- Bitcoin is projected to reach $185K in 2025, fueled by institutional, corporate, and sovereign adoption.

- Ethereum is expected to trade above $5,500 amid staking growth surpassing 50% participation.

- The Bitcoin DeFi market could double to $30 billion while miners pivot to partnerships with AI and hyperscale computing firms.

Galaxy Research has unveiled its bold predictions for the crypto market in 2025, painting a picture of exponential growth and widespread adoption across Bitcoin, Ethereum, and DeFi.

Bitcoin Path to $185K and Beyond

Bitcoin is forecasted to cross $150K in the first half of 2025, with the potential to test or exceed $185K by the year’s end, according to Alex Thorn, Head of Research at Galaxy. This surge is expected to be fueled by a combination of institutional investments, corporate allocations, and even adoption by nation-states.

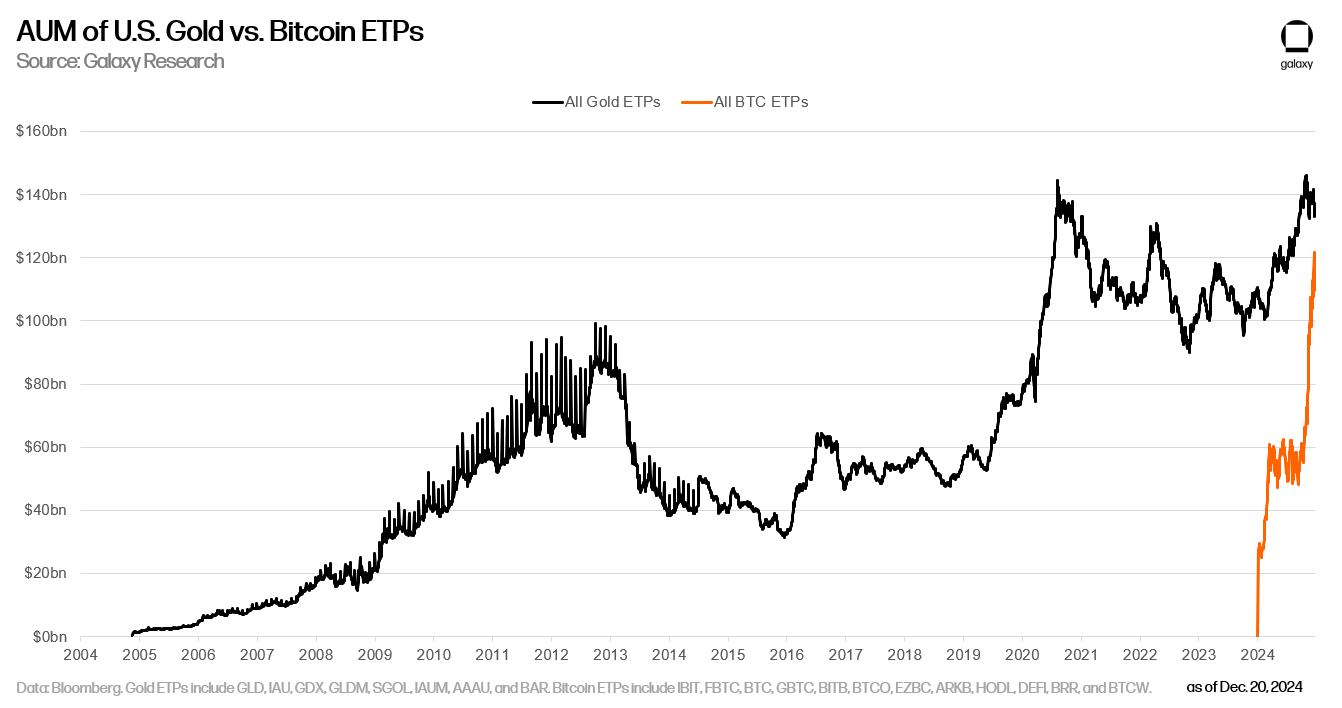

Galaxy also highlighted the rise of U.S. spot Bitcoin exchange-traded products (ETPs), which are projected to surpass $250 billion in assets under management (AUM). Further, with major hedge funds and investment boards already participating, it stated that Bitcoin ETPs could soon eclipse the AUM of physical gold ETPs ..

Adding to this momentum, Bitcoin is expected to gain a foothold in corporate and sovereign balance sheets, with five Nasdaq 100 companies and five nation-states likely to announce holdings. Meanwhile, top wealth management platforms may recommend allocating 2% or more of portfolios to Bitcoin, driving further inflows.

Ethereum 2025 Resurgence: $5,500 in Sight

Ethereum is expected to reclaim its position as a market leader, trading above $5,500 in 2025. Moreover, Ethereum Layer 2 solutions are anticipated to attract corporate experimentation, while NFT trading volumes are set to rebound after a challenging year.

The network’s staking ecosystem is also expected to see unprecedented growth. Galaxy predicts staking participation to exceed 50% of Ethereum’s circulating supply. Protocols like Lido and EigenLayer stand to benefit from this surge in staking activity.

DeFi and Mining Evolution

The Bitcoin DeFi sector is on track to double in size, potentially reaching a market valuation of $30 billion. This growth will stem from increased adoption of Bitcoin Layer 2 solutions and expanded TVL in both existing and emerging DeFi protocols.

On the mining front, over half of the top 20 publicly traded Bitcoin miners are expected to diversify by partnering with hyperscale data centers and AI firms. These strategic shifts could reshape the industry while keeping hash rate growth relatively stable at 1.1 by the end of 2025.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.