Inflation in the United States is steadily easing, as the most recent Consumer Price Index (CPI) report highlights a decline in the inflation rate to 2.8%, edging tantalizingly close to the 2% threshold sought by the U.S. Federal Reserve.

This subtle yet noteworthy dip suggests a gradual moderation in price pressures, offering a glimmer of relief amid ongoing economic recalibrations. The data, while modest, signals a potential shift in inflationary trends, inviting closer scrutiny from analysts and policymakers alike.

Moreover, Core CPI inflation—an indicator that strips out volatile food and energy prices—slipped to 3.1%, narrowly missing the forecasted 3.2%. This drop represents the first instance since July 2024 where both headline and Core CPI have simultaneously retreated. Yet, even amid this encouraging development, the outlook for an imminent rate cut grew decidedly less optimistic.

According to CME Group’s Fedwatch tool, which draws insights from CME’s futures markets, the probability of the U.S. Federal Reserve holding steady on the federal funds rate stands at a striking 99%. This near-certainty reflects a market consensus that the central bank is unlikely to pivot toward rate cuts in the immediate future.

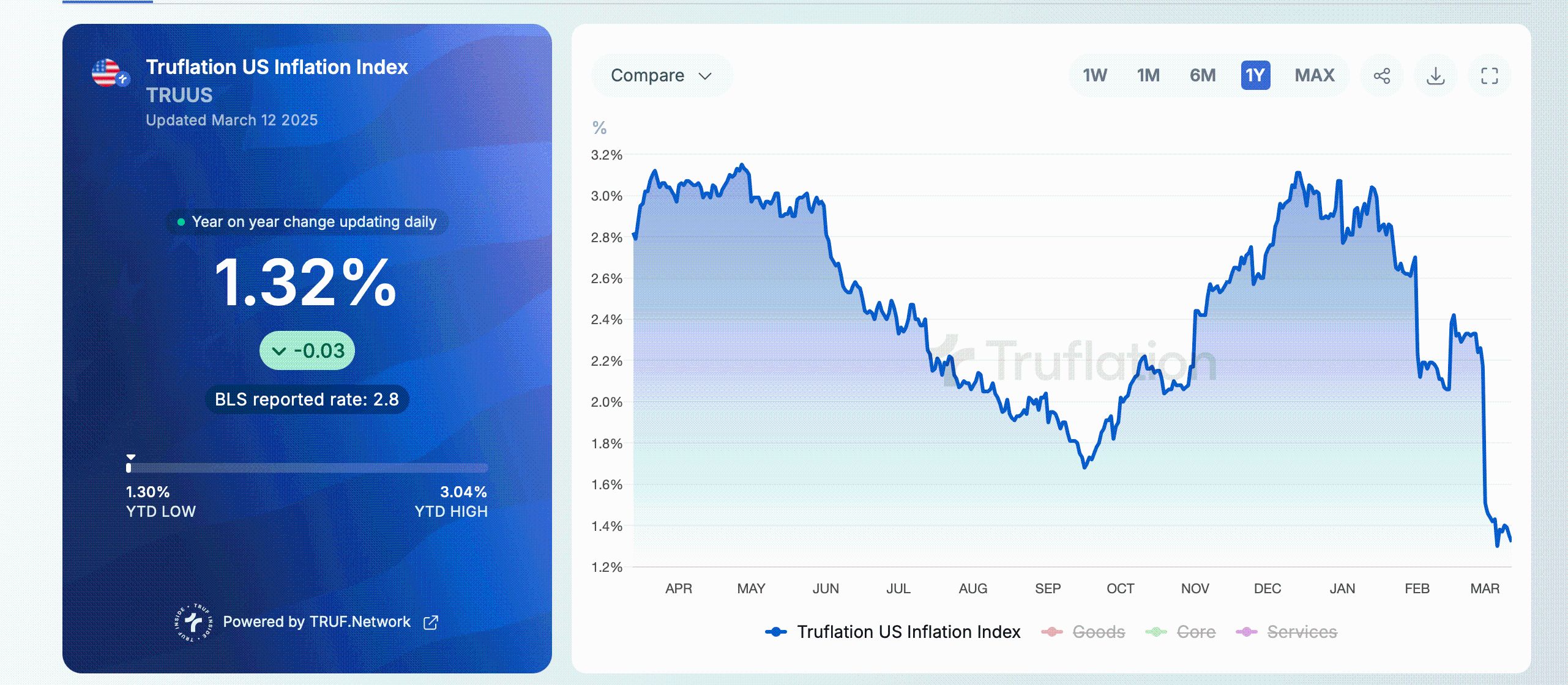

Truflation’s US Inflation Index on March 12, 2025.

Equally interesting is the observation by Truflation, a blockchain-powered platform engineered to deliver real-time, transparent, and precise inflation metrics, which estimates the U.S. inflation rate at a modest 1.32%. By harnessing decentralized technology, Truflation aggregates and scrutinizes pricing information from a diverse array of sources, such as e-commerce sites, government datasets, and financial entities.

The latest inflation metrics, while signaling moderating price pressures, showcase the Federal Reserve’s cautious stance amid mixed signals. Though traditional indices approach target levels, alternative data like Truflation’s blockchain-derived figures suggest even sharper disinflation. With markets overwhelmingly anticipating steady rates, policymakers appear committed to sustaining restrictive measures until sustained stability is evident.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。