XRP New Investor Rate Falls to 4-Month Low, Price Recovery Challenged

XRP's price recovery is challenged by a failure to breach the $2.56 resistance, a 4-month low in new investor activity, and a high NVT ratio. With the market uncertain, the altcoin is likely to remain range-bound unless it successfully breaks this key resistance

XRP has recently struggled to break through key resistance at $2.56, a level that the crypto token’s price has failed to surpass twice this month. This barrier remains the final hurdle on its path to $3.00.

However, despite showing some positive movement, the altcoin’s failure to break this resistance could signal a continued consolidation phase, especially given the current market conditions.

XRP Investors Are Uncertain

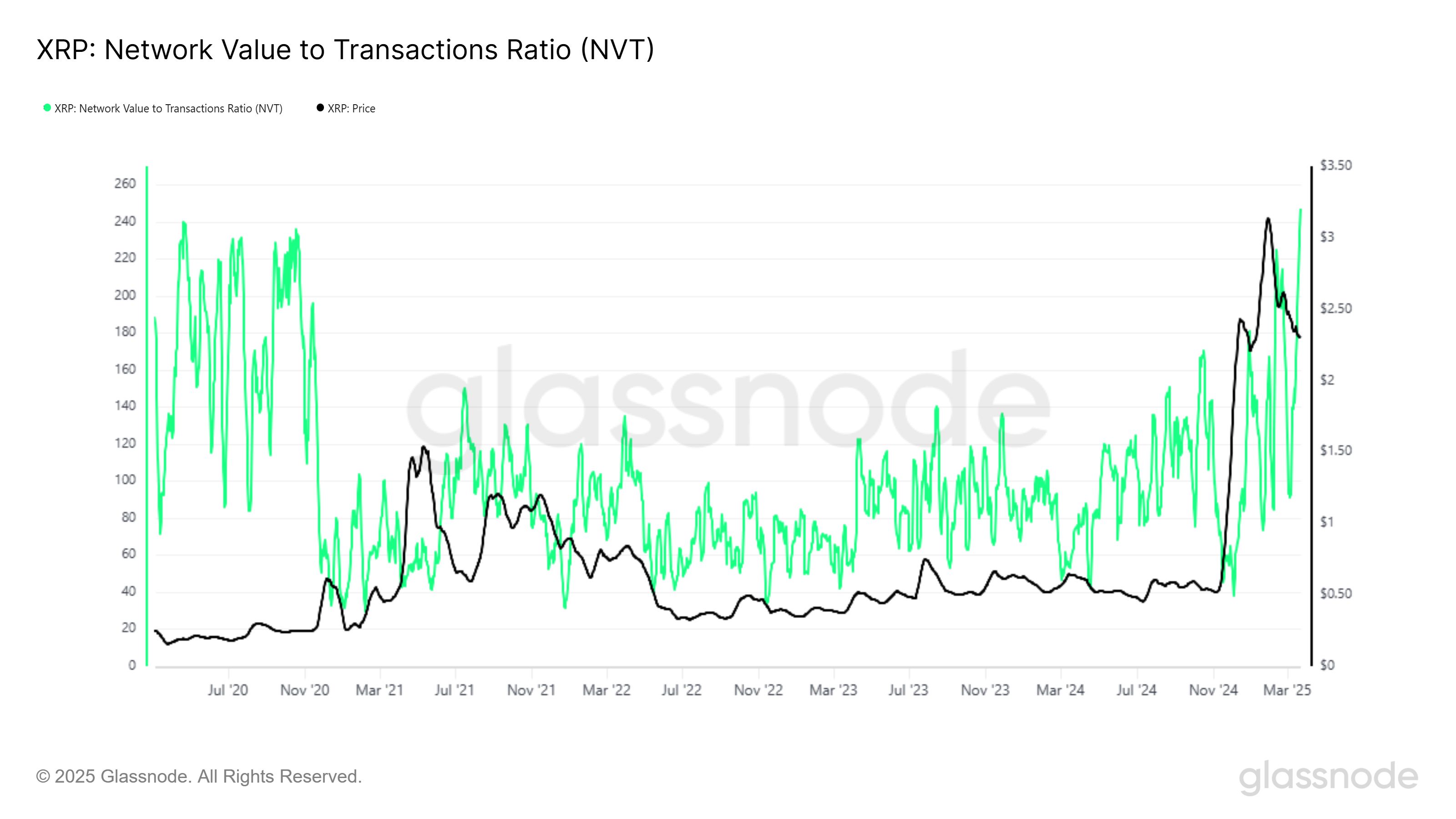

The Network Value to Transaction (NVT) Ratio for XRP has reached a five-year high, a level not seen since January 2020. This metric compares a cryptocurrency’s market capitalization to the volume of transactions conducted on its network.

A high NVT ratio indicates that while investors are bullish, their optimism is not translating into actual growth or usage of the network. This disparity typically signals an overheated market, which often corrects as the excitement cools off.

