Bitcoin stayed lower on Feb. 7 as prediction markets warned of a “huge beat” for US employment.

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

US jobs data threatens fresh Bitcoin headwind

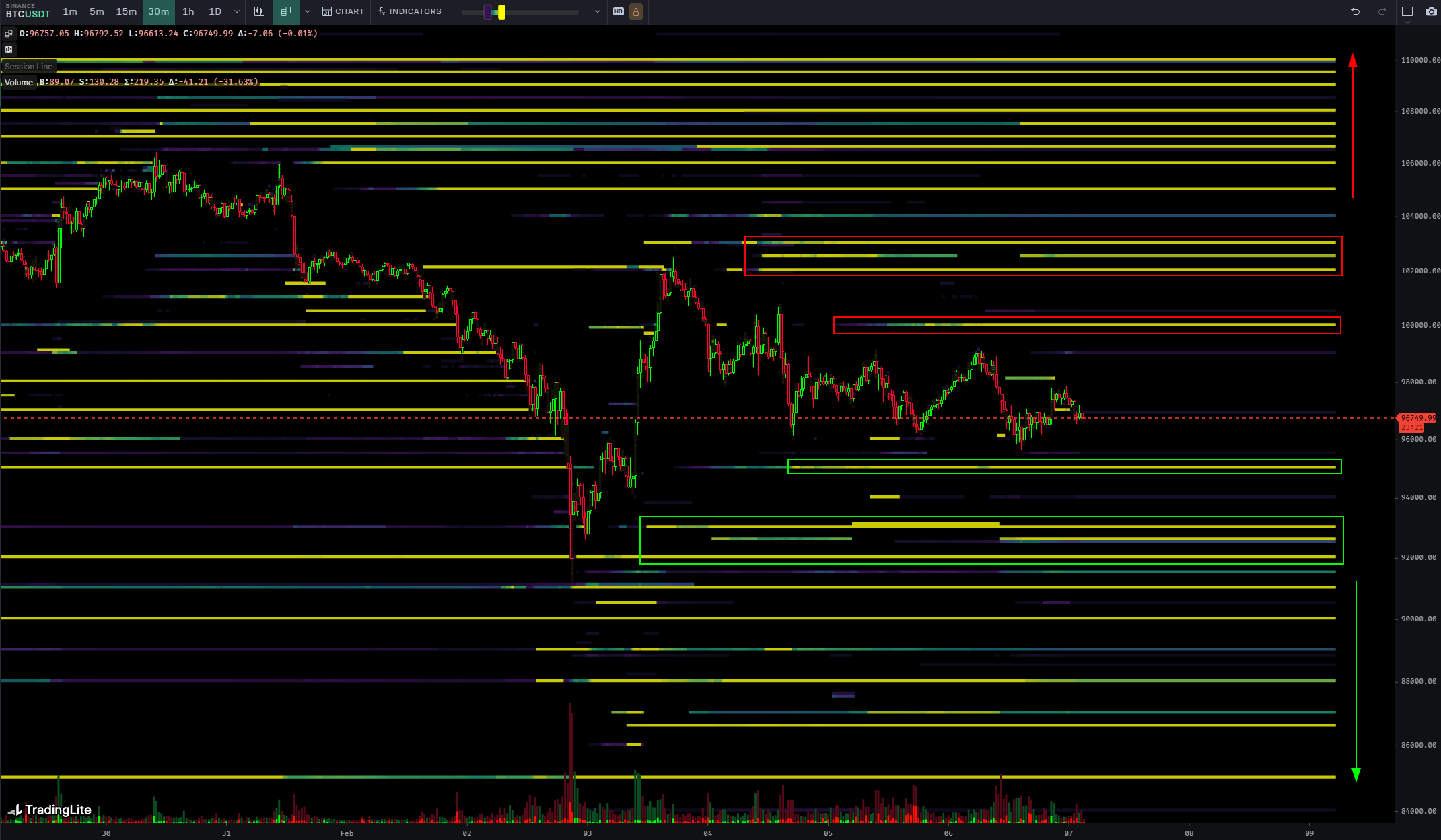

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering around $97,000 after dropping as much as 3.5% the day prior.

US jobless claims came in slightly higher than expected, and while notionally beneficial for risk assets, Bitcoin ( BTC ) was in no mood to celebrate. Going forward, market commentators expected further employment-related market upheaval.

