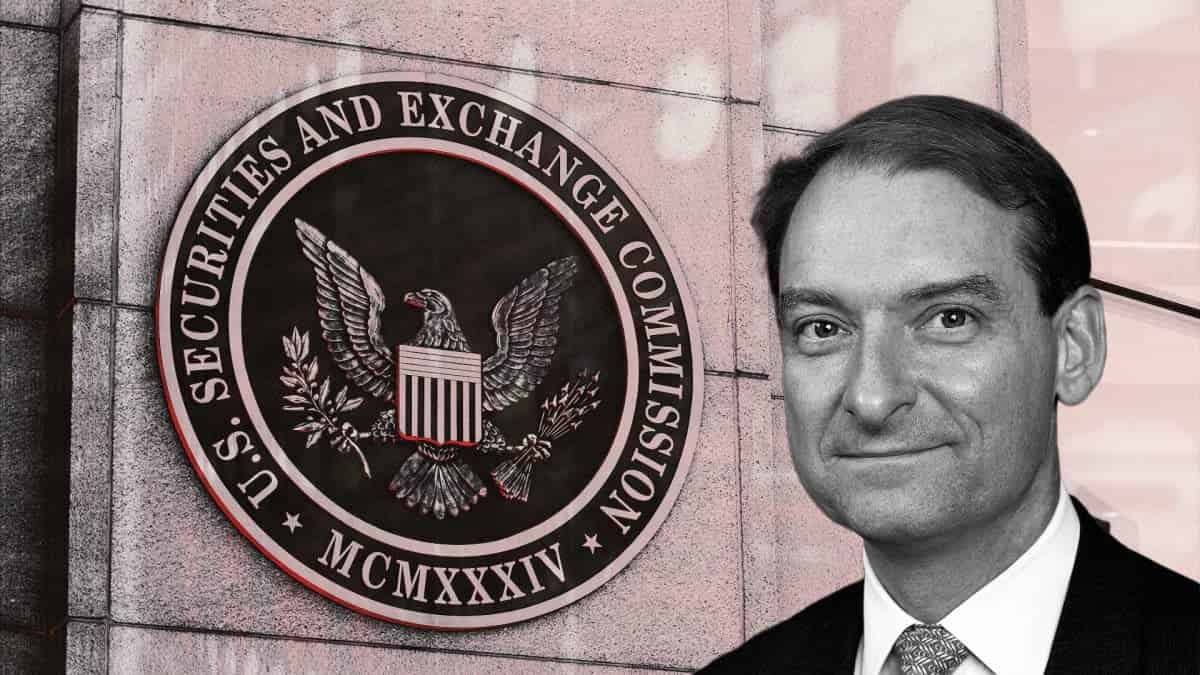

SEC Chair nominee Paul Atkins held shares in Securitize and Anchorage Digital, financial disclosures show: reports

Quick Take The Senate hearing for the crypto-friendly SEC chairman nominee is scheduled for Thursday, March 27. According to an ethics filing obtained by Fortune, Atkins held a board seat and owned up to $500,000 in call options in Securitize.

Ahead of his Senate hearing on Thursday, U.S. Securities and Exchange Commission Chairman nominee Paul Atkins disclosed that he owns shares in three crypto-related companies, though he has no direct cryptocurrency holdings, according to Fortune . Atkins and his spouse have a combined net worth of at least $327 million, Bloomberg reports .

According to an ethics filing obtained by Fortune, Atkins held a board seat and owned up to $500,000 in call options in Securitize. He also held between $250,000 and $500,000 in equity at Anchorage Digital and had a stake of between $1 and $ million in Off the Chain Capital, according to reporting from Fortune on Wednesday.

President Donald Trump tapped Atkins, a crypto supporter, in December to lead the SEC under his administration. Former Chairman Gary Gensler stepped down on Jan. 20, and Acting Chair Mark Uyeda has since led the SEC.

Former President George W. Bush previously appointed Atkins as an SEC commissioner from 2002 to 2008. He founded the consulting firm Patomak Global Partners in 2009, whose clients included crypto exchanges and DeFi platforms. He also joined The Digital Chamber's board of advisers in 2020, but stepped down from that role after Trump's nomination.

Sen. Elizabeth Warren on Monday sent a 34-page letter to Atkins ahead of his nomination, where she pressed him on ties to collapsed crypto exchange FTX and President Trump's possible conflicts of interests with his memecoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Fed’s hawkish rate cuts unveil the illusion of liquidity: the real risks for global assets in 2025–2026

The article analyzes the current uncertainty in global economic policies, the Federal Reserve's interest rate cut decisions and market reactions, as well as the structural risks in the financial system driven by liquidity. It also explores key issues such as the AI investment boom, changes in capital expenditures, and the loss of institutional trust. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content is still undergoing iterative updates.

Cobo Stablecoin Weekly Report NO.30: Ripple's Comeback with a $40 Billion Valuation and the Stablecoin Transformation of a Cross-Border Remittance Giant

Transformation under the wave of stablecoins.

Bitrace's Perspectives and Outlook at Hong Kong FinTech Week

During the 9th Hong Kong FinTech Week, Bitrace CEO Isabel Shi participated in the Blockchain and Digital Assets Forum...

20x in 3 months: Does ZEC’s “Bitcoin Silver” narrative hold up?

You bought ZEC, I bought ETH, we both have a bright future.