Solana dApps generated more revenue than dApps on all other chains combined

Solana’s dApp ecosystem is outearning the competition, with more revenue than all other chains combined.

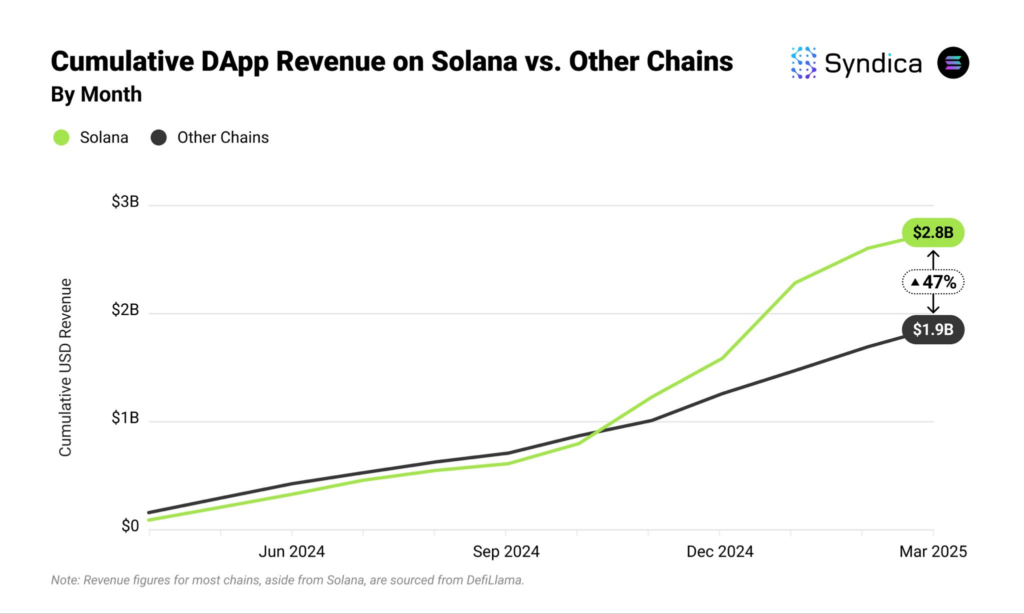

In the last 12 months, Solana (SOL) dApps generated more revenue than dApps on all other chains combined. According to a report by Syndica , published on April 18, Solana dApps earned $2.8 billion in revenue. That’s 47% more than the dApp revenue on all other chains combined.

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Solana’s dApp earnings began outpacing all other chains in October of last year. Since then, the gap has only continued to widen. These figures show that Solana’s ecosystem remains highly attractive to both users and developers. Its low fees and focus on user experience appeal to end users, while developers benefit from the network’s accessible and developer-friendly infrastructure.

