The latest Bitcoin news highlighted growing pursuit of liquidity to channel into the cryptocurrency. It also revealed the brewing race for holder dominance between Strategy and BlackRock.

The Coin Republic previously highlighted Strategy’s upcoming potential acquisition and the latest Bitcoin news further confirms the development. Strategy Chairman Michael Saylor just revealed that his company’s newly issued preferred stock STRF has commenced trading.

Source: X

Source: X

Saylor also revealed that the dividend will allow investors to earn yield on Bitcoin. This latest issuance highlighted the company’s commitment towards maintaining a bullish stance. The timing also came at around the same time that the market has been experiencing a slight recovery.

This potential comeback, followed by liquidity infusion from noteworthy companies such as Strategy could pave the way for more recovery.

BlackRock launches Bitcoin ETF offering in Europe

BlackRock, another U.S-based investment firm has also demonstrated growing interest in BTC. According to the latest Bitcoin news, this company is following a different approach compared to Strategy.

Rather than exploring liquidity options in the U.S, BlackRock has elected to launch a Bitcoin ETF in Europe. This is the company’s first BTC ETF in the European market but not the first overall.

Source: X

Source: X

This move has essentially expanded BlackRock’s potential reach in one of the Biggest markets in the world. The timing could not have been more impeccable considering that most European countries have been experiencing declining economic growth.

Many European investors are thus looking for exposure into emerging opportunities and the blockchain space is at the forefront. This move may also underscore the possibility of more such moves to come in other key markets from other global regions.

Bitcoin news highlight intensifying competition for the top

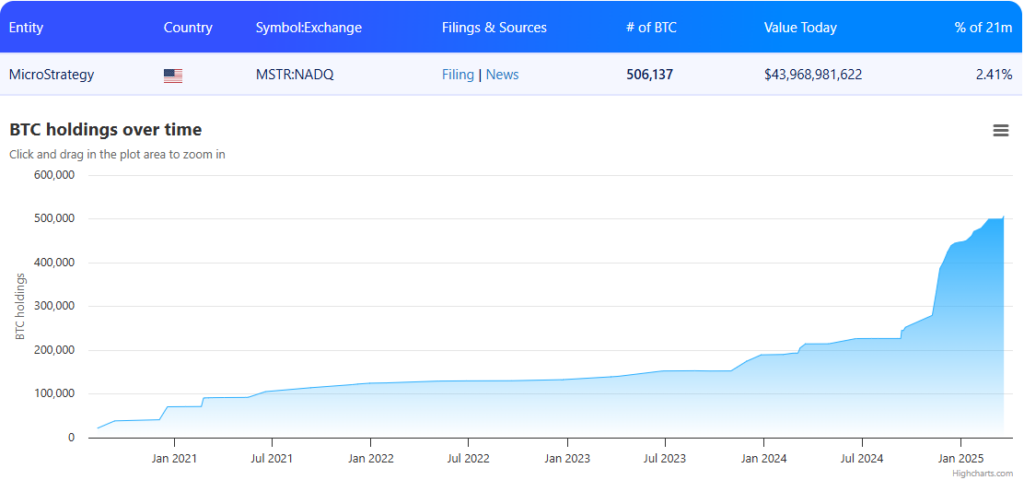

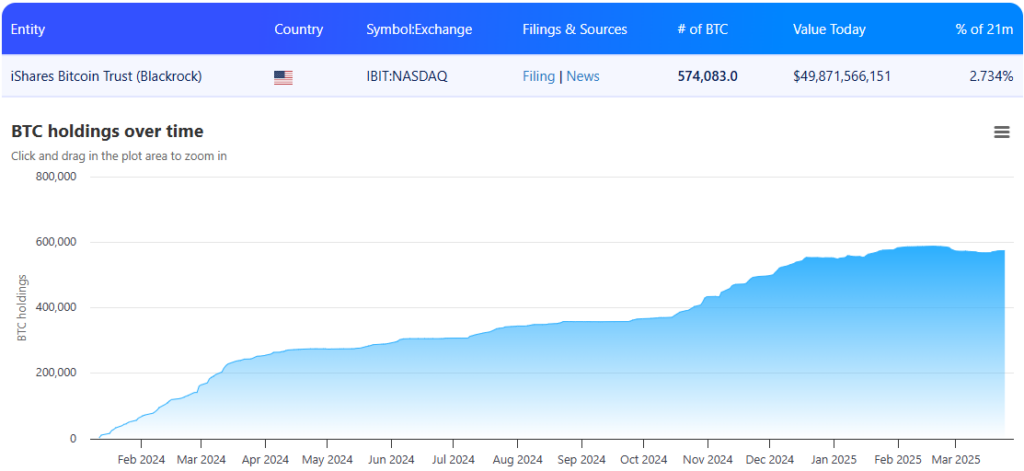

Based on the latest Bitcoin data , it appears that BlackRock and Strategy are among the two biggest institutional bulls. The two have been competing for the top spot for the biggest BTC holder.

Source: Treasuries.bitbo.io

Source: Treasuries.bitbo.io

But how do the holdings of these two companies compare against each other? Well, Strategy had 506,137 Bitcoins as of 24 March. Meanwhile, BlackRock had 574,083 Bitcoins during the same period.

Source: Treasuries.bitbo.io

Source: Treasuries.bitbo.io

This means BlackRock currently holds the crown for the largest institutional BTC holder. However, the charts underscore a more aggressive pace of BTC accumulation. This suggested the possibility that Strategy could potentially close the gap with its latest preferred share issuance.

Nevertheless, BlackRock still has a strong lead which may help it in maintaining the lead a while longer. For context, the gap between the two companies is roughly 67,946 which represents a $5.88 billion gap at BTC’s current market value.

Strategy’s latest share issuance is expected to generate roughly $711 million. Meanwhile, it is still too early to tell how much liquidity BlackRock could pump into BTC courtesy of its latest Bitcoin ETF offering in Europe.