-

Bitcoin’s current holding pattern signifies a critical juncture in the crypto market as investors anxiously anticipate its next significant move.

-

The ongoing trend showcases traders’ preference for high-frequency trading strategies over long-term investments, evident in the recent shifts in market sentiment.

-

According to COINOTAG, “Bitcoin’s volatility is a reminder that the crypto market can shift rapidly, affecting trading strategies and investor confidence.”

The current holding pattern of Bitcoin raises questions about its next move, balancing between bullish potential and emerging selling pressure.

Decoding the current market mood

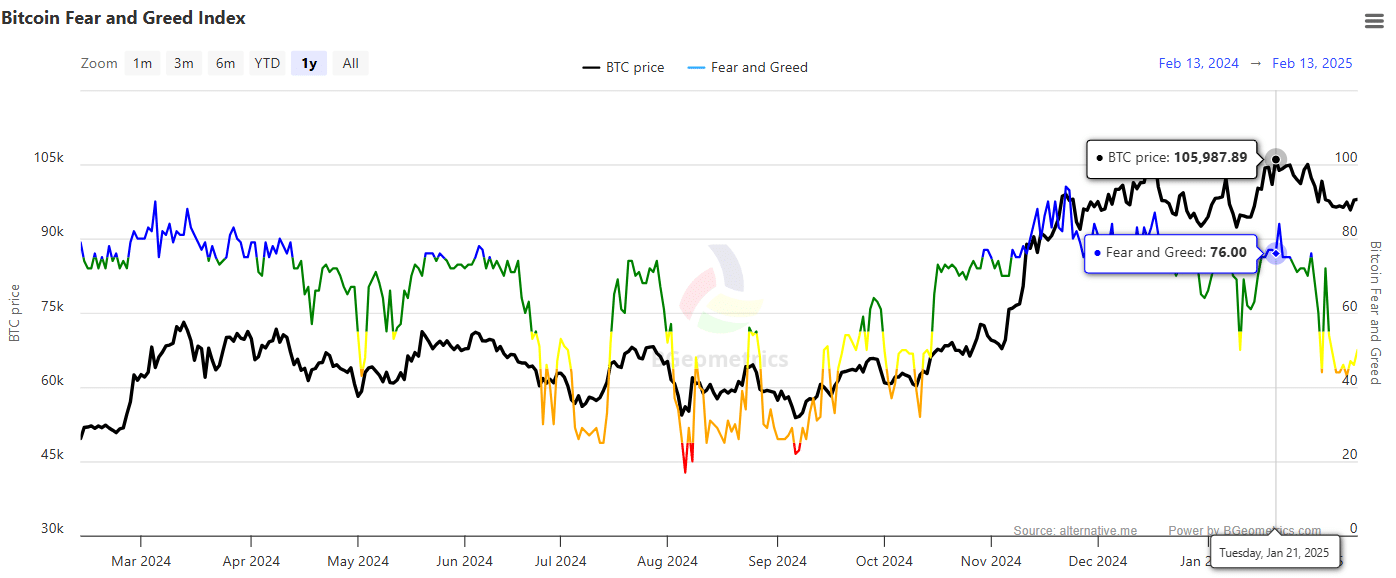

Bitcoin’s current sentiment is notably neutral, despite significant price movements. Since the start of the year, its greed index has only once registered a peak, indicating a lack of strong bullish sentiment. Historical data suggest that a consistent state of greed can fuel substantial rallies, reminiscent of Bitcoin’s surge to $106,000 last December.

Source: BGeometrics

As trading activity shifts, the allure of Bitcoin’s high-risk, high-reward dynamic begins to fade. The market sentiment remains resilient, stopping short of transitioning into an extreme fear zone, which traditionally signals a market bottom. Nevertheless, a compelling observation is that nearly $500 million has exited Bitcoin ETFs in a mere three days, highlighting a trend where large investors are cashing out. This increasing selling pressure, coupled with cautionary indicators from derivatives markets, could signal a pivot in sentiment.

Bitcoin at a crossroads

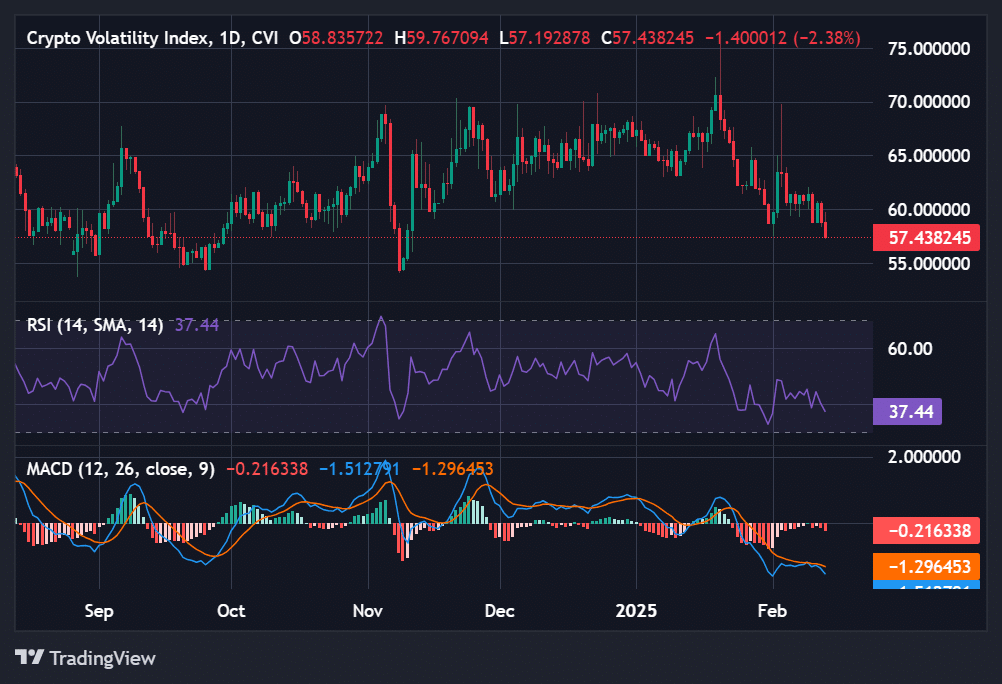

The current landscape for Bitcoin is markedly different from previous cycles, influenced heavily by macroeconomic factors. Notably, the Crypto Volatility Index (CVI) is close to levels seen prior to major market events, reflecting a potentially bullish outlook.

Source: CVI.finance

Technical indicators also present a mixed bag; while the Relative Strength Index (RSI) remains above critical levels, the Moving Average Convergence Divergence (MACD) is displaying bearish trends. This confluence of signals suggests that investors should approach Bitcoin with caution and perhaps wait for clearer buying opportunities.

The high levels of leverage in derivatives markets further complicate the scenario, suggesting that a potential deleveraging phase could introduce volatility into the market. Unlike previous cycles that saw sharp upward movements, the current atmosphere leans more toward consolidation with limited trigger points for significant price hikes.

Conclusion

In conclusion, Bitcoin’s current phase of consolidation may well precede a pivotal market shift, but the combination of muted sentiment and increasing selling pressure presents a challenging environment. As the market awaits clearer signals—either a bullish breakout or a bearish dip—the strategic focus for investors might shift to patience and observation rather than immediate action. Understanding these dynamics is essential for navigating the volatile waters ahead.