The value of Pi Coin from Pi Network continues to decline, recently experiencing a drop of over 9%, trading at approximately $1.26. Technical indicators suggest that the current selling pressure remains strong, with prices expected to fluctuate mainly between $1.20 and $1.40. Additionally, recent developments in the market and updates regarding KYC have raised concerns about the future of Pi Coin.

What Do Technical Indicators Say About Pi Coin?

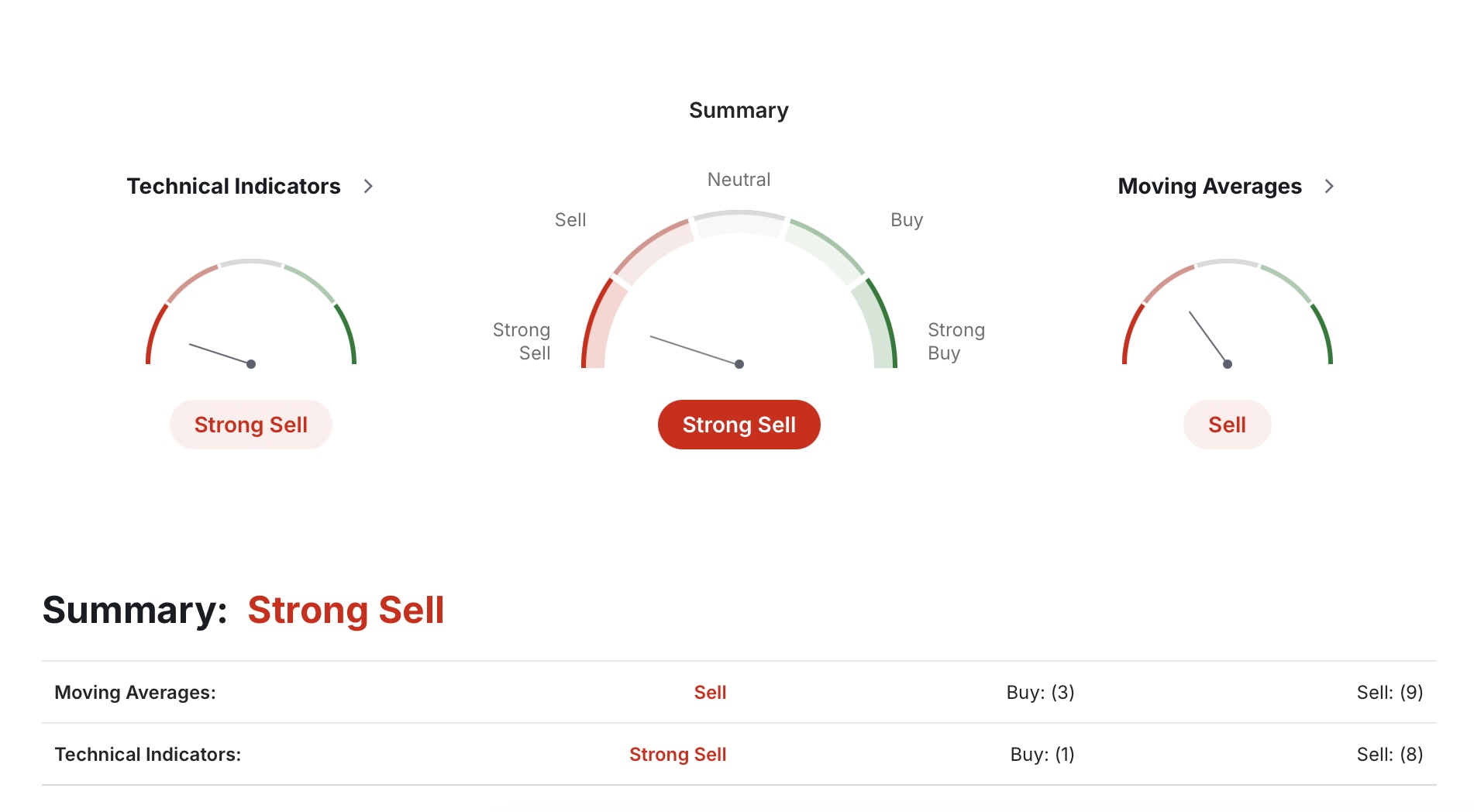

Technical analysis indicators for Pi Coin reveal increased selling pressure and negative price movements. The Rate of Change (ROC) at -19.06 indicates a significant loss of momentum in price movement, signaling increased selling pressure. The Relative Strength Index (RSI) at 36.10 shows that Pi Coin is approaching the oversold territory, which could lead to a short-term recovery.

Pi Network Pi Coin Analysis

Pi Network Pi Coin Analysis

The Commodity Channel Index (CCI) at -111.43 indicates a strong negative trend for the altcoin . Although the Moving Average Convergence Divergence (MACD) at 0.26 shows weak buying activity, it still indicates some volatility. Overall, the outlook remains negative.

KYC Process Completed in Pi Network

The KYC (Know Your Customer) process in the Pi Network has been completed. However, this process has caused price fluctuations. Users who did not complete KYC lost their Pi Coins, leading to a decrease in market supply. While some analysts view this development positively in the long term, it has created uncertainty in the short term. Users who completed KYC can now utilize their mined Pi Coins, which has increased selling pressure and contributed to the price drop.

Moreover, rumors about Pi Coin potentially being listed on major exchanges like Binance and Coinbase are impacting price movements. However, there is no official announcement regarding these listings, which further heightens price pressure. If there is any development regarding listings on Binance or Coinbase, a significant price increase for Pi Coin could be expected.

In the short term, it is critical for Pi Coin to surpass the $1.50 resistance level. Current technical analysis data suggests that while selling pressure persists, approaching oversold levels may facilitate short-term recoveries.