Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

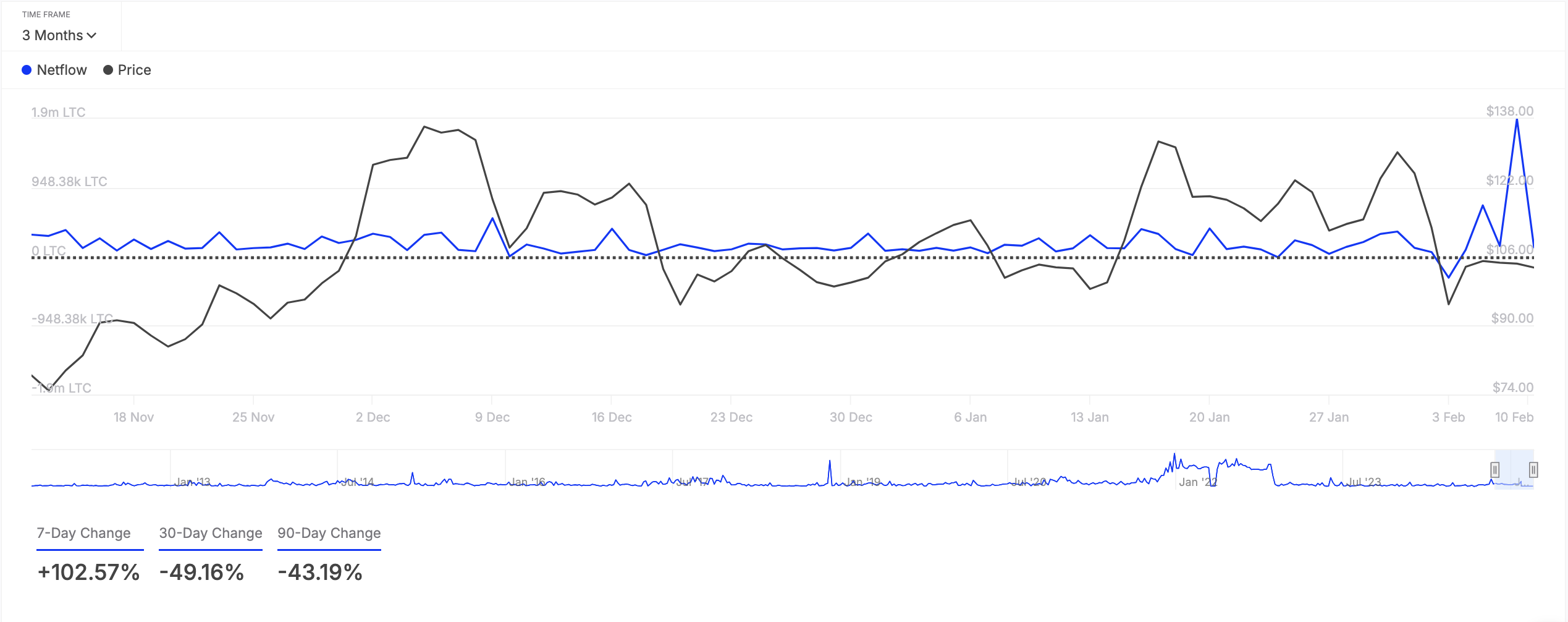

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

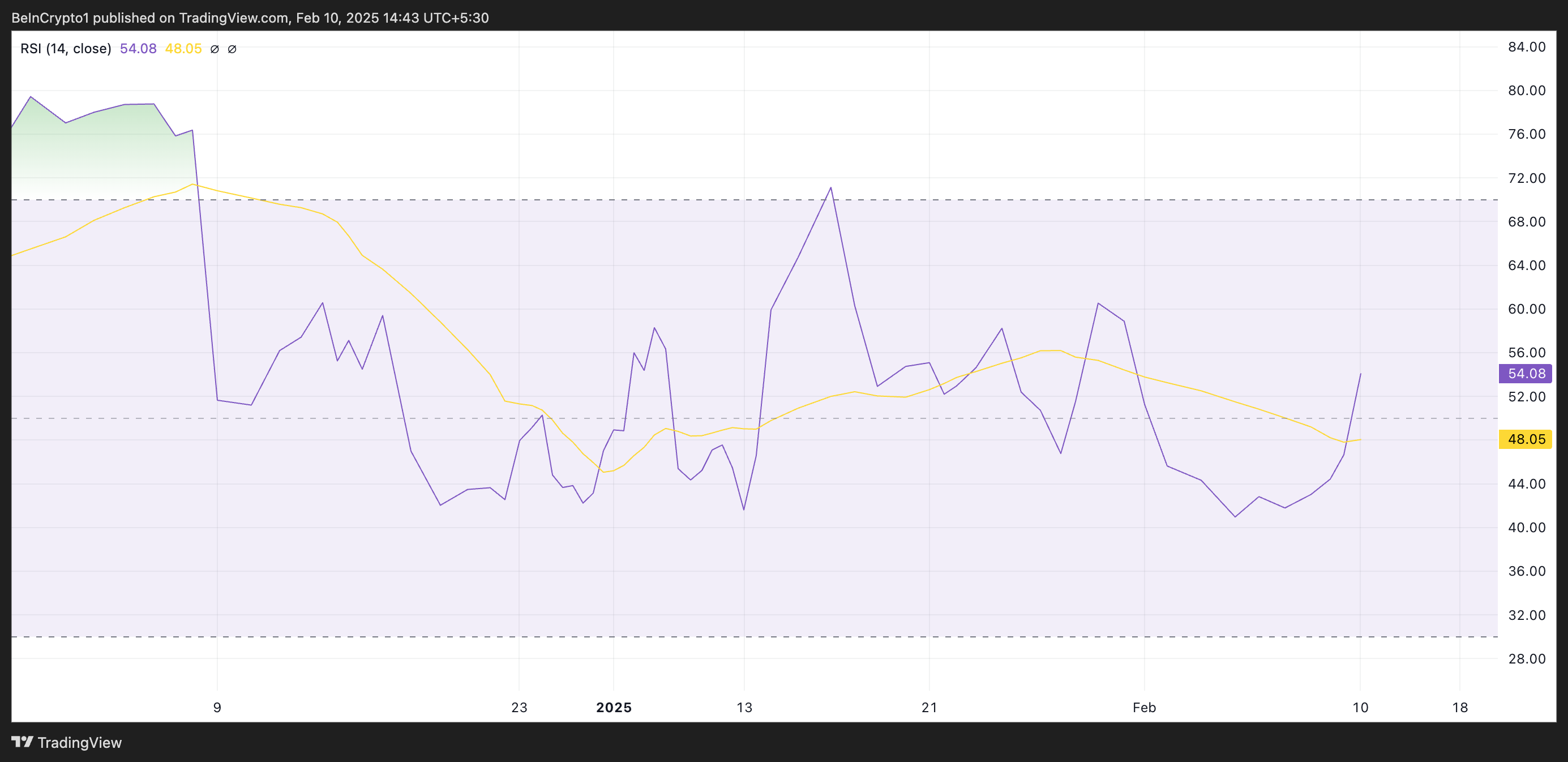

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.

CME Outage Highlights Cooling Systems as the Global Market’s Major Vulnerability

- CME's 2025 outage exposed cooling systems as critical vulnerability, halting 90% of global derivatives trading via CyrusOne data center failure. - Frozen prices in WTI, S&P 500 futures, and gold triggered erratic movements, with silver dropping $1 amid widened bid-ask spreads. - Despite robust financials ($1.54B revenue Q3 2025), CME faces infrastructure scrutiny as crypto futures growth plans clash with outage risks. - 24/7 crypto trading expansion scheduled for 2026 highlights need for resilient system

Gold Climbs as Fed Faces Uncertainty Over December Rate Cut Amid Limited Data

- Gold prices hit $4,120/oz as Fed rate cut expectations dropped to 33% due to delayed November jobs data, triggering market uncertainty. - JPMorgan and Goldman Sachs project gold to reach $5,055/oz by 2026, citing central bank demand and potential Fed policy neutrality. - Asian markets showed mixed performance while U.S. equity futures wavered, reflecting fragility amid geopolitical tensions and Fed leadership speculation. - Geopolitical risks, including U.S.-Ukraine peace talks and China's semiconductor