The current NVT ratio suggests that XRP’s value is outpacing its transaction activity, which is a bearish signal. As the market cools, this imbalance could lead to a price correction, further hindering XRP’s attempts to break through key resistance levels.

XRP NVT Ratio. Source

Glassnode

XRP NVT Ratio. Source

Glassnode

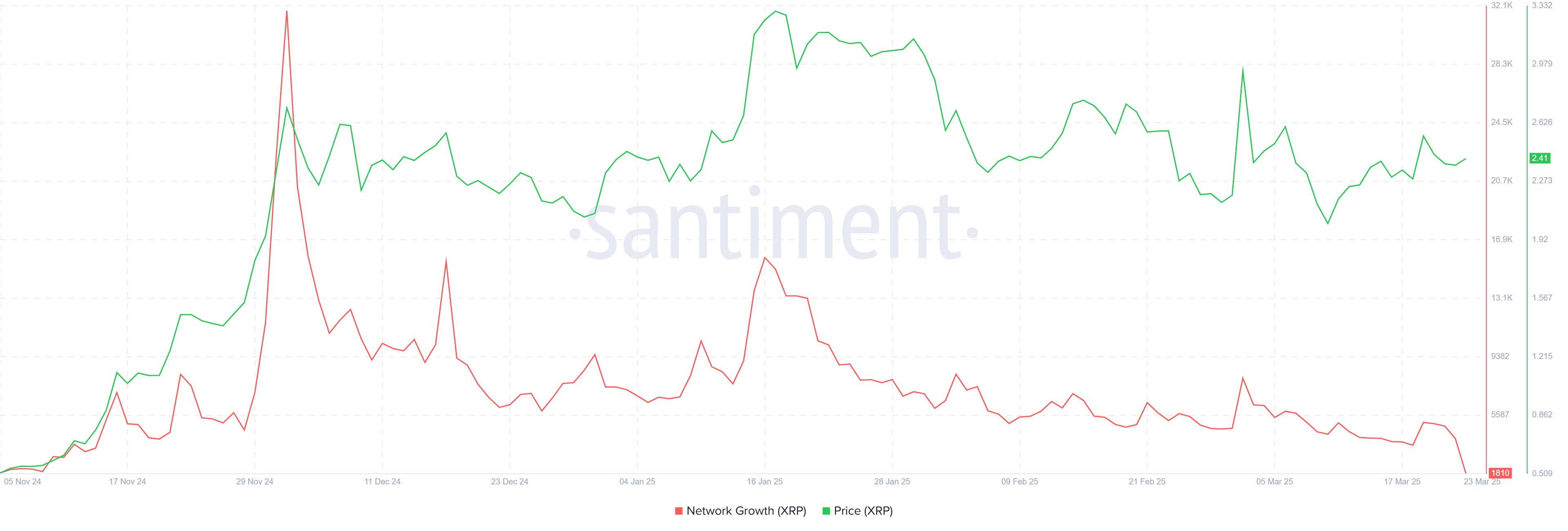

XRP’s macro momentum is also showing signs of strain. The network’s growth is currently at a four-month low, reflecting a decline in the rate at which new addresses are created.

This is a critical metric for assessing a cryptocurrency’s traction in the market, as a growing number of active addresses usually indicates increased adoption.

In XRP’s case, the lack of new address creation suggests that the altcoin is struggling to attract new investors. The lack of incentive for new investors to join the network further dampens XRP’s outlook.

XRP Network Growth. Source:

Santiment

XRP Network Growth. Source:

Santiment

XRP Price Finds Breakout Difficult

XRP is currently trading at $2.40, just below the resistance of $2.56. This level has proven to be a strong barrier, with XRP failing to breach it twice this month.

As a result, the altcoin is likely to continue consolidating between the $2.27 and $2.56 range. This period of consolidation may persist if the market conditions remain unchanged.

Should bearish conditions worsen, XRP could slide below its support at $2.27. In this case, the price may fall to $2.14 or lower, erasing much of the recent recovery from the $2.00 level.

The continuation of this downward movement would reinforce the bearish outlook.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if XRP can breach the $2.56 resistance and flip it into support, the bearish thesis would be invalidated. A successful breakout could push XRP toward $2.95 and, ultimately, the $3.00 mark.

This would require strong support from investors and a more favorable market environment to sustain the upward momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MEET48: From Star-Making Factory to On-Chain Netflix — How AIUGC and Web3 Are Reshaping the Entertainment Economy

Web3 entertainment is moving from the retreat of the bubble to a moment of restart. Projects represented by MEET48 are reshaping content production and value distribution paradigms through the integration of AI, Web3, and UGC technologies. They are building sustainable token economies, evolving from applications to infrastructure, aiming to become the "Netflix on-chain" and driving large-scale adoption of Web3 entertainment.

Digital Euro: Italy Advocates for a Gradual Implementation

Ethereum Validator Queues Surge as 2.45M ETH Sits in Exit Line

21Shares And Canary Ignite XRP ETF Approval Process