-

Cardano (ADA) struggles to maintain its footing, slipping below the $0.70 mark, as recent bearish indicators signal a pivotal moment for the cryptocurrency.

-

The descent has intensified, marked by a negative BBTrend and a falling ADX, indicating diminishing bullish momentum within the market.

-

As noted by analysts at CoinTag, “The current market conditions may lead ADA to test lower support levels, urging traders to reassess their positions.”

Cardano (ADA) dips below $0.70 amid bearish indicators, raising concerns over momentum and price stability, with key support levels now in focus.

Technical Indicators Flash Warning Signs for Cardano’s Momentum

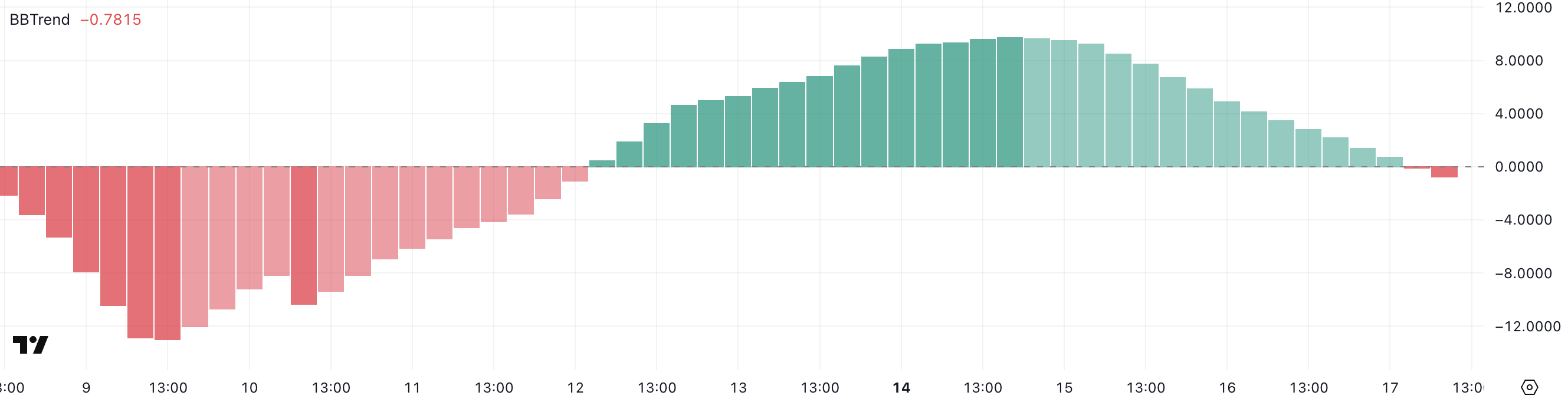

Recently, Cardano’s price action has sparked concern among traders as ADA continues to fluctuate below the critical $0.70 barrier. The negative BBTrend, now at -0.78, indicates a potential end to the upward trend that seemed to gain traction earlier in the month. This measure also reflects a loss of bullish momentum, as evidenced by a drop from previous highs. With the price hovering between support and resistance, ADA’s immediate future hinges on these technical indicators.

Interpreting the BBTrend and Its Implications

The transition to a negative BBTrend is significant; this indicator not only reflects current momentum but also forecasts potential price reversals. As the trend ratio nears the lower Bollinger Band, traders often anticipate increased selling pressure, which could catalyze a broader downward movement if not quickly remedied. Analysts suggest that without a decisive break back above the $0.64 resistance, ADA may struggle to regain previous bullish momentum.

ADA BBTrend. Source: TradingView.