“Are we set for a huge jobs report beat tomorrow?” trading resource The Kobeissi Letter queried in a post on X on Feb. 6.

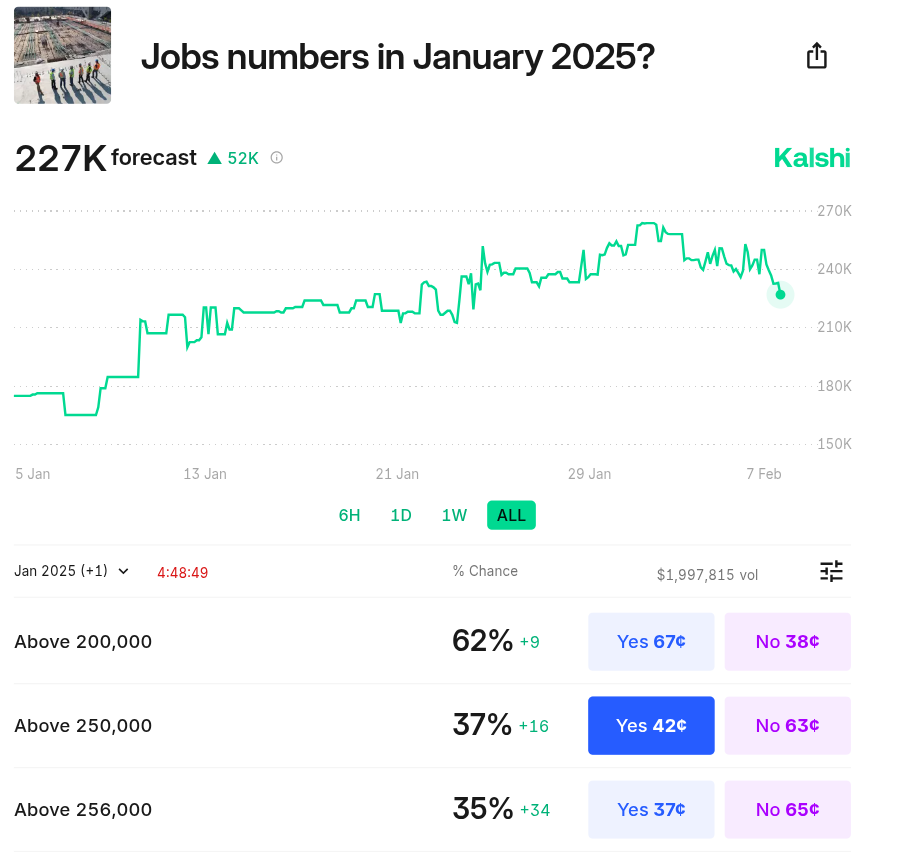

Kobeissi referred to upcoming data relating to jobs added in January. A growing discrepancy between official estimates and odds on prediction service Kalshi meant that more risk-asset pressure may come before the weekend.

Higher than-expected labor market growth would have implications for financial policy, allowing the Federal Reserve to keep interest rates higher for longer with risk-asset headwinds to match.

“Prediction markets currently expect that 238,000 jobs were added to the US economy in January, per Kalshi. In fact, there’s a 28% chance that over 300,000 jobs were added in January,” the post continued.

“This is SIGNIFICANTLY above Wall Street's median expectation of 169,000 jobs added. If the US economy adds over 300,000 jobs, it would mark the first such occurence since March 2024. Prediction markets see a strong start to the labor market in 2025. Tomorrow's jobs report is huge.”

