Date: Thu, March 20, 2025 | 04:56 PM GMT

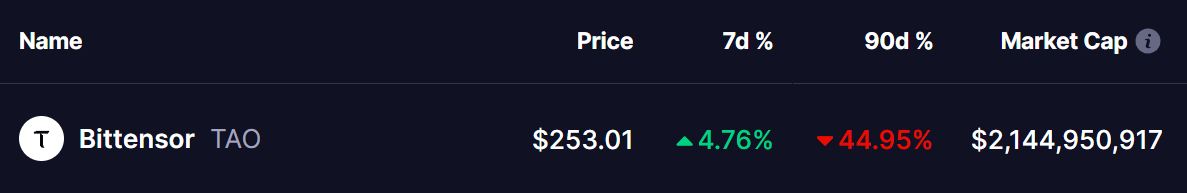

he crypto market is showing mixed signs of a rebound as Ethereum (ETH) has bounced back with 5% weekly gains and is now trading at $1,950—a promising shift after a choppy start to March. As sentiment gradually improves, altcoins like Bittensor (TAO) are beginning to stir as well.

TAO has taken a heavy hit over the past few months, but noticeable weekly gains and ongoing price action suggest that a recovery may be underway.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Pattern Hints at Recovery

On the weekly chart, TAO has formed a classic double-bottom pattern after experiencing a sharp downtrend that started when it failed to break the $743 neckline resistance in early December 2024. Since then, TAO has seen a major correction, with a 70% drop, revisiting the $212 support level, marking the second bottom of the pattern.

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

With this pattern forming, TAO has held this support and has now bounced to $253, indicating a potential shift in trend. The MACD (Moving Average Convergence Divergence) indicator for TAO is also hinting at a possible bullish crossover, suggesting that momentum could continue to build. This aligns with historical trends where double-bottom formations often lead to strong reversals.

If this recovery gains further strength, the next key resistance level is the 50-week moving average (MA) at $413. A decisive move above this level would confirm the uptrend and could pave the way for an attempt to reclaim the $743 neckline resistance in the near term.

Final Thoughts

While the broader market remains volatile, TAO’s technical setup looks promising for a potential bullish breakout. However, a failure to hold the $212 support could invalidate the double-bottom formation, leading to further downside. Traders should watch for a decisive move above key resistance levels to confirm the trend reversal.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.