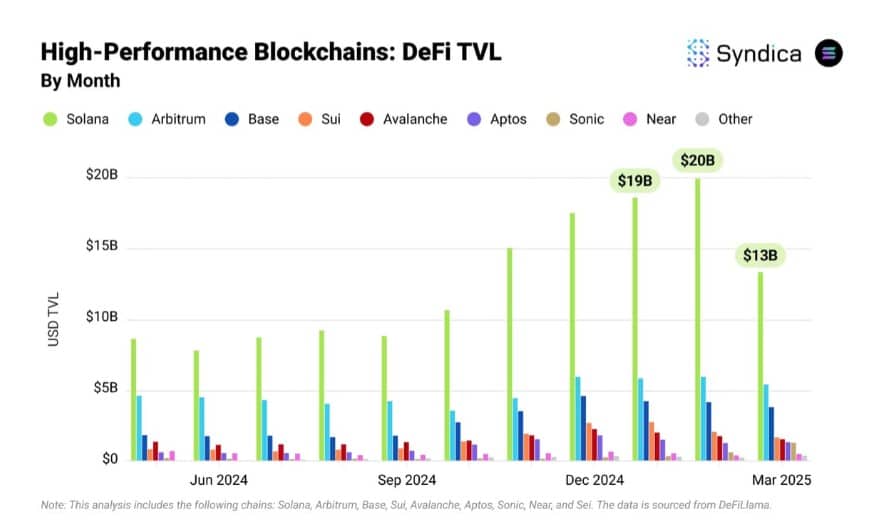

With a $13 billion total value locked (TVL), Solana is reaffirming its role as a significant player in the DeFi space, especially as it secures the highest DEX volume.

-

According to a recent report from COINOTAG, “Solana’s performance amidst market fluctuations showcases its resilience and growing adoption.”

Discover how Solana is solidifying its position in the crypto landscape with impressive metrics, leading DeFi trends, and a steady price recovery.

Solana’s DeFi grip remains unshaken

Even as market tides shift, Solana’s DeFi dominance remains impossible to ignore. By March 2025, Solana secured $13 billion in total value locked (TVL) – a steep lead over other high-performance blockchains.

Source: Syndica

While the broader DeFi space saw contractions from its December 2024 peak ($20B), Solana’s has been holding steady despite volatility.

Chains like Arbitrum, Base, and Avalanche continue to lag far behind, reinforcing Solana’s position as the go-to platform for DeFi builders and users.

Owning the DEX game by a mile

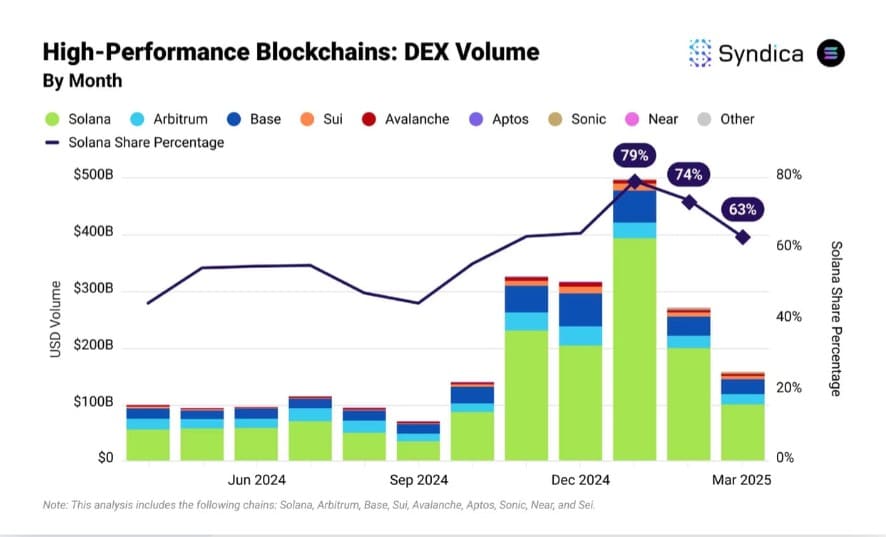

Source: Syndica

As of March 2025, it commanded 63% of the total DEX volume across major high-performance blockchains – miles ahead of the competition.

Sure, it’s a step down from the December 2024 high of 79%, but the bigger story is clear – no other chain is even close.

Is it the chain to watch?