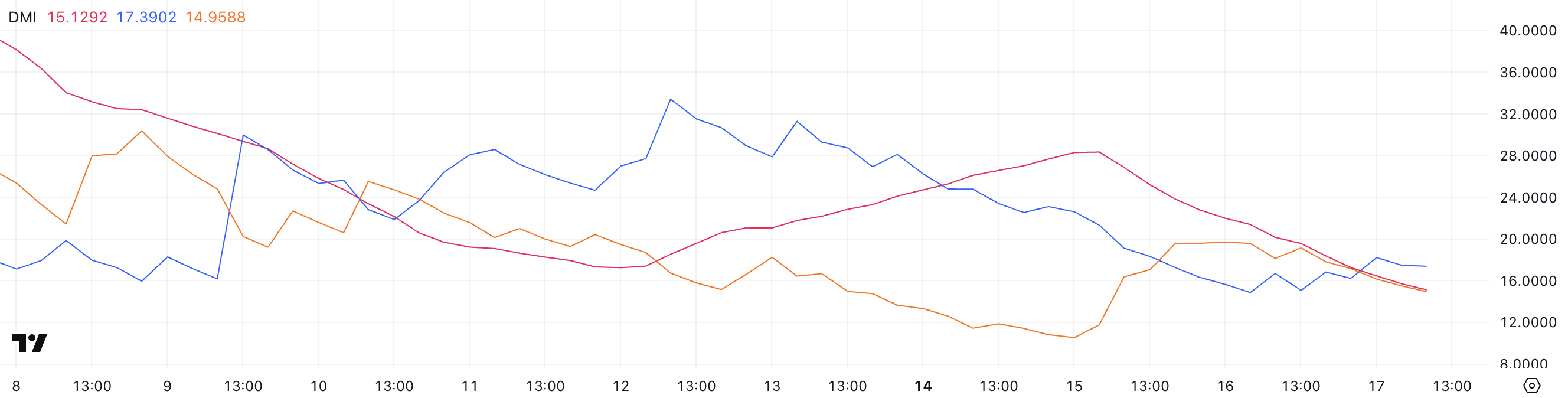

Shifting Sentiment as ADX Decline Signals Weakening Trend

As Cardano navigates through this challenging period, the Average Directional Index (ADX) highlights decreasing trend strength, having plummeted from 28.34 to 15.12 within a few days. Such a drastic change requires close monitoring as it suggests a potential consolidation phase ahead.

ADA DMI. Source: TradingView.

Analyzing the DMI Indicators

The Directional Movement Indicators (DMI) illustrate a shifting dynamic: while the +DI (bullish) has dipped from 22.61 to 17.39, the -DI (bearish) has risen to 14.95. This dichotomy indicates that selling pressure is strengthening, potentially leading to an unfavorable environment for bulls. Traders are advised to remain cautious, as prevailing trends signal a possible change toward a bearish outlook unless supportive buying activity resumes shortly.

Assessing Support and Resistance Levels in Current Market Conditions

Another layer of complexity is added by Cardano’s price positioning in relation to support and resistance levels. Currently, ADA is clinging to a support zone around $0.594; failure to hold this level could spell trouble, with predictions suggesting a further decline towards $0.511. The bearish structure remains intact as EMA (Exponential Moving Average) lines indicate short-term averages persistently below long-term averages, affirming that prevailing downward pressure continues.

ADA Price Analysis. Source: TradingView.

Potential Uptrend Scenarios for Cardano

Conversely, should ADA manage to reclaim upward momentum, traders will look to the $0.64 resistance level, which stands as a crucial barrier for a bullish recovery. A successful breakout above this threshold could pave the way for ADA to recover towards $0.66 and $0.70 marks, essential for reinforcing a trend reversal in favor of a bullish outlook. Continued bullish momentum could eventually lead to a rally aiming for $0.77, suggesting a stronger recovery phase.

Conclusion

In summary, Cardano’s current trading environment presents a mixed outlook, with technical indicators signaling significant caution. While key support holds for now, persistent selling pressure and faltering momentum may necessitate strategic repositioning for traders. Observing ADA closely over the coming days as it tests these critical levels will be vital to understanding the coin’s potential trajectory in this volatile market.