Cardano’s Decline: What Next for ADA as Short-Term Traders Exit

Cardano's ADA faces mounting selling pressure, with short-term holders reducing their positions as the cryptocurrency market remains bearish. ADA's price below the 20-day EMA suggests further declines unless a bullish shift occurs.

Cardano’s ADA has struggled to maintain stability over the past month. It currently trades at $0.70, having declined by nearly 10% over the past 30 days.

The downtrend comes as broader market headwinds weigh on investor sentiment, prompting short-term holders (STHs) to reduce their holding time significantly.

Cardano’s Short-Term Traders Are Selling Fast—Will ADA Find Support?

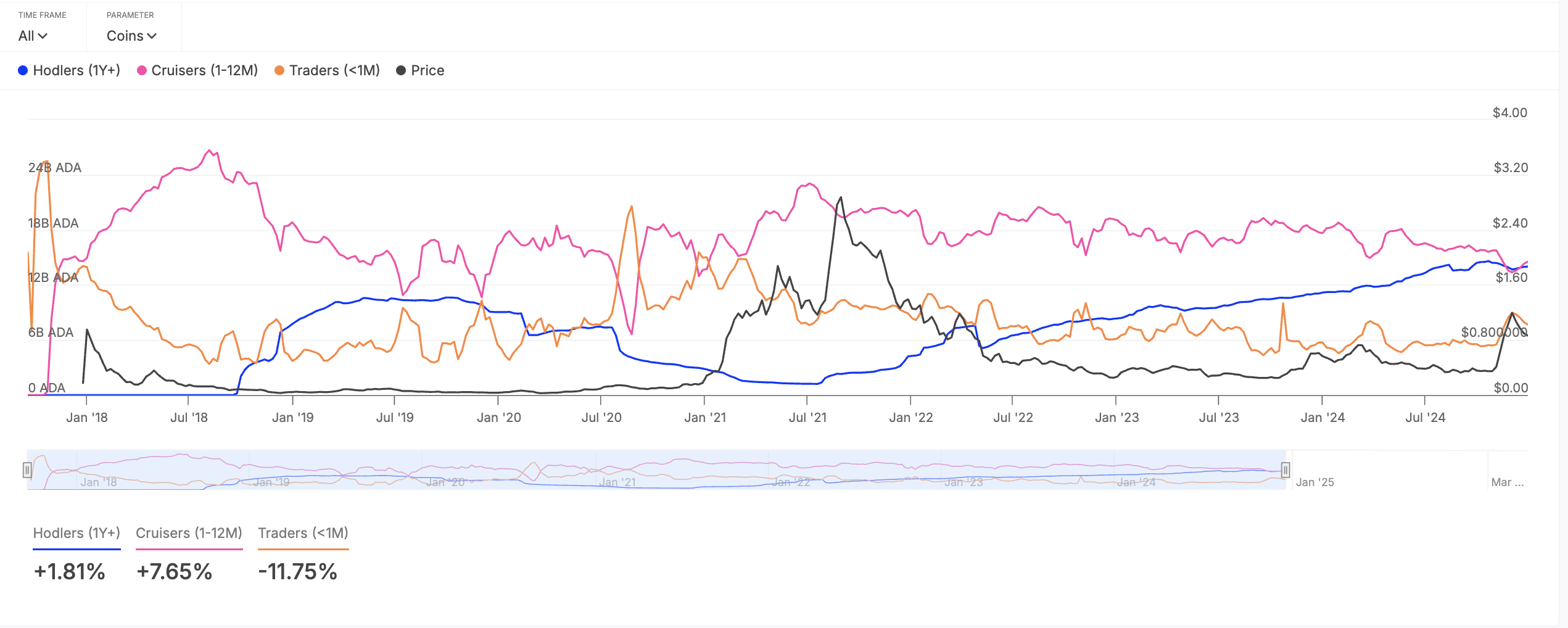

STHs, referring to investors who typically hold assets for less than one month, have significantly reduced their ADA holding time as bearish sentiment intensifies across the crypto market.

According to data from IntoTheBlock, these investors have reduced their holding time by 12% in the past month, exacerbating the coin’s price decline.

Cardano Balance by Time Held. Source:

IntoTheBlock

Cardano Balance by Time Held. Source:

IntoTheBlock

Given their influence on short-term market trends, this drop in activity among STHs suggests a lack of confidence in ADA’s near-term recovery. If this wave of selling continues, the coin may struggle to find a solid support level unless long-term investors or institutional buyers step in to absorb the sell-offs.

