-

The recent unlock of 19 million Chainlink (LINK) tokens has sparked discussions on possible market movements amidst volatile conditions.

-

Chainlink’s unique positioning in the DeFi ecosystem may influence LINK’s price trajectory following significant whale activity and market rebound.

-

As noted by Spot On Chain, “The latest unlock marks a pivotal moment for LINK, prompting traders to reassess their positions in the broader crypto market.”

Chainlink’s recent 19M token unlock raises questions on its market impact, particularly against Bitcoin’s fluctuations. Insights suggest a cautious approach for traders.

Analyzing the 19 Million LINK Unlock and Market Responses

The recent unlock of 19 million LINK tokens, valued at approximately $269 million, has prompted significant reactions within the crypto community. On 15 March, these tokens were released as part of Chainlink’s quarterly distribution plan. According to blockchain analytics platform Spot On Chain, a substantial portion, 14.875 million LINK was transferred to #Binance, while 4.125 million LINK was directed to a multi-signature wallet.

Market Stability Following the Unlock

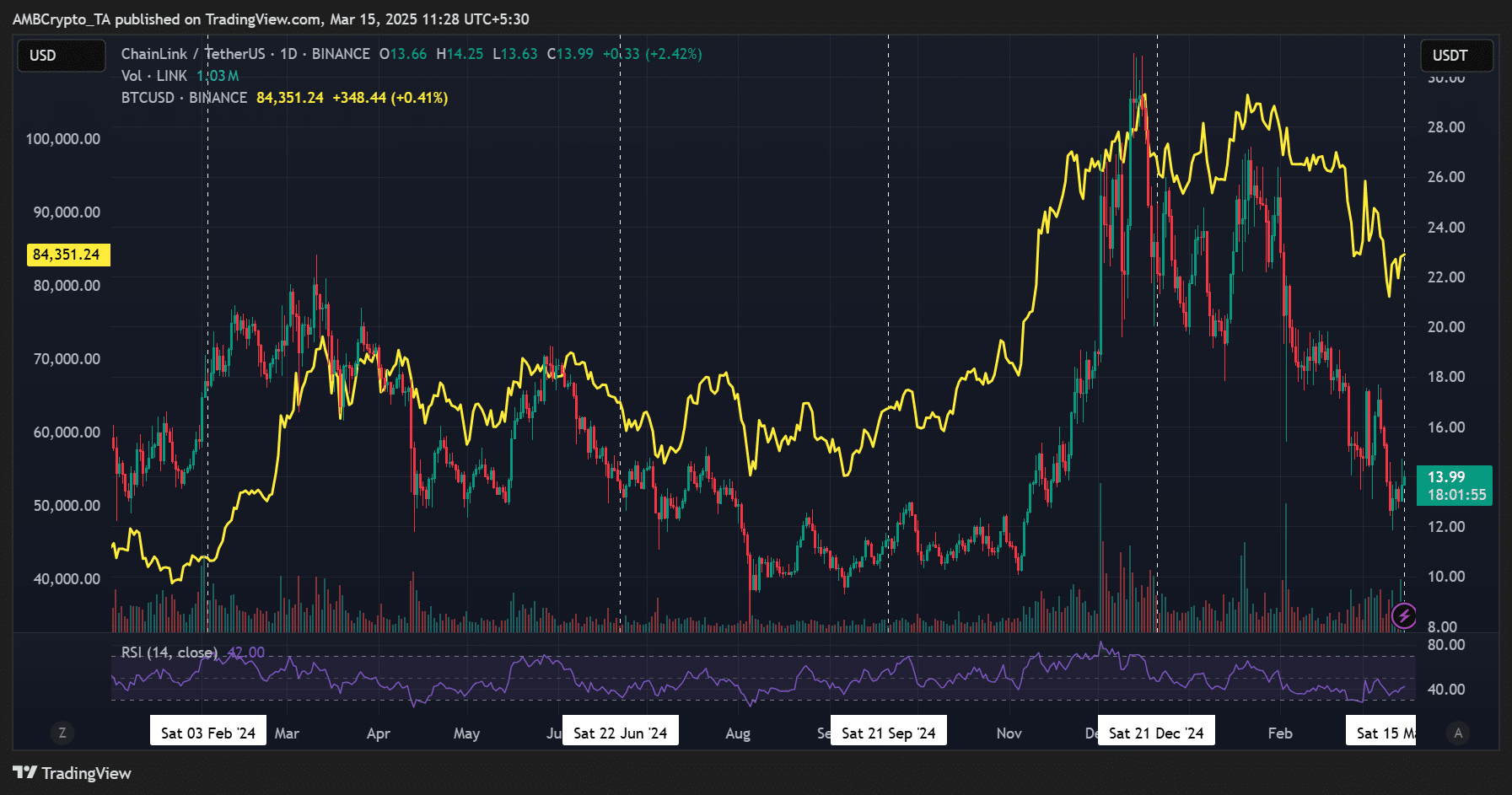

Despite the large volume of tokens entering the market, LINK showcased resilience, experiencing a near 6% increase at press time, driven largely by Bitcoin’s recovery. Historical data suggests similar scenarios post-unlock, raising the question: can LINK maintain stability? Notably, previous unlock events often resulted in short-term price dips, typically followed by rebounds unless Bitcoin suffered a more significant decline.

Source: TradingView (LINK price reaction to unlocks)

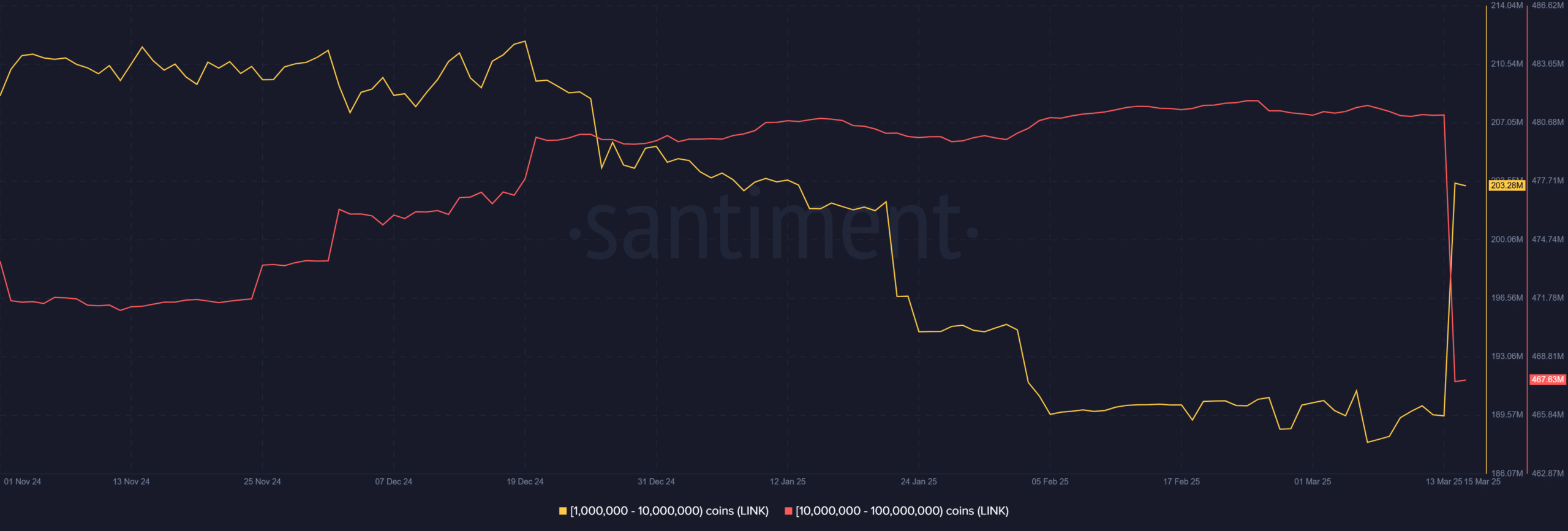

Details reveal that high-net-worth wallets—those holding between 10 million and 100 million LINK—offloaded approximately 13 million tokens just ahead of the unlock date. This strategic selling may indicate a shift in market sentiment. Conversely, smaller wallets in the 1 million to 10 million LINK range have capitalized on this selling, absorbing much of the offloaded supply.

Source: Santiment (whale offloading)

While some traders aggressively repositioned themselves—one notable trader initiated a long position of $7.1 million prior to the unlock—the subsequent market behavior illustrates the inherent risks of such strategies, evidenced by the liquidation of their position shortly after the event.

