-

Circle’s recent IPO filing underscores both impressive revenue growth and substantial concerns regarding profitability amidst rising costs.

-

The company faces heightened scrutiny due to a significant increase in distribution expenses expected to exceed $1 billion in 2024, prompting doubts about its long-term viability.

-

Analysts have criticized Circle’s $5 billion valuation, citing challenges such as high operational costs and excessive risk exposure in the volatile cryptocurrency landscape.

Circle’s IPO filing reveals significant revenue growth but raises alarms over profitability and high operational costs, demanding scrutiny in the crypto market.

Analysts Highlight Red Flags With Circle IPO

On April 1, COINOTAG reported that Circle had filed for an IPO. The company plans to list its Class A common stock on the New York Stock Exchange (NYSE) under “CRCL.”

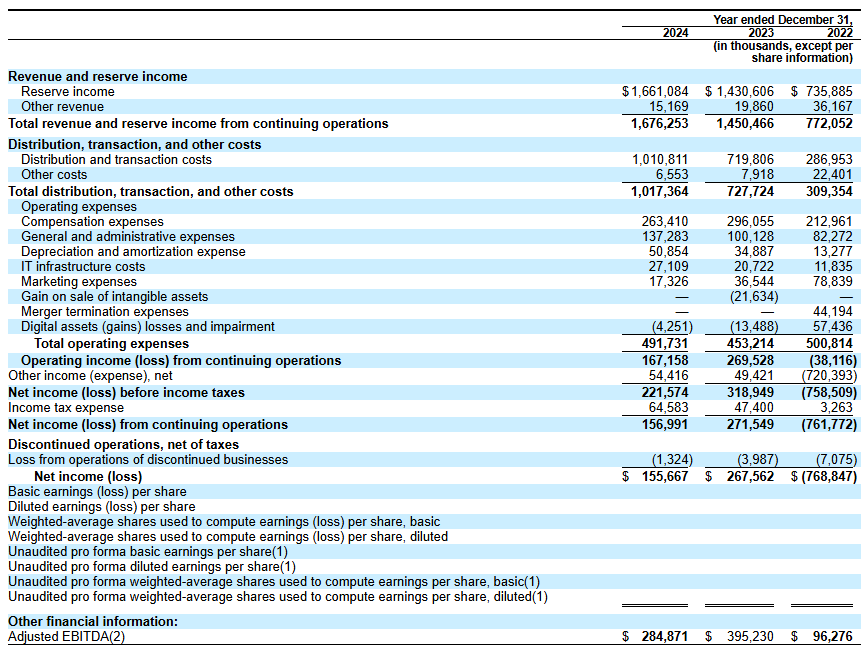

Circle’s IPO filing showcases an impressive revenue of $1.67 billion projected for 2024, which marks a notable increase from previous fiscal periods. However, a closer examination unveils troubling issues within the company’s financial landscape.

