Bitcoin spot ETFs have witnessed their largest three-month daily inflow. This occurred as Bitcoin briefly reclaimed the $91,000 level.

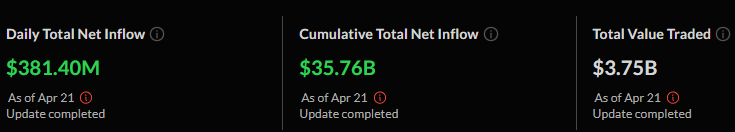

As of April 21, US Bitcoin ETFs had recorded $381.40 million of net inflows daily. The rise in ETF inflows occurs when sentiment around investing in crypto assets is still mixed.

Bitcoin ETF performance figures are showing high trading volumes

The breakdown of Bitcoin ETF performance shows large volumes of trading everywhere. April 21 statistics show the total value traded in US Bitcoin spot ETFs was $3.75 billion.

BlackRock’s IBIT leads the market by the value of its net assets at $50.02 billion and posted a one-day price gain of 0.35%. IBIT drew strong investor interest with net one-day inflows totaling $41.62 million.

Fidelity’s FBTC ranks second with $17.07 billion in net assets. FBTC experienced a daily price gain of 0.26% and brought in $87.61 million, within a day. Its overall net inflows are now at $11.37 billion.

Source: SoSoValue

Source: SoSoValue

Grayscale’s GBTC has $16.66 billion in net assets. It is still in third place even after a net outflow of $22.78 billion since the transition. GBTC experienced daily inflows of $36.60 million on April 21.

Ark Invest’s ARKB now controls $4.12 billion in assets with a daily price increase of 0.25%. The fund saw substantial one-day inflows of $116.13 million, bringing its cumulative inflows to $2.60 billion.

Smaller ETFs within the sector also performed well. VanEck’s HODL recorded a price appreciation of 0.34% on a daily basis with $11.72 million of inflows per day. Its assets stood at $1.24 billion. Valkyrie’s BRRR recorded a price appreciation of 0.37% with a total asset value of $500.47 million and total inflows of $302.42 million.

Franklin’s FZBC and Invesco’s BTCO both increased by 0.32% and 0.08% respectively. FZBC experienced $10.10 million of daily inflows. Grayscale’s BTC was the only ETF that declined in value by 0.07% despite having $32.55 million in daily inflows.

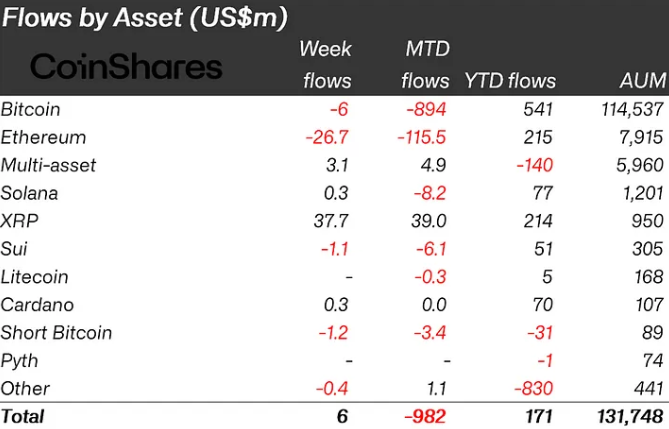

Crypto investment products saw $6 million net inflow

The significant inflows into US Bitcoin ETFs on April 21 contrast sharply with CoinShares’ assessment of the previous week’s crypto asset investment products. According to CoinShares statistics, digital asset investment products witnessed net inflows of only $6 million for the whole week, compared to $381.40 million for US Bitcoin ETFs on a daily basis.

The weekly data from CoinShares reveals that mid-week stronger-than-expected US retail sales figures likely triggered outflows of $146 million across all crypto investment products. Regional differences in investor sentiment are also apparent in the data. The US as a whole saw $71 million in outflows from digital asset investment products over the week, while European and Canadian markets displayed more positive sentiment.

Source: CoinShares

Source: CoinShares

Switzerland recorded inflows of $43.7 million, Germany saw $22.3 million in inflows, and Canada added $9.4 million. Bitcoin investment products specifically ended the week with minor outflows of $6 million according to CoinShares. This suggests that non-ETF Bitcoin investment vehicles may have experienced more substantial outflows earlier in the week.

Ethereum continues to face challenges, with an additional $26.7 million in outflows last week. Over the past eight weeks, total outflows from Ethereum investment products have reached $772 million. XRP performed different and recorded inflows of $37.7 million last week.

Bitcoin price performance correlates with ETF performance

The surge in Bitcoin ETF inflows coincides with Bitcoin’s price briefly reclaiming the $91,000 level. This correlation between price performance and ETF investment flows continues a pattern observed throughout the ETF market’s development since January 2025.

Trading data from April 21 shows that most Bitcoin ETFs recorded modest price increases for the day and ranged between 0.25% and 0.37%. BlackRock’s IBIT, the largest Bitcoin ETF, saw a 0.35% price increase, while Fidelity’s FBTC rose by 0.26%.

The only ETF showing a negative daily price movement was Grayscale’s BTC, which declined by 0.07% despite recording $32.55 million in daily inflows. The total value traded across Bitcoin ETFs on April 21 reached $3.75 billion.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot