Bloomberg: Bitcoin's annual increase lags behind gold, Trump's remarks trigger a rise in demand for safe-haven assets

According to Bloomberg, Bitcoin is currently under pressure after outperforming most asset classes in 2024. Data shows that Bitcoin has only risen about 3% this year, while gold has increased by 9%.

On February 4th, Trump stated that the United States might take over the Gaza region. Despite his staff's attempts to downplay this statement, it still pushed the price of gold to a historic high of $2,882 per ounce. Currently, the price of Bitcoin is still about 10% below its historical peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

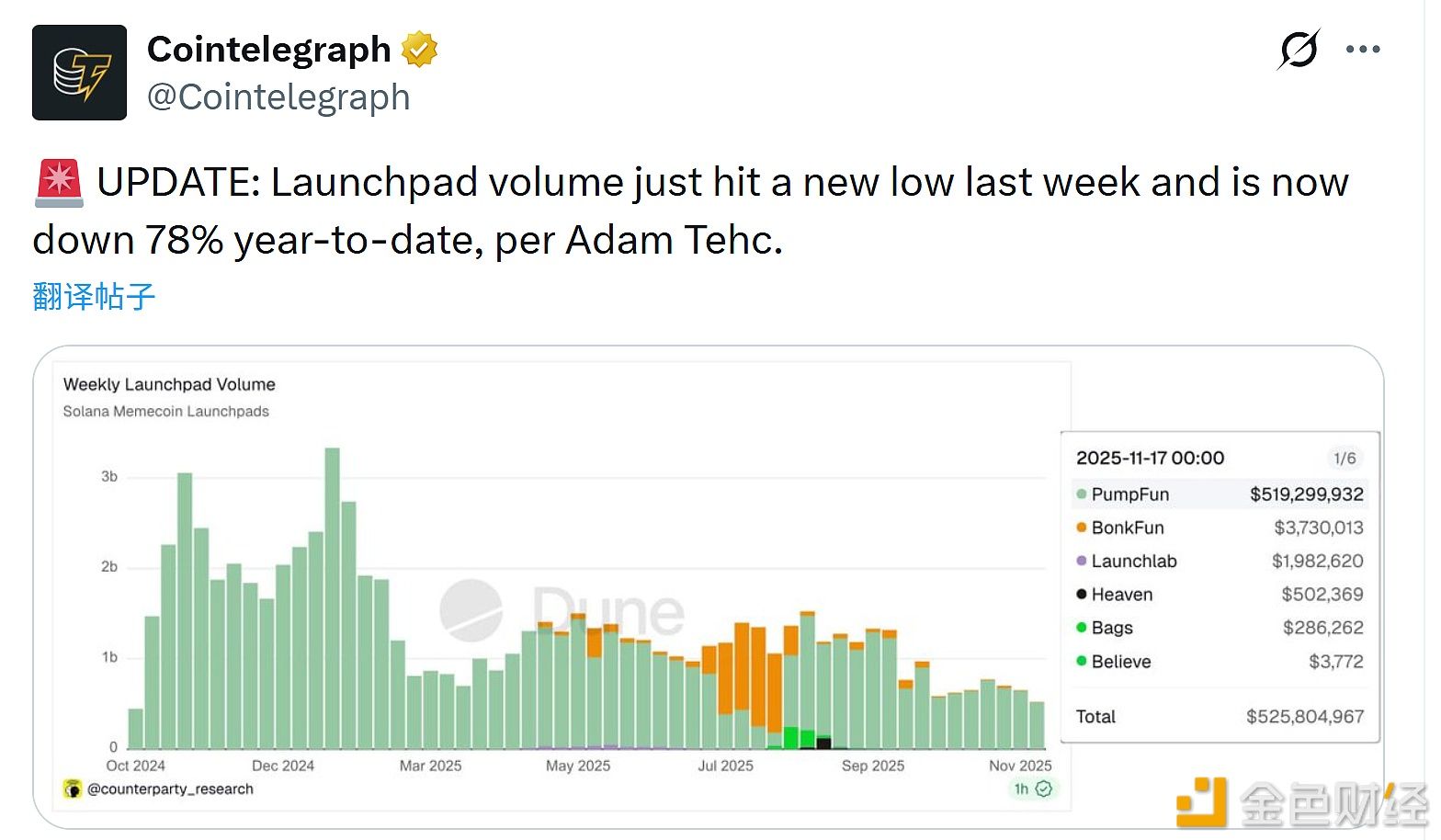

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93