Date: Mon, April 14, 2025 | 05:59 AM GMT

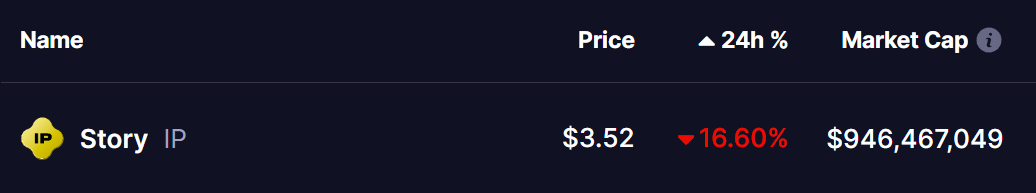

In the past few hours, the cryptocurrency market has turned its attention toward Story (IP)—a Layer 1 blockchain tailored to be the backbone for intellectual property (IP) on the internet. However, not for the best reasons. IP has seen a sharp 16% decline, with its market cap dipping below the $1 billion mark, raising eyebrows among investors and analysts alike

Source: Coinmarketcap

Source: Coinmarketcap

What’s catching even more attention than the price drop, is the chart pattern emerging on Story’s daily timeframe. It’s one that looks remarkably similar to Hyperliquid’s (HYPE) recent bearish trajectory—raising the question: Is IP about to follow the same fractal path?

Story (IP) Mirrors HYPE’s Bearish Structure

On the left side, we see HYPE’s 1-day chart. It started with a massive +232% surge, breaking out into a parabolic run. However, after forming a symmetrical triangle (with descending tendencies), HYPE faced multiple rejections from the upper trendline. Eventually, it broke down below both the triangle’s support and the 50-day moving average (highlighted in the red circle), triggering a steep sell-off. This led to a 73% decline from its local high before the token found support and started bouncing in early April.

Now, shift your eyes to the right side, where Story (IP) appears to be tracing a near-identical structure.

IP rallied over +445% in a short span and consolidated in what now appears to be a symmetrical triangle. Much like HYPE, it failed to hold the lower boundary of that triangle and also broke below its 25-day moving average, again marked in red. The result? A steep fall to around $3.50, echoing HYPE’s trajectory before its bounce.

Are We Headed to Downside?

If IP continues to follow the HYPE fractal, the next key zone to watch is the support region around $1.50, indicated in the shaded gray zone on the chart. This would mark a total drawdown of nearly 80% from IP’s recent top—eerily similar to HYPE’s bearish move.

This doesn’t mean a bounce is guaranteed at $1.50, but if the pattern continues to mirror HYPE’s path, that zone could act as a potential reversal or accumulation area.

What’s Next?

All eyes will be on how IP behaves in the coming sessions. Does it find early support? Or will it continue its descent toward the projected $1.50 zone?

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.