Onyxcoin (XCN) Finds Whale Support Despite Failing To Breach $0.01 This Month

Despite Onyxcoin's stagnant performance and a bearish RSI, whale addresses continue to hold, showing confidence in a potential recovery if market conditions shift.

Onyxcoin (XCN) has experienced a month-long consolidation with little upward momentum, leaving the price largely stagnant. The altcoin has struggled to make significant gains, but this has not deterred key investors.

Whale addresses have continued to hold their positions, signaling optimism despite the market’s sluggishness.

Onyxcoin Whales Are Optimistic

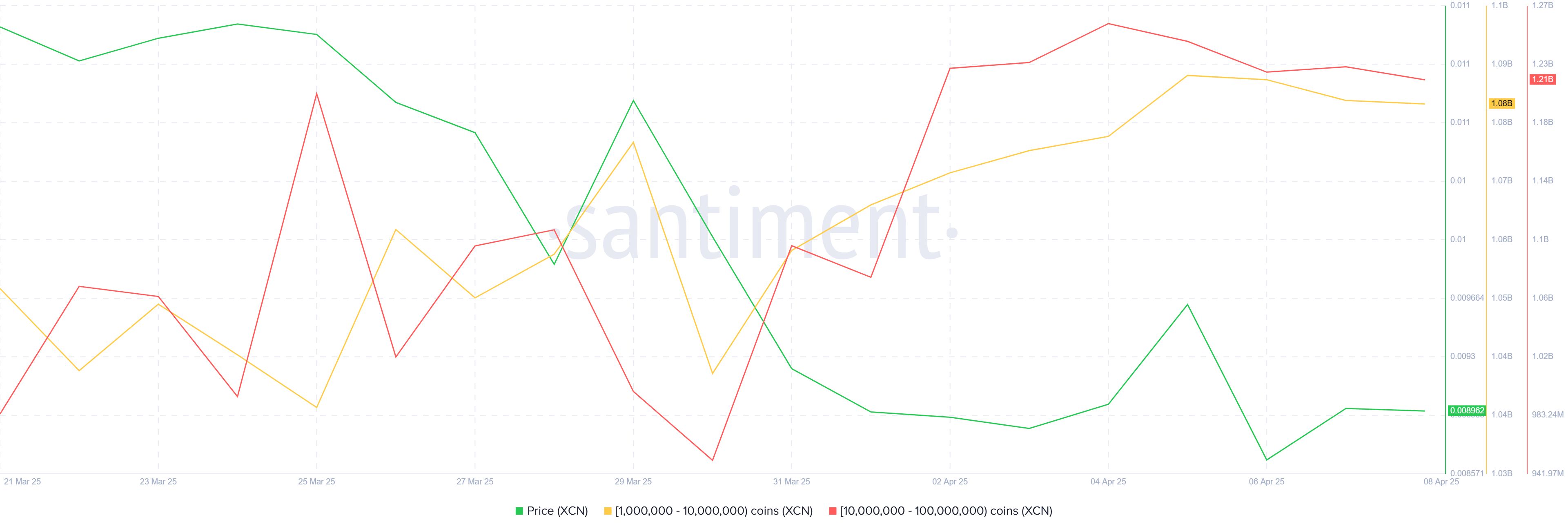

Whale addresses, or holders with significant XCN holdings, have shown resilience amid the price decline. Over the past week, even with no growth in the altcoin’s value, these investors have refrained from selling sharply. This ongoing HODLing behavior suggests that they maintain a long-term bullish outlook for Onyxcoin, possibly expecting future gains once market conditions improve.

This conviction among large holders reflects a belief in Onyxcoin’s potential for recovery. Despite a lack of short-term gains, these investors appear focused on holding until the price begins to rise again. Their reluctance to sell even in a stagnant market is a positive indicator of potential upside when the market conditions shift.