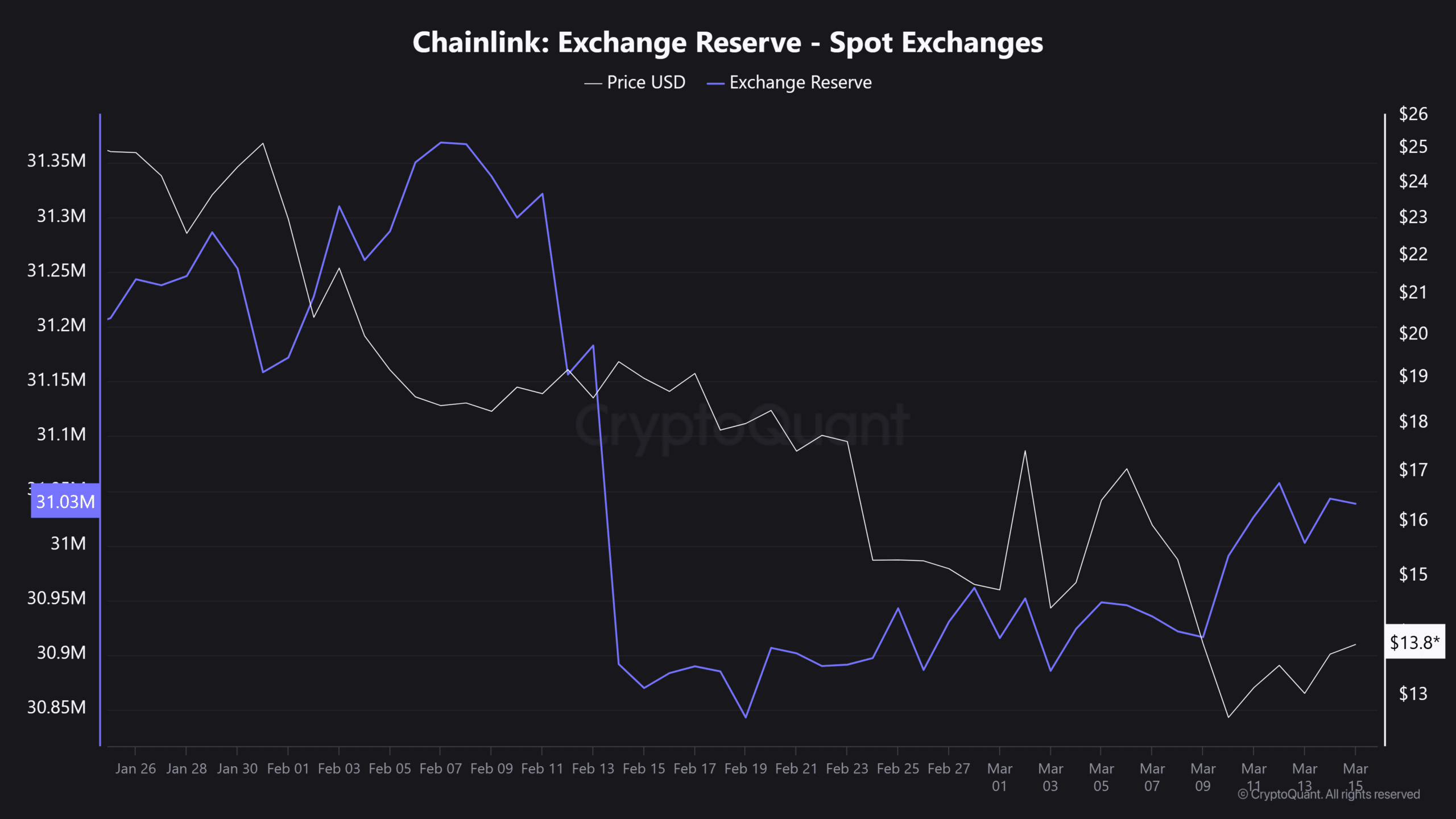

Sell Pressure Analysis and Exchange Dynamics

Market dynamics reveal interesting patterns regarding selling pressure. Although total sell pressure remained relatively stable, a slight increase in liquidations was noted, with reserves on centralized exchanges rising from 30.8 million LINK to 31 million LINK right before the unlock. This uptick may suggest traders preparing for post-unlock volatility.