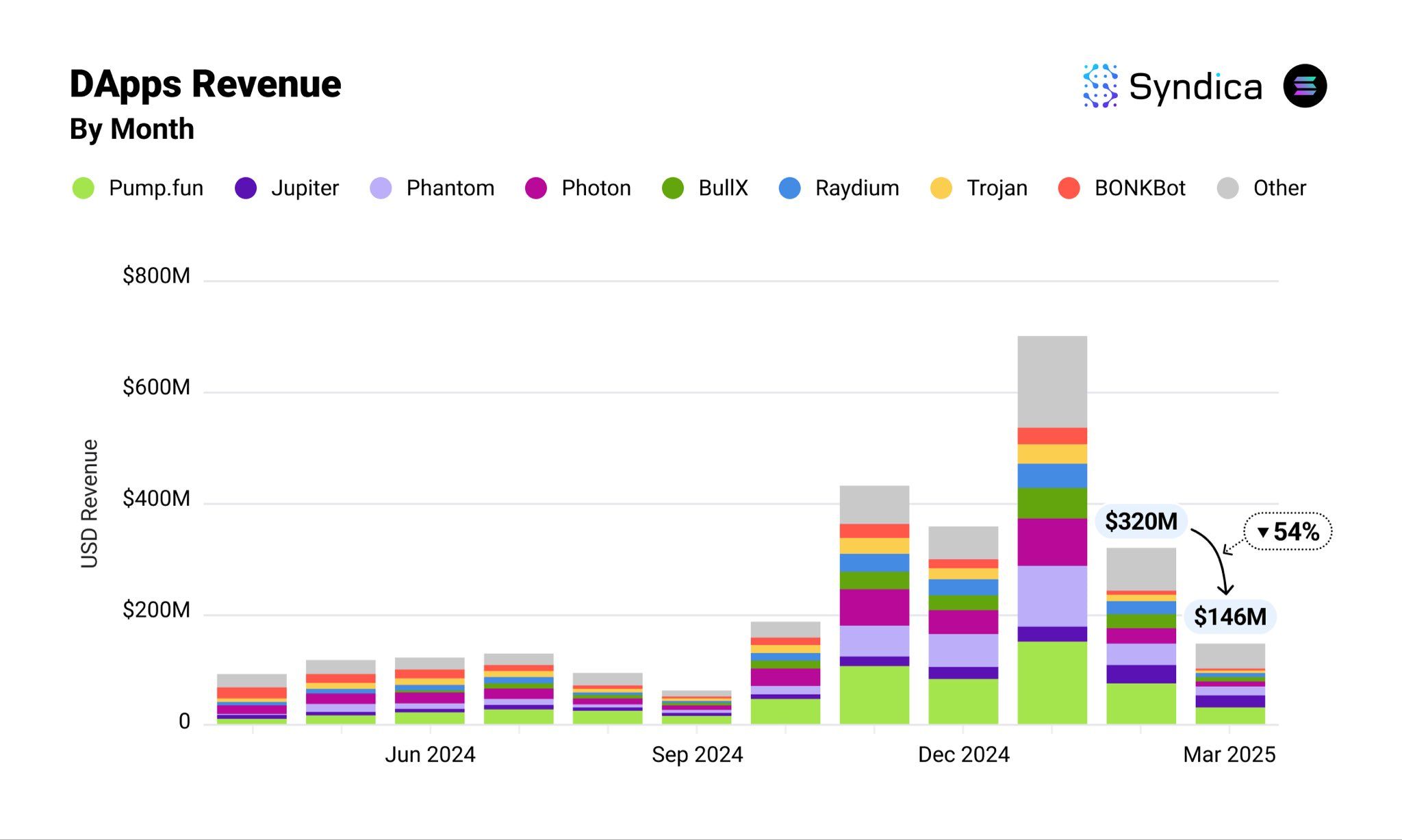

Still, Solana’s dApp revenue is largely driven by crypto trading applications, which makes earnings highly volatile. For example, revenue peaked in January at $701 million, coinciding with Solana’s all-time high of $294.33.

Solana dApp revenue each month, by category | Source: Syndica

Solana dApp revenue each month, by category | Source: Syndica

Since that peak, dApp revenue has declined significantly, dropping to $146 million in March. This highlights how closely dApp earnings correlate with high trading volumes and elevated asset prices.