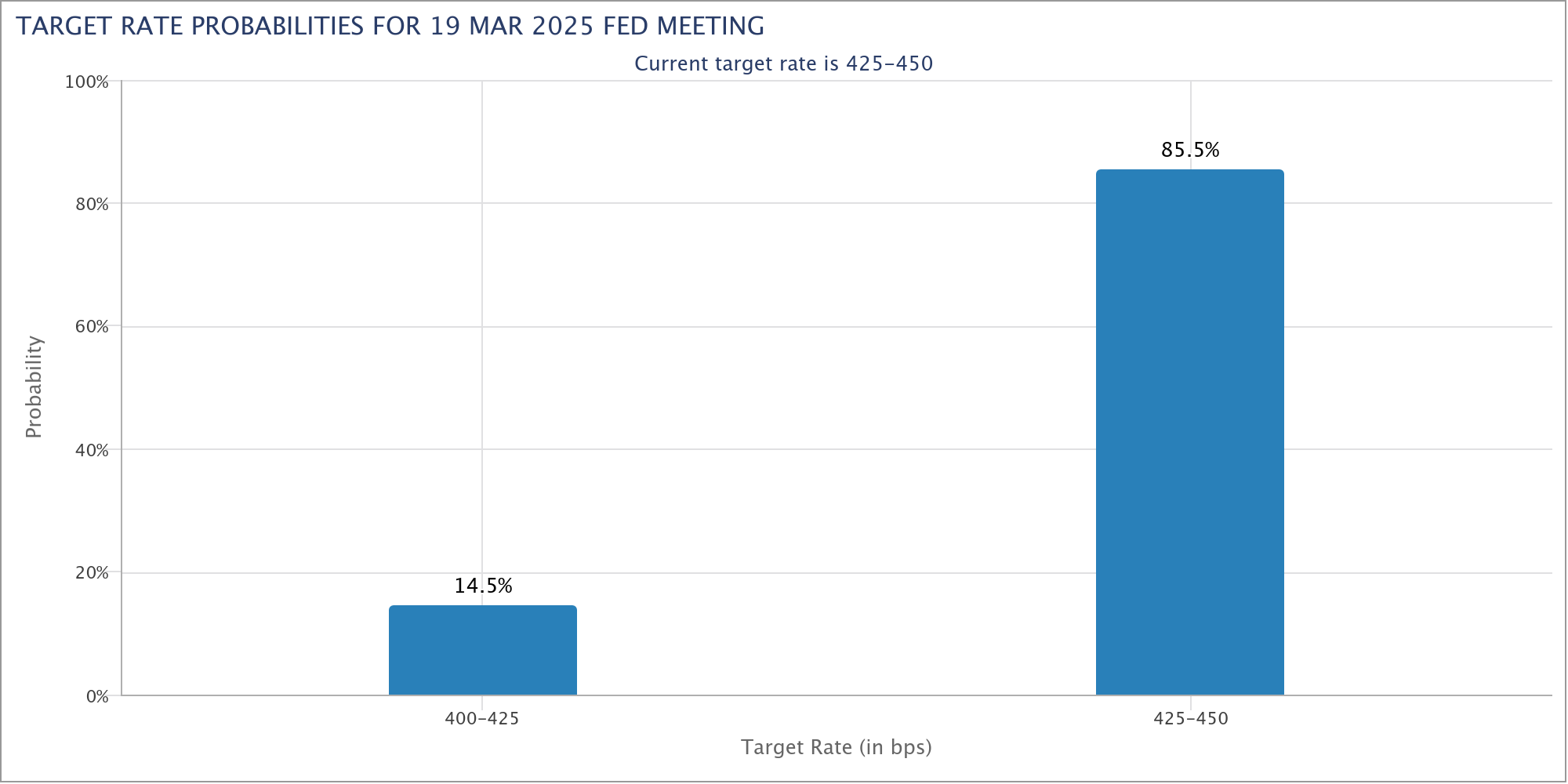

The latest data from CME Group’s FedWatch Tool underscored markets’ lack of conviction over further policy easing in Q1.

Even a small 0.25% interest rate cut at the Fed’s next meeting in March is currently attracting odds of just 14.5%.