Source: CryptoQuant

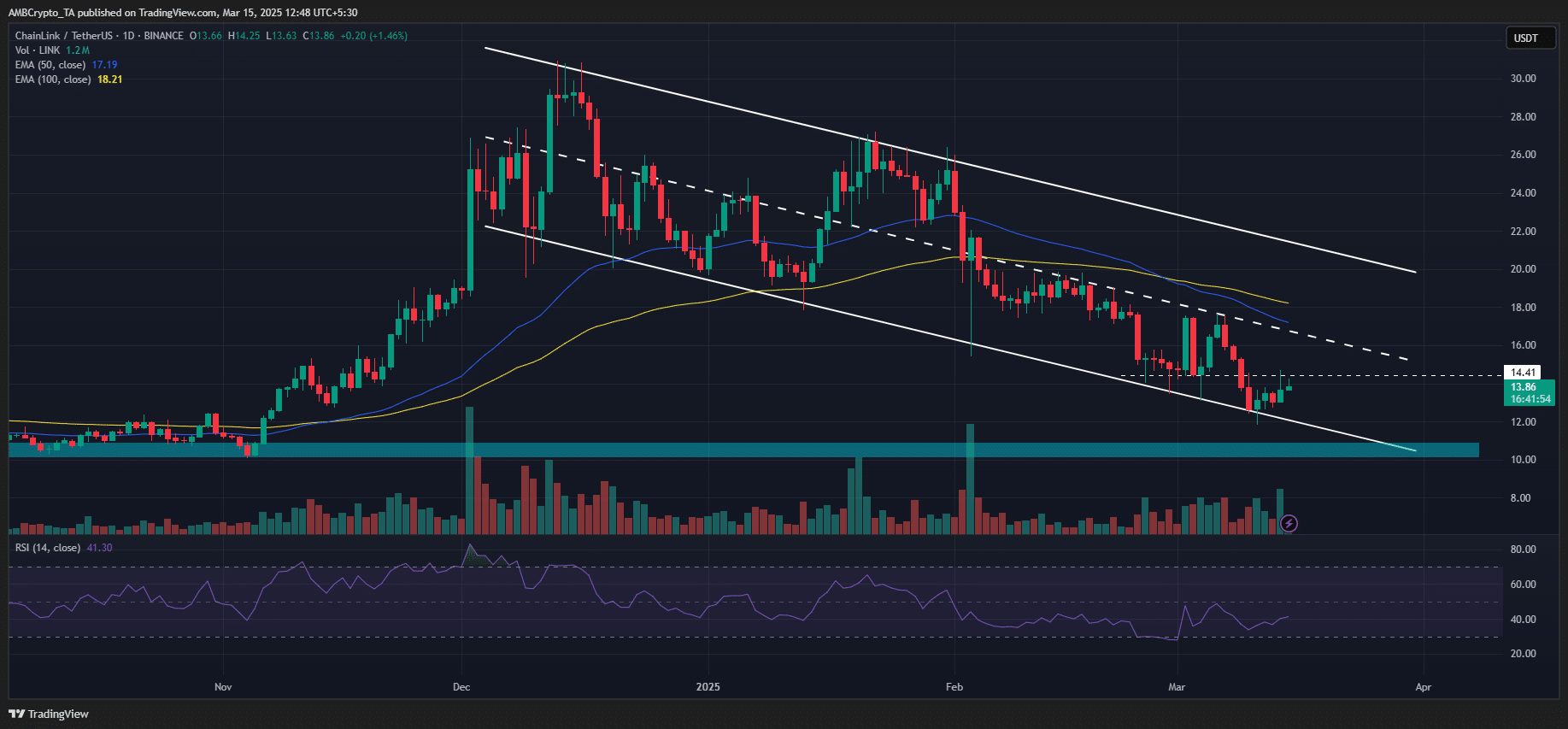

Furthermore, reserves on derivatives exchanges experienced sharp increases, indicating potential for heightened volatility in the aftermath of the unlock. Technical analysis suggests that should LINK’s price rebound, key resistance levels near $16-$17 could be tested. Conversely, persistent selling pressure might see LINK retrace to levels akin to those seen during the November U.S. elections, possibly around $10.

Source: LINK/USDT, TradingView

Conclusion

The recent unlock of Chainlink tokens presents a mixed narrative for market participants. While short-term volatility remains a concern, macro trends and historical performance post-unlock could provide valuable insights for traders. Careful analysis and awareness of market dynamics will be essential as LINK navigates this pivotal period in its trading history.