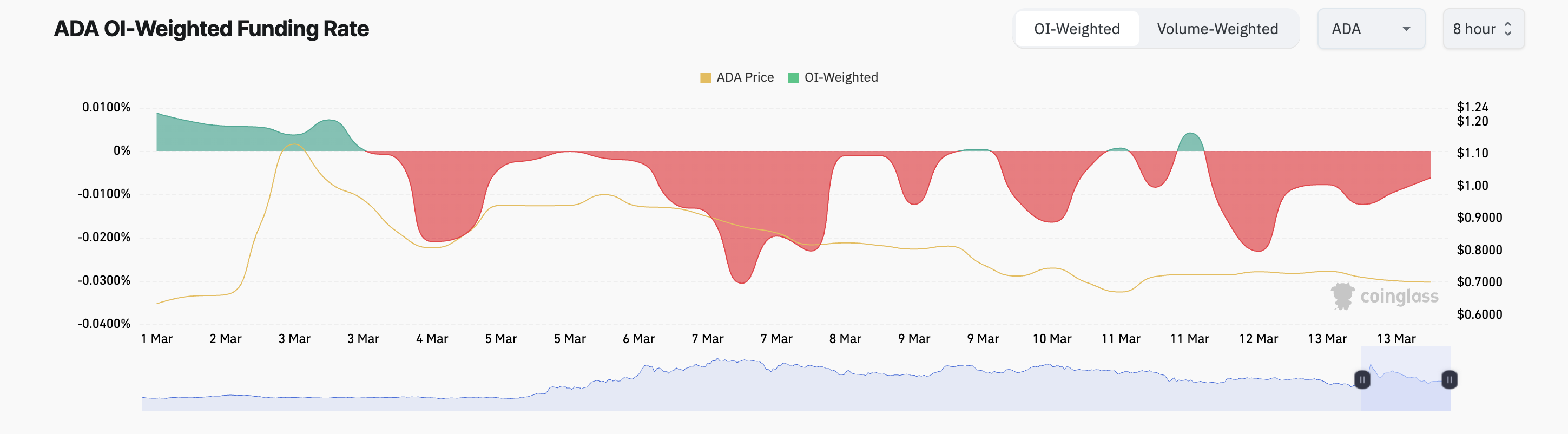

Additionally, ADA’s funding rate across its derivatives market has remained negative, confirming the bearish bias against it. Per Coinglass, this is currently at -0.006%.

Cardano Funding Rate. Source:

Coinglass

Cardano Funding Rate. Source:

Coinglass

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts. It is designed to keep contract prices aligned with the spot market.

When it is negative, short traders are paying longs, indicating that bearish sentiment dominates, with more traders betting on price declines.

ADA Faces Increased Selling Pressure

ADA’s decline has pushed its price below the 20-day exponential moving average (EMA) on a daily chart. This indicator measures an asset’s average price over the past 20 trading days, giving weight to recent price changes.

When an asset’s price falls below this key moving average, it signals weakening market momentum and hints at a shift to a short-term downtrend. Traders see this as a bearish signal, suggesting increased selling pressure and the possibility of further declines.

If this holds, ADA’s price could drop to $0.60.

ADA Price Analysis. Source:

TradingView

ADA Price Analysis. Source:

TradingView

On the other hand, a bullish resurgence could trigger a break above the $0.72 resistance and a charge toward $0.82.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"I'm panicking, what happened?" Cloudflare outage causes global internet chaos

The incident once again highlights the global internet's heavy reliance on a few key infrastructure providers.

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data

The United States will fill in missing employment data and release new economic data. The Coinbase CEO is looking forward to progress in crypto regulatory legislation. Market participants predict the market is nearing a bottom. Phantom has launched a professional trading platform. Trump hints that the candidate for Federal Reserve Chair has been decided. Summary generated by Mars AI This summary was generated by the Mars AI model, which is still being iteratively updated for accuracy and completeness.

Countdown to a comeback! The yen may become the best-performing currency next year, with gold and the US dollar close behind

A Bank of America survey shows that more than 30% of global fund managers are bullish on the yen's performance next year, with undervalued valuations and potential central bank intervention possibly paving the way for its rebound.