‘Bull Cycle Is Over’ – CryptoQuant CEO Abruptly Flips Stance on Bitcoin, Warns BTC Could Be Bearish for One Year

The chief executive of a prominent analytics firm is suddenly turning bearish on Bitcoin, saying BTC has hit a major cycle top.

CryptoQuant CEO Ki Young Ju tells his 417,200 followers on the social media platform X that on-chain data suggests that Bitcoin will not print new highs for at least half a year.

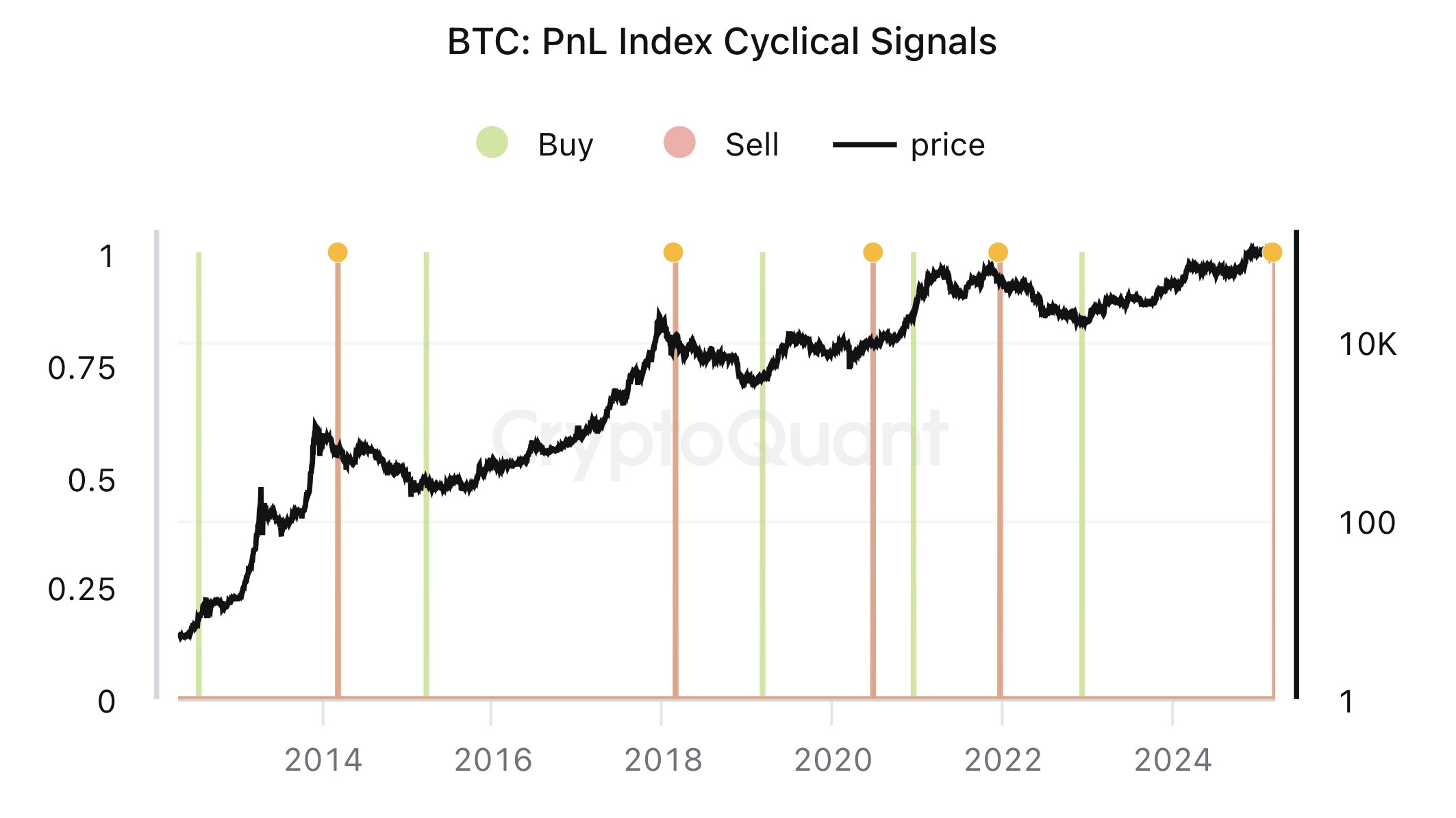

The analytics firm executive says Bitcoin’s profit and loss (PnL) Index Cyclical Signals, an analytical tool that aggregates several on-chain metrics to identify cycle tops and bottoms, just flashed a signal that potentially marks the end of BTC’s bull market.

“Bitcoin bull cycle is over, expecting six to 12 months of bearish or sideways price action.”

