XRP Price Analysis: Can Bulls Push Past $2.15 Resistance This Week?

Ripple’s XRP is making waves again this week. During mid-week trading, the altcoin rose nearly 1% on the day and over 2% across the past week, climbing to $2.09.

While the broader crypto market is gaining traction—with a 1% uptick pushing the global market cap to $2.69 trillion—XRP is once again outperforming thanks to renewed legal clarity and a surge in institutional buzz.

SEC Deal Clears the Air—And Clears the Path; XRP Supported?

Much of this renewed confidence comes from Ripple’s long-awaited settlement with the SEC. After a four-year legal tug-of-war, Ripple agreed to a $50 million penalty —down significantly from the originally proposed $125 million. That move lifted a massive cloud that had been hanging over Ripple for years.

But that’s not all. Ripple also gets to reclaim $75 million that had been locked in escrow, signaling a fresh start and putting more strategic capital back into Ripple’s ecosystem.

“This was a turning point,” said Ripple CEO Brad Garlinghouse, adding that the deal will likely unlock new waves of institutional interest.

Adding to the excitement, political tailwinds have kicked in. The Trump administration’s pro-crypto stance—coupled with Ripple’s growing connections in Washington—has strengthened XRP’s legitimacy.

There’s even chatter about Ripple being considered for the U.S. government’s crypto reserve. That kind of speculation is fueling investor optimism in a big way.

On-chain activity tells the story too:

Active XRP addresses surged from 16,000 to over 100,000 following the legal resolution and political support. Ripple has now reclaimed its spot as the second-largest altcoin by market cap, valued at a hefty $125.8 billion.

XRP’s ETF Momentum and Institutional Demand Grow

The buzz doesn’t stop at politics or lawsuits. ETF speculation is adding fuel to the fire. Multiple XRP ETF proposals are under SEC review, and analysts are increasingly confident that 2025 might be the year one gets approved.

Adding more credibility, HashKey Capital—with Ripple as an anchor investor—recently launched Asia’s first XRP tracker fund. That move is seen as a major milestone in XRP’s journey toward institutional legitimacy.

Technical Setup: XRP Poised for a Breakout?

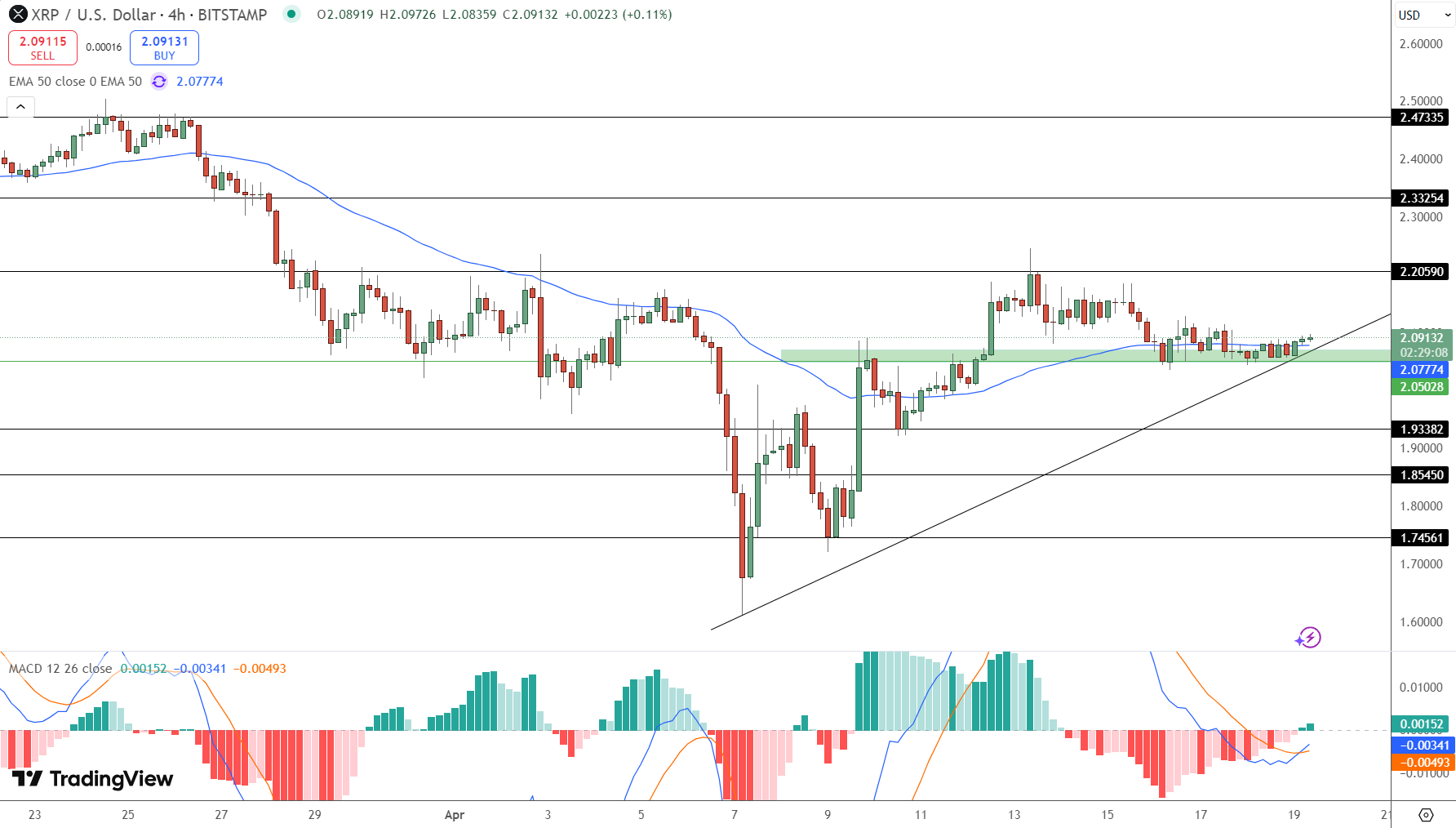

XRP’s price action is hinting at something big. The charts show a descending triangle formation—a setup that often precedes a bullish breakout.

XRP Price Chart – Source: Tradingview

XRP Price Chart – Source: Tradingview

Currently trading at $2.09, XRP is flirting with a key resistance zone between $2.20 and $2.23, where both the 50-day and 100-day EMAs are clustered.

A breakout above this range could open the door to $2.50, and possibly even a retest of $3 to $4.50 over time.

- MACD: Flipping bullish, histogram turning green

- RSI: Neutral at 51—leaving plenty of room for upside

- Whale Activity: Still strong, signaling smart money accumulation

- Funding Rates: Positive on Binance, a bullish sign

Bottom line: If XRP can flip $2.20 into support, this rally could have legs.

XRP Trade Setup

For new traders looking to join the action, here’s a simple, risk-managed plan:

- Entry: Buy above $2.10 with strong volume

- Target: First target at $2.21, extended to $2.33

- Stop Loss: Below $2.05 support zone

Tip: Watch for a solid candle close above $2.10. Volume confirmation matters. Without it, the move could fizzle out.

If XRP holds above $2.05 and bulls step in with conviction, a push through resistance is very possible. But if that level fails, the setup weakens—so stay nimble.

Final Thoughts

Between the SEC settlement, rising institutional interest, ETF momentum, and an improving technical picture, XRP is one of the most talked-about altcoins right now—and for good reason. If bulls can hold support and flip key resistance levels, XRP might just be gearing up for its next major move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.