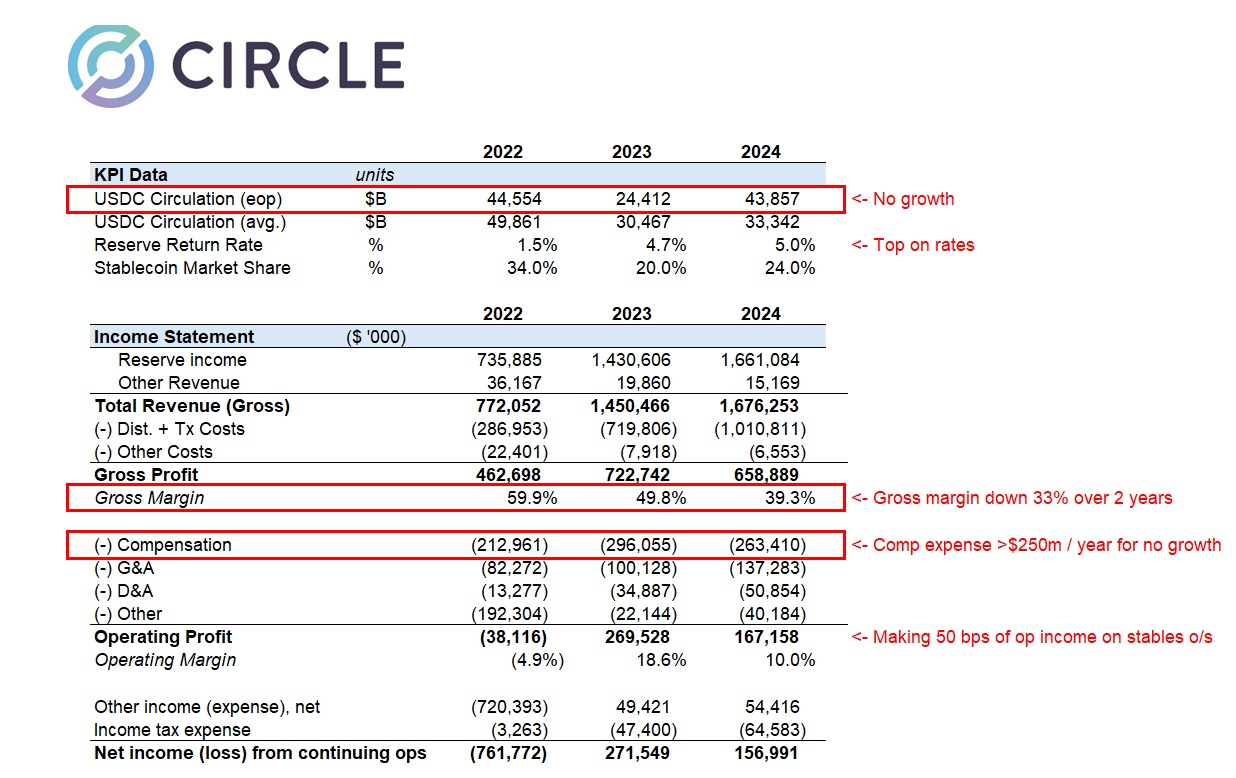

Matthew Sigel, Head of Digital Assets Research at VanEck, highlighted that while revenue grew by 16% year over year, Circle also reported a significant 29% decline in EBITDA, reflecting diminishing operational profitability. Moreover, net income saw a troubling 42% plunge, raising serious questions about overall financial health.

Sigel identified several critical factors contributing to the downturn in financial metrics. He noted that rapid expansion and new service integrations have negatively impacted net income.

Moreover, the discontinuation of high-revenue services, such as Circle Yield, significantly constricted other revenue sources, further exacerbating profitability challenges.

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel elaborated.

Crucially, he emphasized the alarming rise in Circle’s distribution and transaction costs. Increased fees paid to significant partners like Coinbase and Binance have contributed to this rise.

A related analysis by Farside Investors published on X (formerly Twitter) elaborated on the staggering expenses involved. They reported, “In 2024, the company spent over $1 billion on distribution and transaction costs, likely much higher than Tether as a percentage of revenue.”

This raises the specter that Circle may be overspending to secure its market share amid fierce competition in the stablecoin sector. Historical performance data suggests vulnerability during market fluctuations.

According to Farside Investors, Circle recorded a staggering $720 million loss in 2022, a year beset by significant upheaval in the crypto industry, including the notable collapses of FTX and Three Arrows Capital (3AC).

This history raises alarming questions about Circle’s capacity to manage risks within the volatile cryptocurrency environment.

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

In a further critique, analyst Omar expressed skepticism about Circle’s $5 billion valuation.

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he remarked, drawing attention to additional concerns regarding Circle’s financial viability.

He pointed out that gross margins are heavily burdened by high distribution costs. Additionally, the impending deregulation of the U.S. market is expected to destabilize Circle’s position.

Furthermore, Omar noted that Circle incurs over $250 million annually in compensation and an additional $140 million on general and administrative costs, calling into question its operational efficiency. He warned that potential declines in interest rates—key income drivers for Circle—may exacerbate existing challenges.

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar concluded.

Ultimately, the analyst concluded that the IPO filing could be perceived as a desperate maneuver to secure liquidity ahead of looming market pressures.

Meanwhile, Wyatt Lonergan, General Partner at VanEck, shared his predictions regarding Circle’s IPO, outlining four potential scenarios, with the base case suggesting that Circle could leverage the stablecoin narrative effectively to forge significant partnerships aimed at fostering growth.

In a bear case, Lonergan speculated that unfavorable market conditions might trigger a buyout by Coinbase.

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan proposed.

Finally, he suggested a scenario wherein Ripple could drive up Circle’s valuation to an astounding $15 to $20 billion and proceed to acquire the company.

Conclusion

The initial public offering from Circle serves as a litmus test, revealing critical vulnerabilities amidst impressive revenue growth. As analysts evaluate the long-term sustainability and operational efficiency of Circle, the outcome of its venture into the public market will undoubtedly shape the conversation around the future of stablecoins and the broader cryptocurrency landscape.