Onyxcoin Whale Holdings. Source:

Santiment

Onyxcoin Whale Holdings. Source:

Santiment

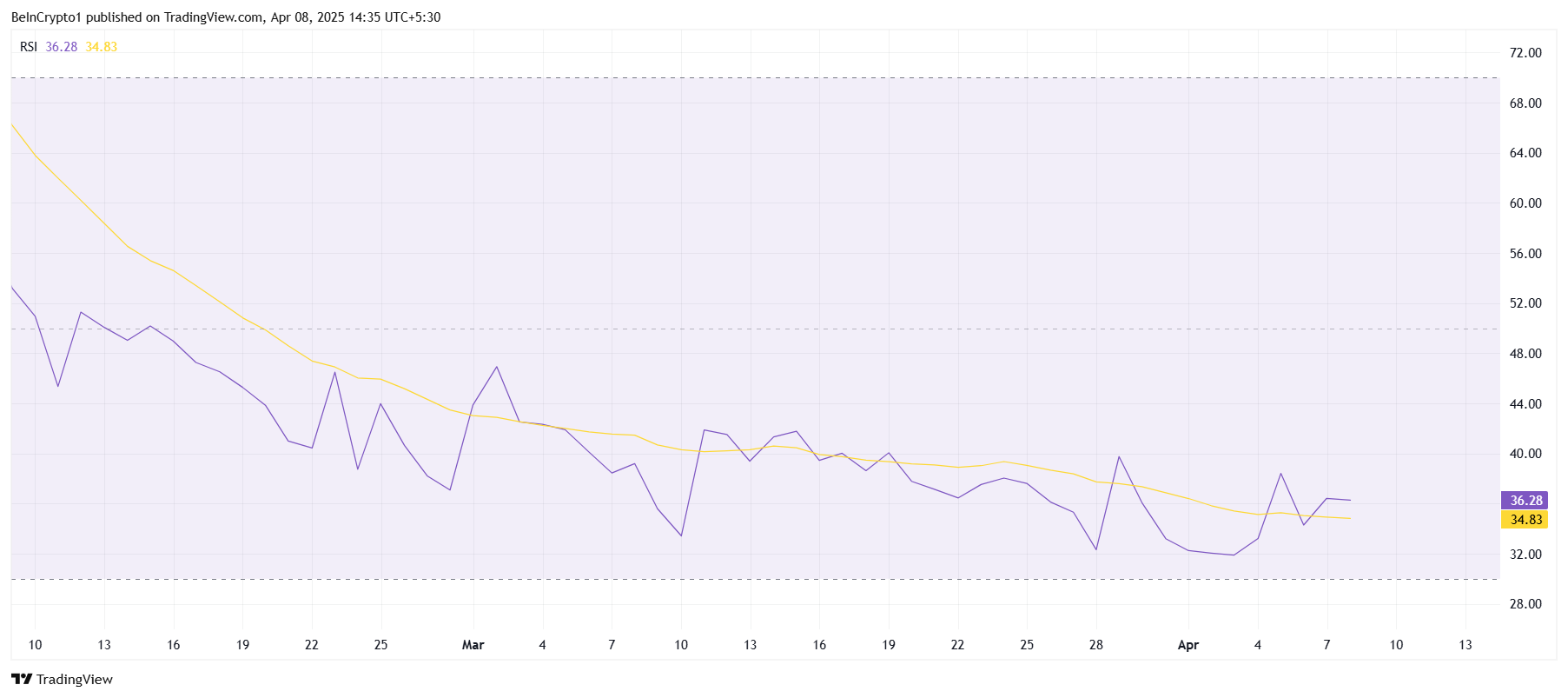

On the broader scale, technical indicators like the RSI have been showing a bearish trend for over a month, remaining stuck below the neutral line. The RSI’s positioning below 50.0 suggests that selling pressure still outweighs buying momentum, keeping the price suppressed. The indicator’s prolonged decline points to a sustained bearish market environment.

While this presents challenges for Onyxcoin in the short term, it also implies that the bearish momentum could eventually reach a saturation point. If the market shifts and buying pressure increases, XCN may experience a recovery rally, provided other macroeconomic factors align.

