LINK Faces Volatility Amid Whale Activity: Can It Hold Support?

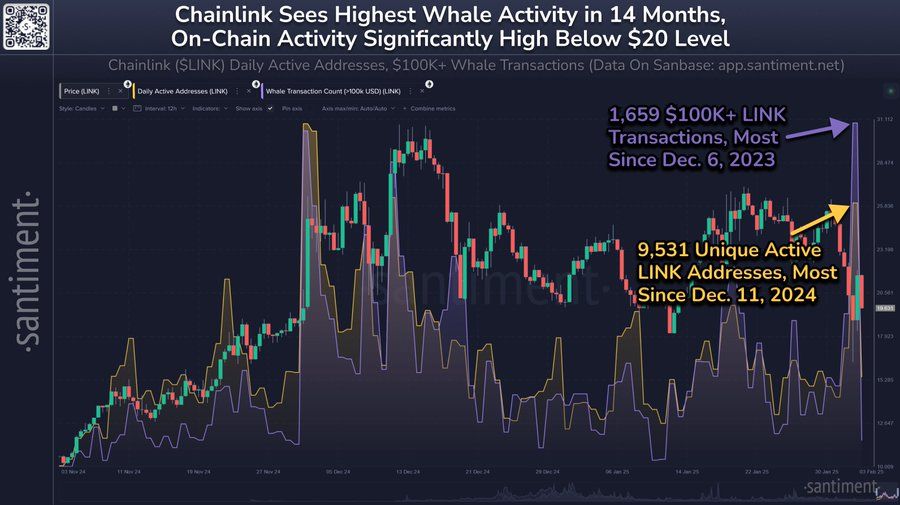

- Chainlink records 1,659 transactions over $100K, the highest since December 2023.

- 9,531 active wallets recorded, marking the most since December 2024 for Chainlink.

- Whales offload 4.13 million LINK in 48 hours, triggering volatility in price action.

Chainlink (LINK) attracts significant investor interest levels during a recent market correction period. At press time, LINK price stands at $19.93, which has decreased by 4.39% throughout the day. Chainlink experiences heightened scrutiny because of significant whale transaction patterns, including market buying and selling behaviors during market volatility. What impact will whale movements have on LINK’s ongoing price recovery from its recent market drop?

Whale Activity Influences LINK’s Price

Chainlink’s recent price action shows fluctuations between $19 and $21. Based on its price consolidation, LINK appears to have reached an essential support zone. According to Santiment, LINK saw 1,659 transactions exceeding $100K, the highest level since December 2023. The asset also recorded 9,531 active wallets, the highest number since December 2024. The rising whale transactions and active wallet numbers show growing LINK investor interest, suggesting the digital asset could experience a market price movement when market stability returns.

Source:

X

Source:

X

LINK shows signs of downward pressure despite increased whale activity as whales completed recent sell-offs. According to Ali Martinez’s analysis, the offloading of 4.13 million LINK by whales in the last 48 hours is significant since it might cause additional pricing pressure. The substantial price decline of LINK occurred after whales unloaded their vast holdings, which reached highs of $21. The chart Ali provides shows how whale movement affects LINK price trends during this substantial market dump.

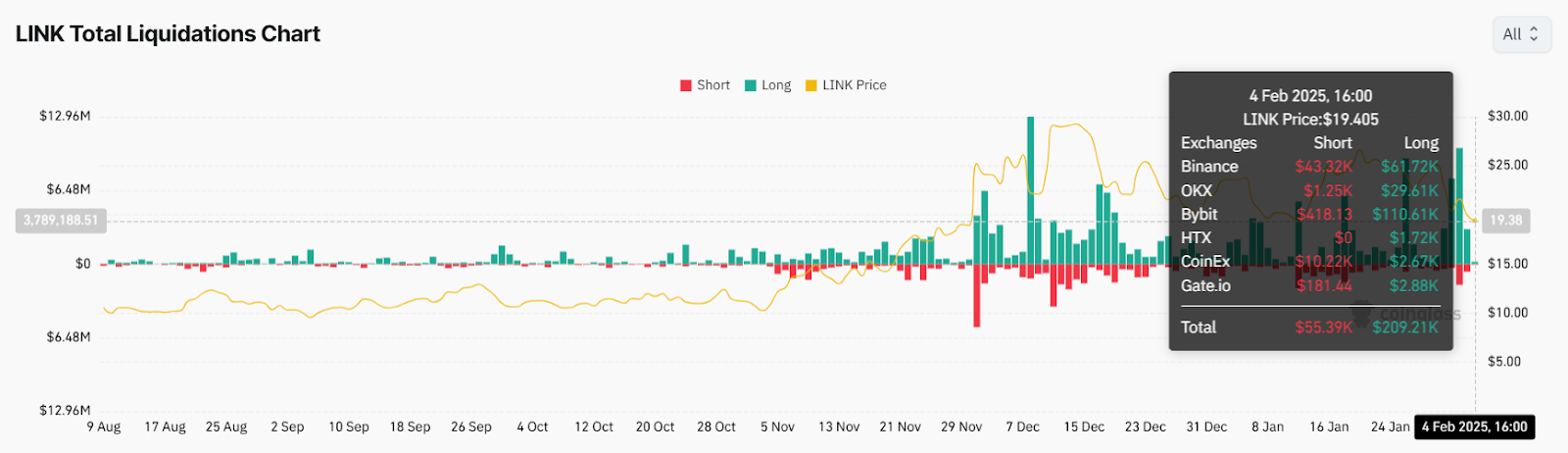

Chainlink’s Total Liquidations: How Are Traders Reacting?

Total liquidations indicate that Chainlink has faced major market oscillations. On February 4, 2025, traders faced extensive position closures that strongly affected holders investing long. The market data suggests traders are both collecting profits and closing their positions due to market confusion. Increasing market liquidations threatens to decrease LINK prices when market sentiment turns more negative.

Source:

Coinglass

Source:

Coinglass

Related: Chainlink Eyes $35 Amid Developments and Technical Strength

Conclusion: Can Chainlink Maintain Its Momentum?

Despite recent market dips, investor attention toward Chainlink remains intact based on the data showing major transactions coupled with multiple wallet address activities. The offloading of 4.13 million LINK by whales, while the technical indicators point to bearish behavior, presents potential negative risks for LINK. Link’s recovery to a bullish trend will become more likely once market conditions strengthen and temporary selling pressure declines. LINK has a neutral market direction that reveals multiple challenges and prospective benefits to traders at the present time.

The post LINK Faces Volatility Amid Whale Activity: Can It Hold Support? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a