Bitcoin Signaling Readiness To Launch Bullish Move, According to Glassnode Co-Founders – Here Are Their Targets

The co-founders of the blockchain analysis platform Glassnode say Bitcoin ( BTC ) may be gearing up for a series of rallies based on key metrics.

Glassnode and Swissblock co-founders Jan Happel and Yann Alleman, who share the social media handle Negentropic, say that the Bitcoin Fundamental Index (BFI) is starting to signal a breakout.

The BFI evaluates several aspects of the Bitcoin market, including wallet activity and transaction volume. When it increases, the chances of a market rally increase.

The analysts predict Bitcoin may soon hit $110,000. However, they say that Bitcoin must first convincingly break through resistance at $106,000.

“Get ready for the next bullish move: Bitcoin has held above $100,000 while showing improvements in liquidity and network growth. This indicates stability for launching a bullish movement from the $101,500-$102,500 zone.

The target is the previous high at $108,000-$110,000, but first, the $104,000-$106,000 zone needs to be breached with strength and volume.”

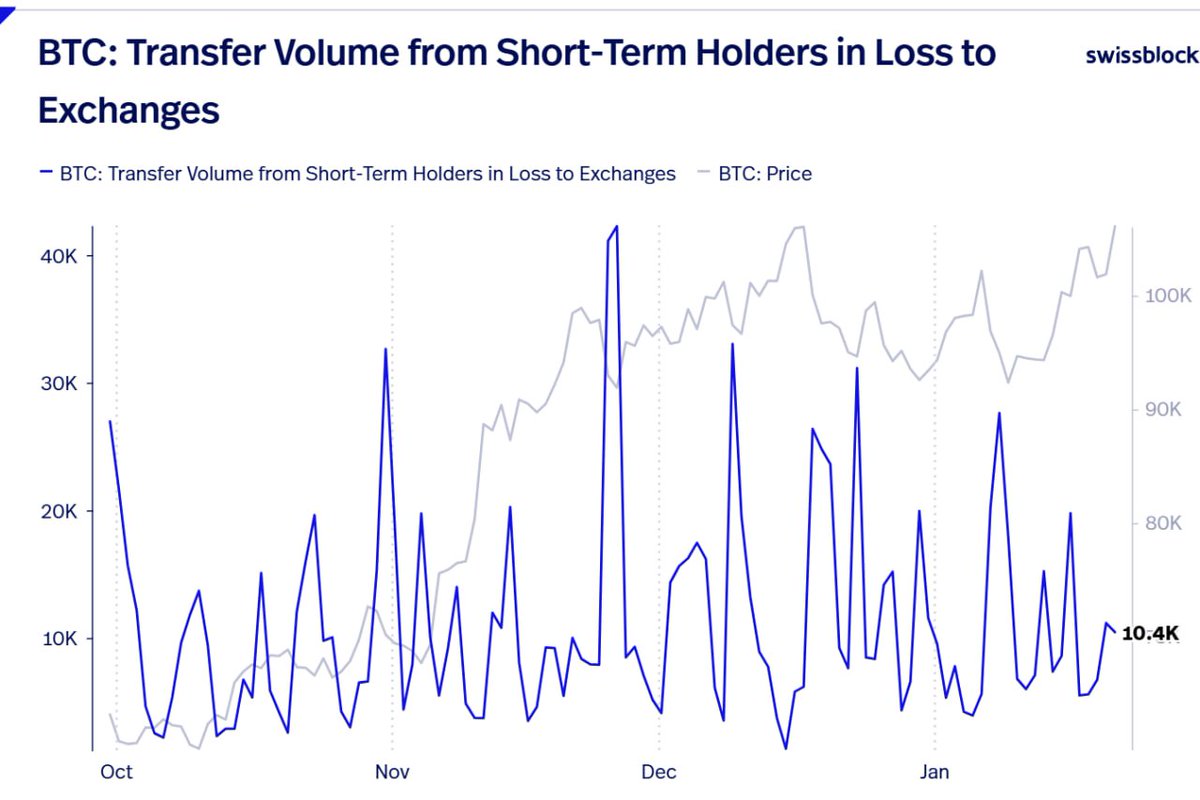

The analysts also say that the number of short-term holders taking a loss on their investments during the recent market volatility is declining, suggesting a more bullish outlook.

“Do we need a new category of holders? Short-term holders, once known for quick selling at losses, are evolving. They’re now showing resilience, tolerating price drops, and reacting less emotionally to sudden crashes. Selling pressure continues to fall, signaling a shift in behavior. These investors are bridging the gap between impulsive sellers and steadfast holders. What should we call them? Steel hands? Iron hands? Something stronger? Let us know!”

Source: Negentropic/X

Source: Negentropic/X

Lastly, the analysts warn that Bitcoin may correct to as low as $97,200 if it loses the $101,500-$102,500 range as support.

“Next steps: Hold $101,500-$102,500 to sustain momentum. Losing it could send BTC to $97,200-$98,500. Immediate target: $104,00-$106,000. If liquidity gathers here, BTC may aim for $108,000-$110,000, a key bear liquidation zone. Consolidation is key for further gains!”

Source: Negentropic/X

Source: Negentropic/X

Bitcoin is trading for $104,797 at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Master1305

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.

A respite for global markets? Bitcoin halts its decline as Japanese bond auction eases liquidity concerns

Bitcoin also stabilized and rebounded, rising by as much as 0.7% to surpass the $87,000 mark. Strong demand in the Japanese government bond auction and the recovery of the crypto market have jointly eased investors' concerns about liquidity tightening.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

From pushing the performance limit of 1 Gigagas to building the architectural vision of Lean Ethereum, Fede showcased with the most hardcore technical details and sincere passion how Ethereum should maintain its dominance in the next decade.