Can Pepe Really Hit $1? Traders Flock Back After 16% Bounce

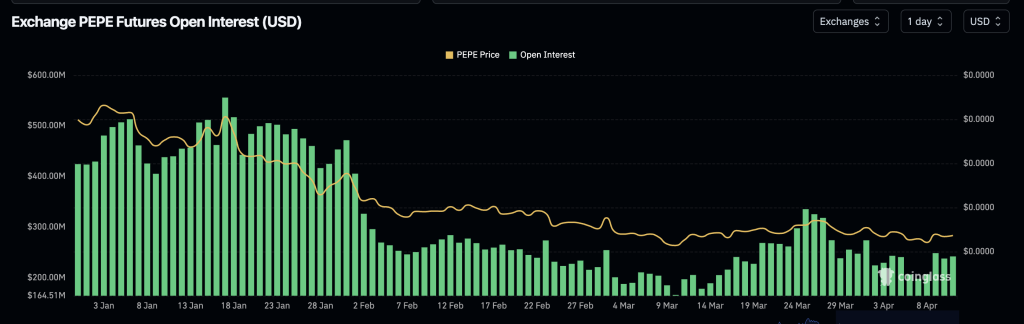

Pepe has gone up by 2.2% in the past 24 hours and currently sits at $0.00000683 while open interest for PEPE has made a strong comeback as cryptocurrencies recover.

In the past three days, data from CoinGlass shows that contract volumes have jumped to an average of $241 million. This represents an 18% increase compared to the average for the previous three-day period.

Open interest reflects traders’ interest in speculating with the price action of an asset. In the case of PEPE, trading volumes have exploded to nearly $600 million in the past day and currently account for a fifth of the token’s circulating supply.

PEPE has been one of the most resilient meme coins in the past week as it has gained 1.8% while others like Dogecoin (DOGE) and Shiba Inu (SHIB) have seen 7-day losses of 1.7% and 0.2% respectively.

Currently, the token is trading 76% below its all-time high of $0.00002825 from December last year. Can it ever climb to $1? A look at the charts may tell us if this is a real possibility.

PEPE Could Rise Near ATHs In the Next Few Months if This Support Holds

The weekly chart shows that PEPE has been in a bearish cycle since it hit all-time highs in December.

The past three times that PEPE has climbed to record levels and retreated, it has spent around two months in a downtrend as sellers take profits from the rally and then it has bounced strongly off its lows and has delivered gains ranging from 200% to nearly 372%.

Meanwhile, the token has found strong demand at the $0.00000580 level during the most recent selling spree and this raises the odds that PEPE may have hit a local bottom.

If that is the case, based on the strength of previous rallies, this could propel the token near its current all-time high.

Momentum indicators seem to be favoring a bullish outlook as the MACD’s histogram shows a deceleration in the negative momentum that has pushed PEPE to its current levels.

Four consecutive light red bars have popped up in the past 4 weeks while the Relative Strength Index (RSI) has been plateauing after it hit 37.

As long as the $0.00000580 level holds, the odds of a strong recovery in the next few months for PEPE are quite high.

So, can PEPE really hit $1?

While such a milestone may seem far off given its current price, crypto history is filled with surprise rallies and seemingly impossible milestones being shattered—especially in the meme coin space.

If demand holds and broader market sentiment continues to improve, PEPE could follow the same path as early Dogecoin or Shiba Inu gains.

In crypto, nothing is off the table.

As PEPE regains traction, presales like MIND of Pepe are quietly drawing investor interest, with nearly $8 million raised in its presale.

MIND of Pepe ($MIND) Gathers Intel from Social Media to Give Investors an Edge

MIND of Pepe (MIND) is an AI agent designed to interact with high-profile social media accounts across platforms like X to gain influence, collect information on social trends, and deliver insights to $MIND holders.

The agent discusses topics and engages in conversations related to meme coins and the crypto space to capture the attention of crypto enthusiasts and establish credibility.

Once its follower count rises, it can launch its own meme coins inspired by the social trends it has identified and $MIND holders will get privileged access to these initial offerings to reap the highest returns once they are launched.

To buy $MIND, simply head to the MIND of Pepe website and connect your wallet (e.g. Best Wallet ).

You can either swap USDT or ETH for this token or use a bank card to make your investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.