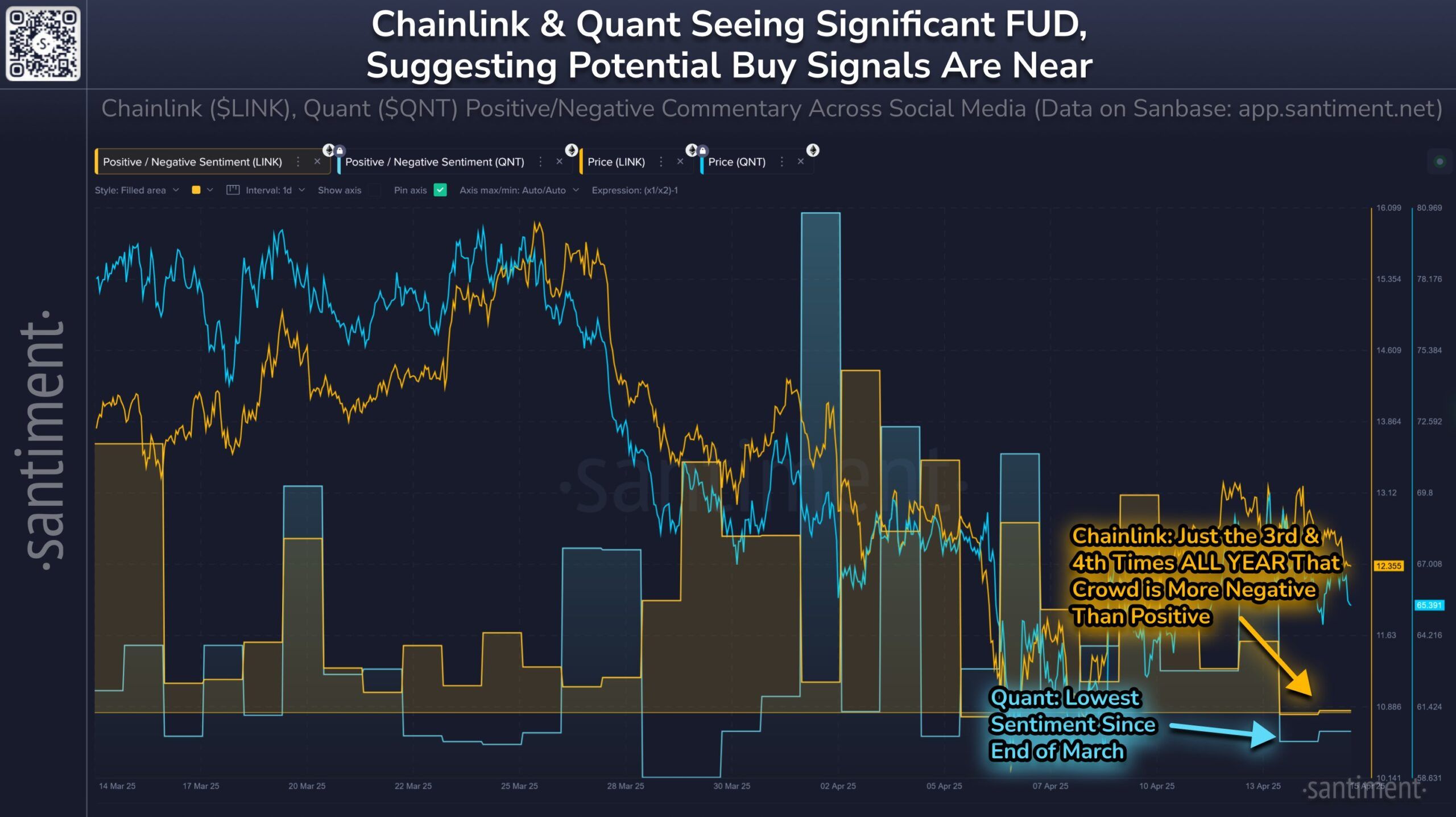

In the cryptocurrency market, particularly among altcoins, the pursuit of direction continues as recent price declines over the past three weeks have left investors in Chainlink $12 ( LINK ) and Quant (QNT) feeling impatient. According to social media data analyses, negative comments regarding both assets have surged. Historical trends highlight that such intense periods of negativity often precede sudden directional shifts, as the market frequently moves against the prevailing sentiment. Santiment indicates a potential recovery signal for both LINK and QNT coins in the near term.

On-Chain Sentiment Data Raises Concerns

Santiment data reveals that Chainlink’s negative sentiment among investors has only dipped below positive levels three times since the beginning of the year. Recent data indicates this has occurred for the fourth time, marking a rare break in trend. The significant shift to a negative sentiment in on-chain analysis could signal that the price of LINK coin has hit rock bottom.

Altcoin Chainlink (LINK) and Quant (QNT)

Altcoin Chainlink (LINK) and Quant (QNT)

On the side of Quant, the situation is even more striking. The sentiment level among QNT coin investors on social media has dipped to its lowest since the end of March. This indicates that Quant investors have adopted a nearly entirely pessimistic attitude. Historically, such widespread negative sentiment has acted as a precursor to significant rallies.

Price Pressure Turns into a Test of Patience

In the last three weeks, there has been a significant pullback in the prices of LINK and QNT coin. Chainlink’s price has fallen from around $13 to below $11, while Quant has dropped below the $100 mark, leading to disappointment among investors. These price declines have created a challenging period, especially for short-term investors, testing their patience.

However, from a technical analysis perspective, it is known that sharp recoveries typically follow such pullbacks. Indeed, many believe the price declines for LINK and QNT have been exaggerated, and investors have entered a state of excessive fear. The surge in “FUD” (fear, uncertainty, doubt) on social media may present an opportunity for investors.