Pump.fun leads in Solana revenue

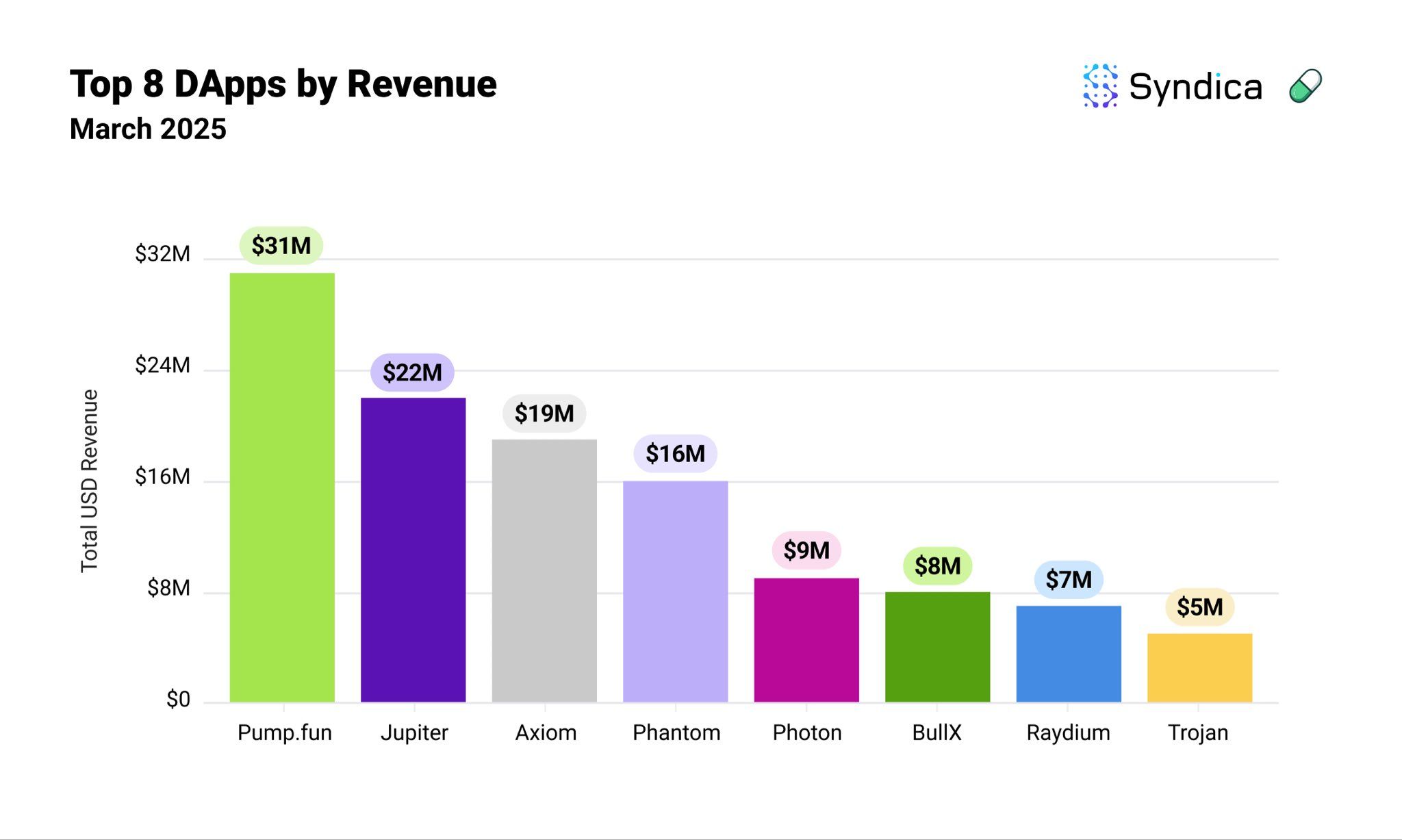

Exchanges, wallets, and other trading-focused platforms dominate Solana’s top-earning dApps. The biggest contributor in March was memecoin launchpad Pump.fun, which brought in $31 million, surpassing platforms like Jupiter and Phantom.

Solana dApps by revenue | Source: Syndica

Solana dApps by revenue | Source: Syndica

Pump.fun is now facing rising competition from Axiom, a memecoin launchpad backed by Y Combinator. Axiom has quickly gained traction, capturing 29% of the memecoin dApp market and generating $19 million in revenue.

Meanwhile, Jupiter remains the dominant force among Solana DEXs, earning 93% of total DEX revenue on the network. It maintained strong performance in March, bringing in $22 million despite the cooling market—alongside consistent results from Kamino Finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOTA partners with top global institutions to build Africa’s “digital trade superhighway”: a new $70 billion market is about to explode

Africa is advancing trade digitalization through the ADAPT initiative, integrating payment, data, and identity systems with the goal of connecting all African countries by 2035. This aims to improve trade efficiency and unlock tens of billions of dollars in economic value. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated.

Panic selling is all wrong? Bernstein: The real bull market structure is more stable, stronger, and less likely to collapse

Bitcoin has recently experienced a significant 25% pullback. Bernstein believes this was caused by market panic over the four-year halving cycle. However, the fundamentals have changed: institutional funds such as spot ETF are absorbing the selling pressure, and the structure of long-term holdings is more stable. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom

Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?