XCN RSI. Source:

TradingView

XCN RSI. Source:

TradingView

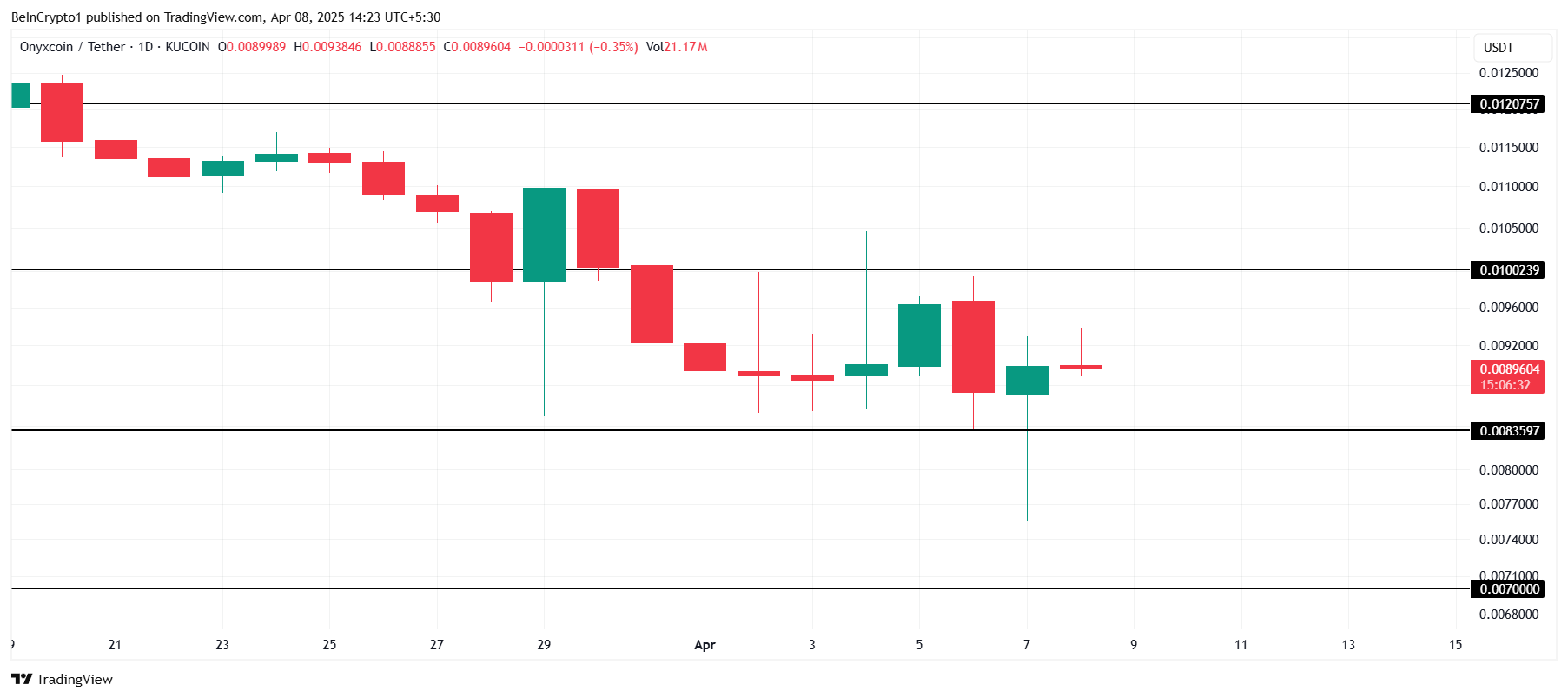

XCN Price Is Looking To Rise

XCN is currently trading at $0.0089, staying within a narrow range between $0.0100 and $0.0083 for the past week. This consolidation is likely to continue unless market conditions improve. The altcoin’s price action has been largely dictated by the lack of positive market momentum, limiting any immediate breakthroughs.

If the broader crypto market sees improvement, XCN could break through the $0.0100 resistance and begin moving toward the $0.0120 level. This would mark a recovery of a portion of the recent losses, potentially restoring investor confidence and signaling a shift toward a more bullish trend.

XCN Price Analysis. Source:

TradingView

XCN Price Analysis. Source:

TradingView

However, if XCN fails to hold above $0.0083, the altcoin could face a further decline, potentially reaching $0.0070. This would invalidate the bullish outlook and deepen the losses, reinforcing the need for caution among investors awaiting market stabilization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

Bitcoin ‘risk off’ signals fire despite traders’ view that sub-$100K BTC is a discount

Trending news

MoreETH price fluctuates violently: the hidden logic behind the plunge and future outlook

[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)