Source: Ki Young Ju/X

Source: Ki Young Ju/X

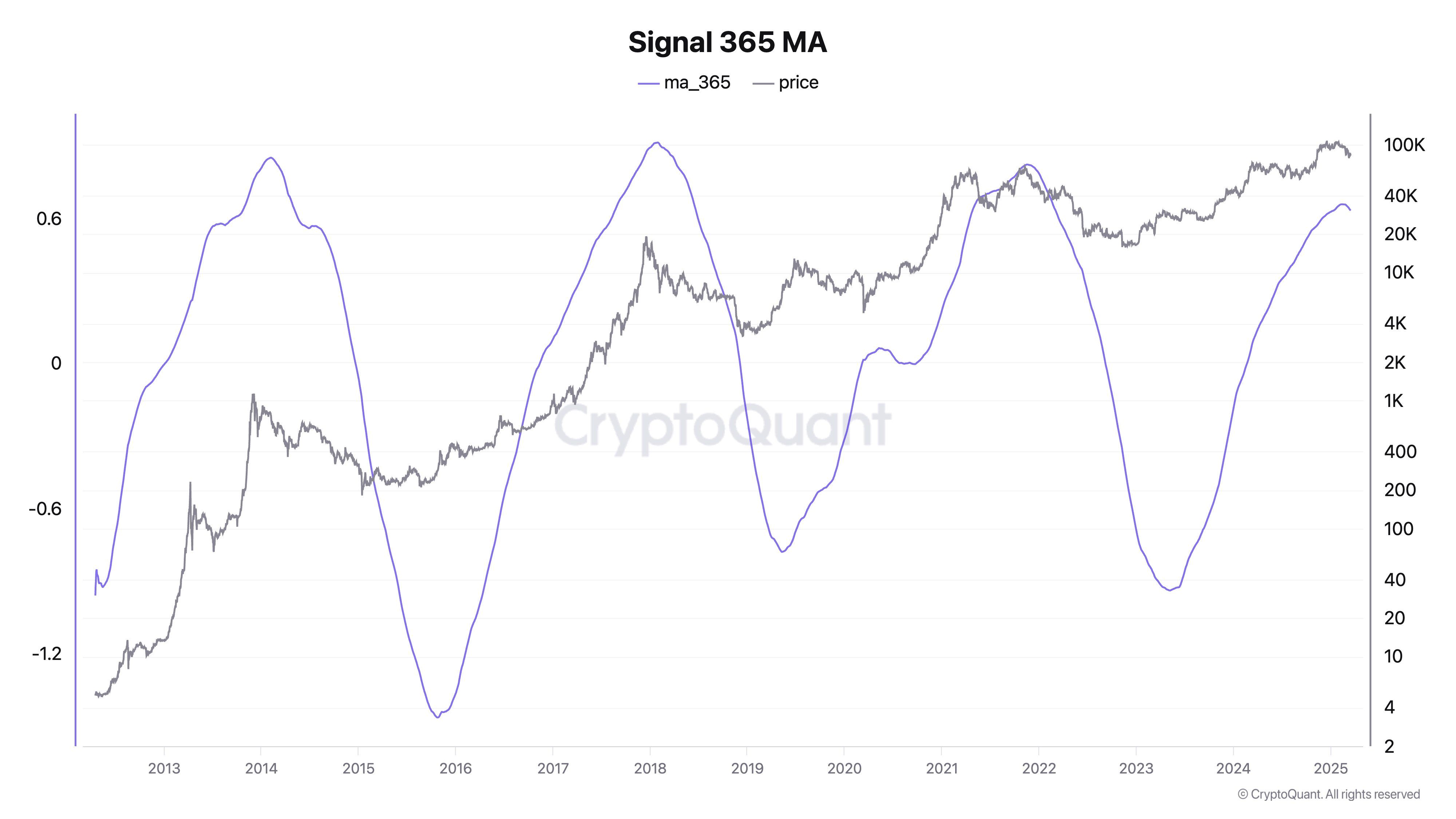

He also says that Bitcoin’s 365-day moving average is starting to roll over, another signal that Bitcoin may be ready to enter bear territory.

“Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices…

This alert applies PCA (Principal Component Analysis) to on-chain indicators like MVRV (market value to realized value), SOPR (spent output profit ratio) and NUPL (net unrealized profit/loss) to compute a 365-day moving average. This signal identifies inflection points where the trend of the one-year moving average changes…

I double-checked the data – it’s accurate.”

Source: Ki Young Ju/X

Source: Ki Young Ju/X

MVRV is a metric designed to determine whether a crypto is overvalued or undervalued by comparing its current price (market cap) to the average price at which all coins were last moved (realized cap). SOPR is a metric that tracks whether holders of a coin are unloading at a profit or loss to pinpoint price reversal areas.

Meanwhile, NUPL is a signal used to assess the overall profit or loss status of a coin’s investors to peer into general market sentiment.

According to Ki Young Ju, the on-chain signals suggest that Bitcoin is “entering a bear market.”

“Realized cap-based indicators show a lack of new liquidity. Massive volume around 100,000 failed to push the price higher, and ETF (exchange-traded fund) inflows have been negative for three consecutive weeks.”

At time of writing, Bitcoin is worth $83,157.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%