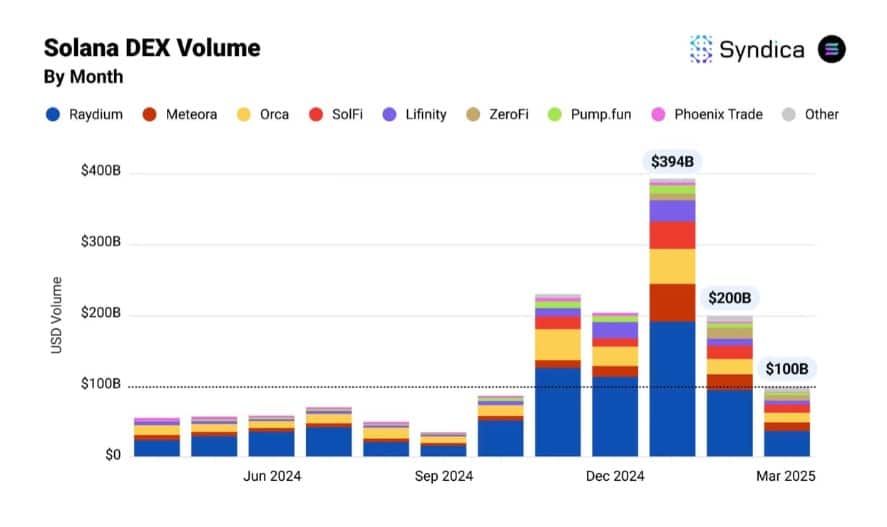

Source: Syndica

March 2025 marked a cooler phase for crypto, but Solana’s DEX ecosystem still posted $100 billion in volume. This was a level higher than any month before November 2024. While the broader market wrestled with memecoin fatigue and weakening sentiment, Solana proved its staying power.

Perhaps, strength isn’t just hype-driven anymore. Instead, it’s becoming cyclical.

Solana’s price outlook

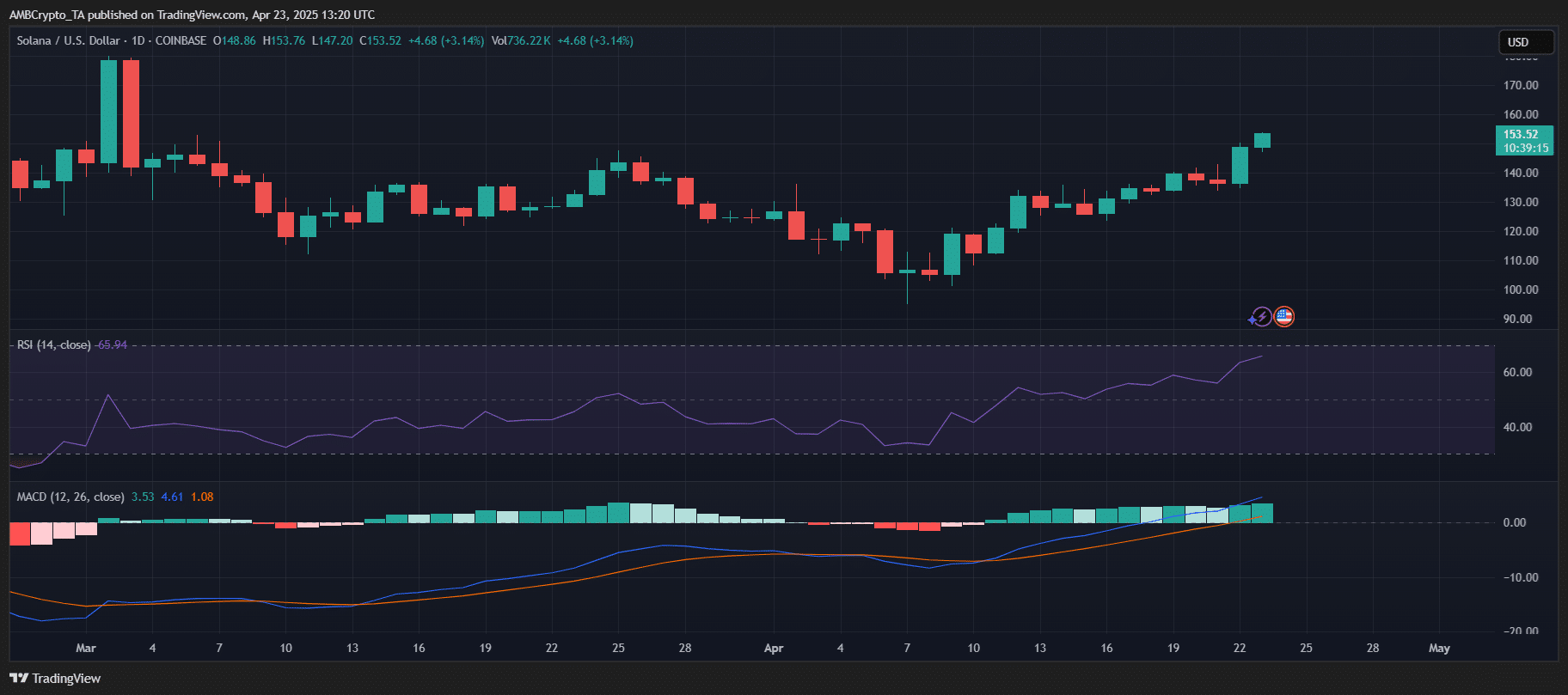

After a choppy March, SOL began April with a steady uptrend, with the altcoin trading at around $153 at press time – a strong recovery from its March lows.

The RSI sat close to 66, indicating healthy bullish momentum without entering overbought territory. Meanwhile, a bullish MACD crossover further supported the upward bias.

Source: TradingView

With all its DEX strength, Solana’s sustained price recovery revealed that its present momentum is less of a hype cycle. Instead, it’s more like a new baseline.

Conclusion

As Solana continues to demonstrate its resilience and leadership in the DeFi space, its strong performance suggests that it will remain a key player in the evolving cryptocurrency landscape. The upward momentum in both DEX activity and price recovery indicates a potential new era for this blockchain, making it a vigilant point of interest for investors and analysts alike.