BTC price forecasts see liquidity hunts returning

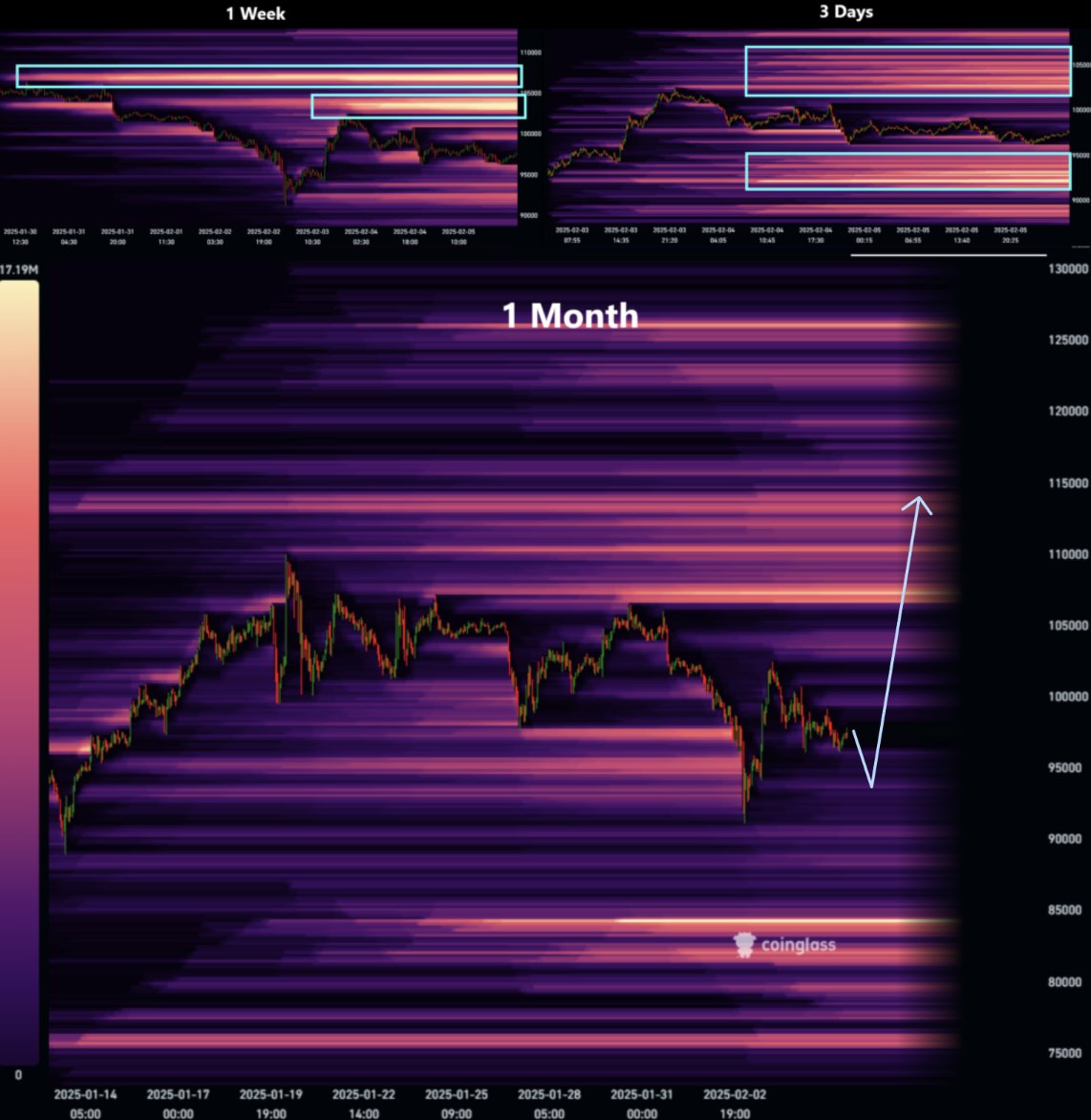

BTC price action, meanwhile, respected an entrenched range with clear bands of liquidity, reducing the chances of significant volatility.

“Short term liquidity is surrounding current price, so wouldn't surprise me for both sides to get run before the real move occurs,” trader Mark Cullen explained to X followers.

“With both the weekly showing significant liquidity to the upside, my guess would be a run of the 95k liquidity and then up for the significant areas of interest above the last months highs.”

Fellow trader Skew agreed, suggesting that an external volatility catalyst was required to spark a stronger BTC price trend.

“Another very much pinned market till resolution (usually driven by macro),” an X post about the Binance spot market stated .

“Currently market quotes the price range for todays expected price action ($100K - $95K).”

Skew reiterated the importance of the day’s employment figures.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COC the Game Changer: When Everything in GameFi Becomes "Verifiable", the Era of P2E 3.0 Begins

The article analyzes the development of the GameFi sector from Axie Infinity to Telegram games, pointing out that Play to Earn 1.0 failed due to the collapse of its economic model and trust issues, while Play for Airdrop was short-lived because it could not retain users. COC Game has introduced the VWA mechanism, which verifies key data on-chain in an attempt to address trust issues and build a sustainable economic model. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.