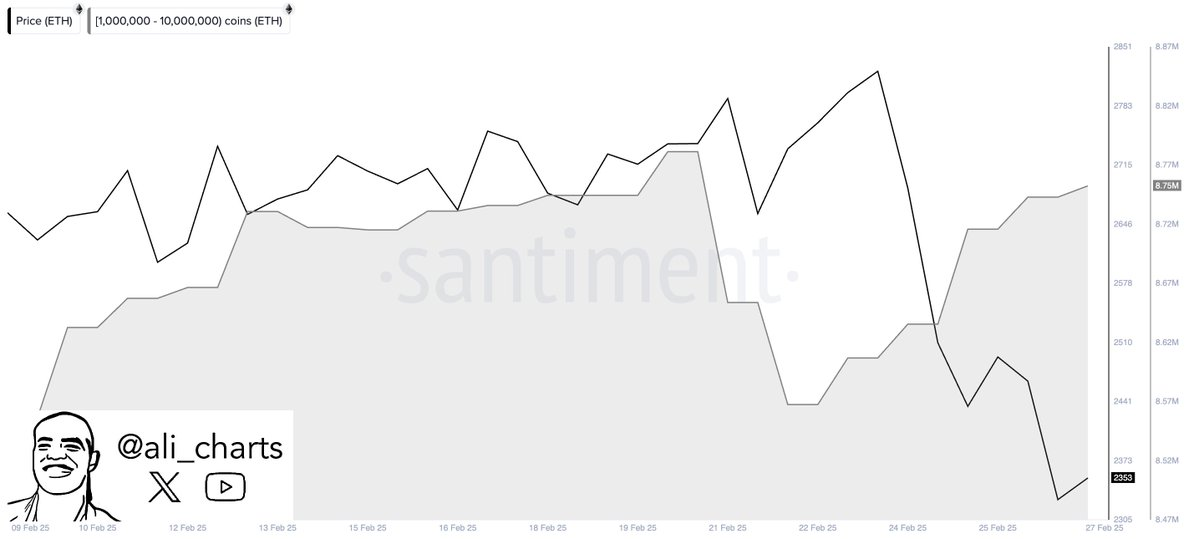

- Whale accumulation boosted Ethereum’s price until Feb 21, showing their strong influence on market trends.

- A sharp sell-off by whales after Feb 21 led to ETH’s steep decline, reinforcing their role in price volatility.

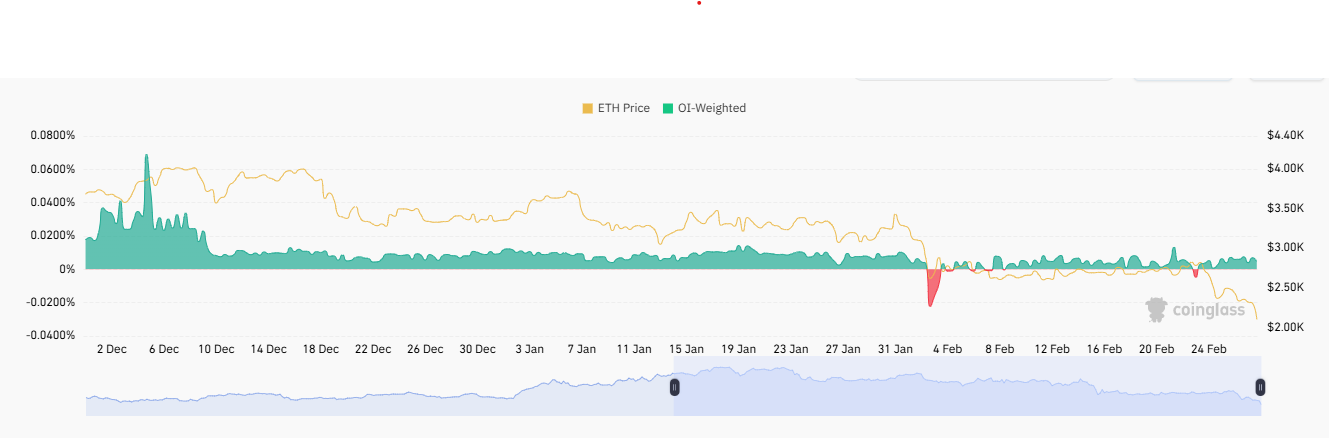

- Open interest data signals market sentiment shifts, with whale activity driving ETH’s ups and downs.

Ali, a popular analyst, highlighted an Ethereum market movement involving whales. Over the past 72 hours, large investors accumulated 110,000 ETH. The activity reveals a correlation between whale holdings and price trends . Market fluctuations mirror whale behavior, showcasing a synchronized effect on ETH’s value.

Whale Accumulation Triggers Uptrend

The price of Ethereum increased from February 9 to February 21. From 1,000,000 to 10,000,000 ETH, whale positions grew. This is alongside an increase in price, further strengthening the power of large players in market direction.

Source: Ali

Source: Ali

ETH remained relatively stable initially, experiencing minor volatility around February 12. However, as whales increased their holdings, Ethereum’s price surged. The peak arrived around February 21, marking the highest value in the observed period. The direct relationship between accumulation phases and price appreciation was evident.

Sharp Decline as Whales Offload ETH

After February 21, Ethereum’s price faced a steep decline. Between February 23 and February 27, both whale holdings and ETH’s price plummeted. Consequently, Ethereum dropped, reaching approximately $2,353 by February 27. This sharp downturn suggested that whales were reducing their holdings, directly influencing the price fall.

The synchronized movements of price and holdings indicated a cause-and-effect relationship. Large investors exited their positions, causing market sentiment to shift. Selling pressure led to increased volatility, reinforcing the impact of whale activity on Ethereum’s value.

Open Interest and Market Trends

Ethereum’s open interest (OI)-weighted data provide further insights into market behavior. Ethereum briefly surged in early December before leveling off. Between the middle of December and the middle of January, ETH fluctuated in value. There was a short price surge around January 15 before stabilizing again.

Source: Coinglass

Source: Coinglass

In early February, Ethereum experienced a sharp drop , accompanied by a decline in OI-weighted data. However, the market stabilized as OI-weighted data turned green. This indicated renewed market engagement and potential for future price movement. Whales’ buy and sell-offs had a lot on Ethereum’s price volatility in February.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.