Bitcoin’s market is grappling with a sustained liquidity contraction and muted investor activity, according to a March 18 Glassnode report authored by researchers Cryptovizart and Ukuria OC. The asset has slumped 30% from its February peak of $97,000 to $82,000, with net capital inflows nearly stalling.

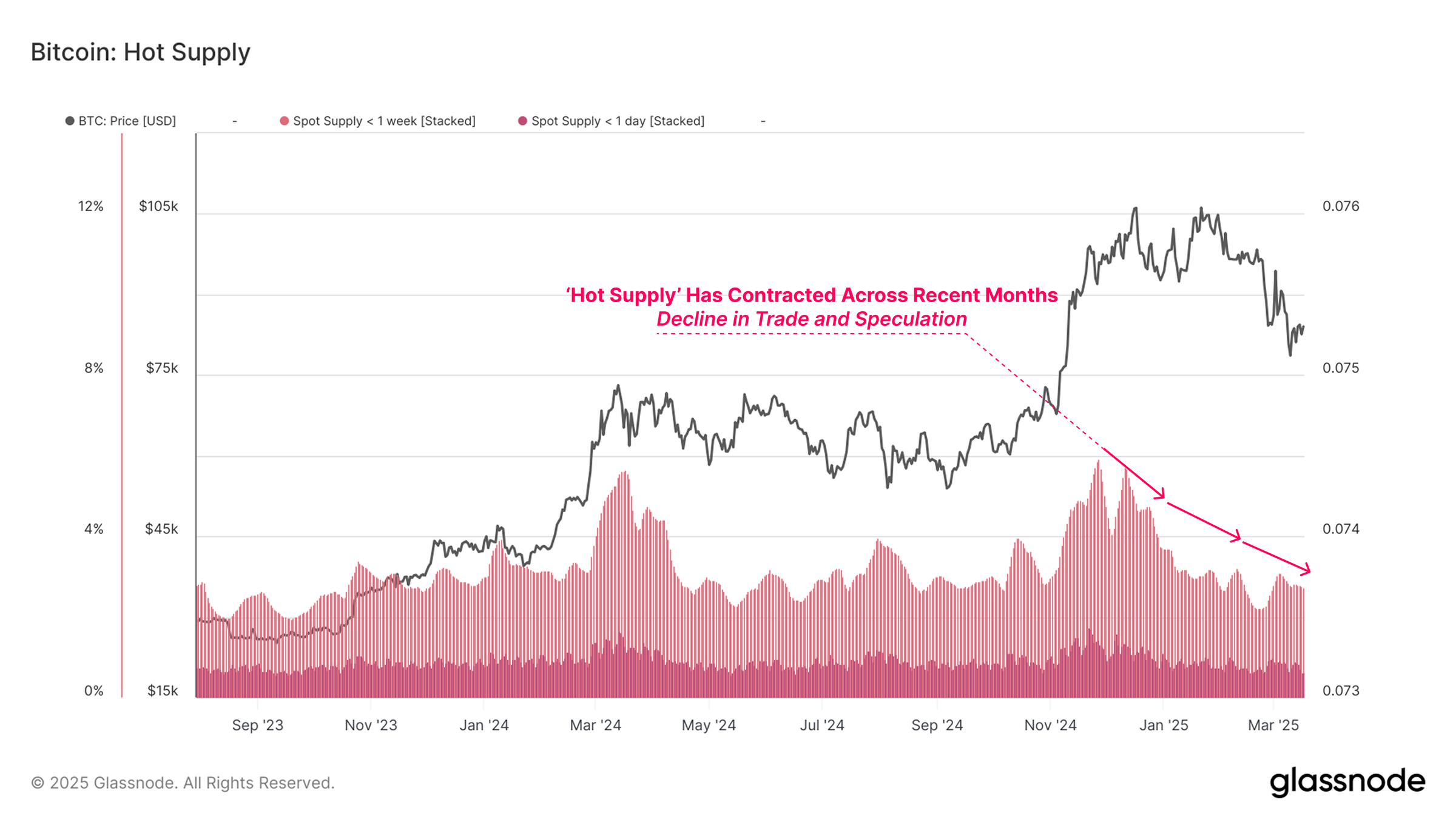

Glassnode data shows the Realized Cap—a measure of Bitcoin’s network value—is growing at just 0.67% monthly, signaling a dearth of fresh capital to buoy prices. Liquidity strains are evident across onchain and derivatives markets. Exchange inflows have plummeted 54% since late February, while the volume of “Hot Supply” (coins held for less than a week) has halved to 2.8% of circulating BTC.

Source: Glassnode report

Glassnode attributes this to declining speculative appetite. Futures open interest has also dropped 35%, reflecting reduced hedging and arbitrage activity. Notably, analysts highlight an ongoing unwind of cash-and-carry trades, where institutions paired long spot exchange-traded fund (ETF) positions with short futures.

This has triggered $378 million in CME futures closures and ETF outflows, pressuring spot markets. “However, as long-side bias starts to soften in the market, an unwinding of the carry-trade appears to be underway,” Glassnode’s onchain report states. “This has resulted in substantial ETF outflows, and the closure of a similar volume of futures positions.”

The study shows options markets highlight rising risk aversion. The Volatility Smile metric reveals elevated premiums for put options, indicating traders are prioritizing downside protection. The 25 Delta Skew for one-week and one-month contracts also shows puts outpacing calls in cost—a pattern Glassnode ties to institutional caution.

Short-Term Holders (STHs) face acute stress, with unrealized losses nearing cycle highs, the report disclosed. A record $7 billion in STH losses has been locked in since February, though Cryptovizart and Ukuria OC note this remains milder than 2021–2022 capitulation events. Long-Term Holders (LTHs), meanwhile, are reducing sell-side activity. “We can evaluate the percentage of the total Long-Term Holder balance sent to exchange addresses,” the researchers note.

Glassnode’s analysis adds:

By this metric, we can see a pronounced, but swift spike in distribution as the market traded down into the low-$80k range. This suggests that some long-term investors opted to de-risk, taking profits off the table amidst the uptick in volatility.

Glassnode’s report emphasizes that LTHs still control 40% of Bitcoin’s wealth, creating a potential supply overhang. However, their restraint—paired with STH distress—paints a bifurcated market.

“When we look at the investor response to volatility, we see two divergent stories,” the report concludes. “First, Short-Term Holders are taking some of the largest losses of the cycle, reflecting a degree of fear. Long-Term Holders on the other hand, have slowed their spending, seeming to move away from sell-side distribution, and perhaps back towards patient accumulation and holding.”

As liquidity tightens and volatility persists, bitcoin’s path hinges on whether institutional demand can counterbalance wary retail sentiment—an intriguing dynamic everyone will be watching this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。