Solana Price Analysis Hints $300 Recovery Amid TVL Spike

This week, the cryptocurrency market recorded damped volatility as Bitcoin wavers between the $100k and $90k levels. This consolidation trend has stalled the prevailing correction sentiment in most major altcoins, including SOL. The Solana price holding above a confluence of major support signals a potential for a bullish recovery.

According to Coingecko, SOL price currently trades at $184.5, with an intraday loss of 2.5%. The asset market cap stands at $88.5 Billion, while 24-hour trading is at $3.6 Billion.

Key Highlights:

- A renewed uptrend in Solana’s TVL and open interest signals increased adoption and investor confidence if further rally.

- A downsloping trendline drives the current correction in Solana price.

- The $175 support is closely aligned with the 50% Fibonacci retracement level, and the 200-day Exponential moving average creates a high accumulation zone.

SOL Rebounds as Open Interest and TVL See Notable Increases

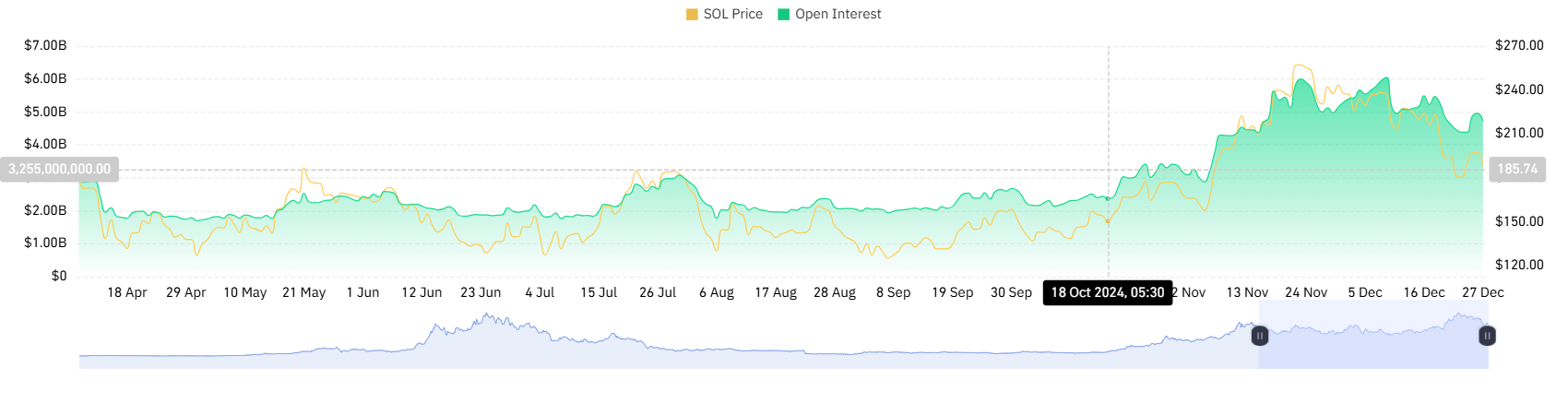

According to Coinglass data, the SOL futures open interest records a notable surge from $4.38 to $4.96— a 13% increase since last week. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trader activity, signaling heightened interest and confidence in SOL’s price movements.

In the same period, Solana’s Total volume locked (TVL) records a jump from $8.06 to $8.67 Billion, registering a 7%. A growing TVL showcases increased trust in Solana’s DeFi platforms, suggesting that more users are staking, lending, or providing liquidity within its ecosystem.

Solana Price Correction Hits Key Support

For over a month, the Solana price has witnessed a major correction from $264 to $183, registering a 30% loss. The pullback is currently seeking support at $175, a horizontal coinciding with 50% FIB, 50-day EMA, and an emerging support trendline.

This creates a high area of interest for buyers to recuperate the bullish momentum and drive price reversal. An analysis of the daily chart shows the support trendline has acted as suitable pullback support for SOL since mid-September.

A potential reversal could drive the price 7.8% before a key breakout from the downsloping trendline. A successful breakout will further accelerate the bullying pressure to drive a rally past $300.

Also Read: Bitwise Files for Bitcoin Standard Corporations ETF with the SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Home Depot Faces Decline: Industry-Wide Slowdown or Company-Specific Challenge?

- Home Depot shares slumped 2–3% premarket after Q3 2025 earnings missed profit forecasts and slashed full-year guidance. - Weak comparable sales growth (0.2% vs 1.3% expected) and housing market pressures highlighted sector-wide challenges. - GMS acquisition added $900M revenue but couldn't offset 1.6% transaction volume decline and margin pressures. - Analysts revised 2025 EPS forecasts down 5% as Stifel downgraded HD to "Hold," reflecting cyclical uncertainty. - Mixed investor reactions persist, with in

Klarna Achieves Highest Revenue Yet, but Strategic Lending Leads to Losses

- Klarna reported $903M Q3 revenue (up 31.6%) but $95M net loss due to higher loan loss provisions as it expands "Fair Financing" loans. - Klarna Card drove 4M sign-ups (15% of October transactions) and 23% GMV growth to $32.7B, central to its AI-driven banking strategy. - Q4 revenue guidance of $1.065B-$1.08B reflects $37.5B-$38.5B GMV, supported by $1B facility to sell U.S. loan receivables. - CEO cites stable loan portfolio and AI-driven efficiency (40% workforce reduction) but warns of macro risks incl

PDD's Rising Profits Fail to Compensate for E-Commerce Expansion Challenges

- PDD Holdings reported mixed Q3 2025 results: $15.21B revenue missed forecasts by $90M despite $2.96 non-GAAP EPS beating estimates by $0.63. - E-commerce growth slowed amid intensified competition in China and U.S. regulatory shifts impacting Temu's operations. - Profitability showed resilience with 14% YoY net income growth to $4.41B, driven by cost discipline and 41% R&D spending increase. - $59.5B cash reserves highlight financial strength, but Q4 revenue projections face risks from pricing wars and g

Citigroup Achieves Earnings Growth Despite Obstacles, Analysts Raise Ratings as Regulatory Hurdles Persist

- Citigroup reported Q3 adjusted EPS of $2.24, exceeding estimates, with $22.09B revenue up 9.3% YoY, prompting analyst price target upgrades. - The bank declared a $0.60 quarterly dividend (2.4% yield) and saw institutional ownership growth, including 100%+ stake increases by key firms. - Despite 14.14 P/E ratio and 1.37 beta volatility, Citigroup maintains 7.91% ROE and 8.73% net margin, though faces regulatory scrutiny and macroeconomic risks. - Analysts remain divided: Cowen reiterates "hold" at $110,