Crypto Investors HODLing Solana in Anticipation of Higher SOL Prices, According to Analytics Firm

New data from market analytics firm Glassnode reveals that traders are keeping their Solana ( SOL ) stacks amid expectations that its price will continue to rise.

In a new thread on the social media platform X, Glassnode says that long-term holders now own a significant supply of SOL, believing that Solana’s bullish phase is far from over.

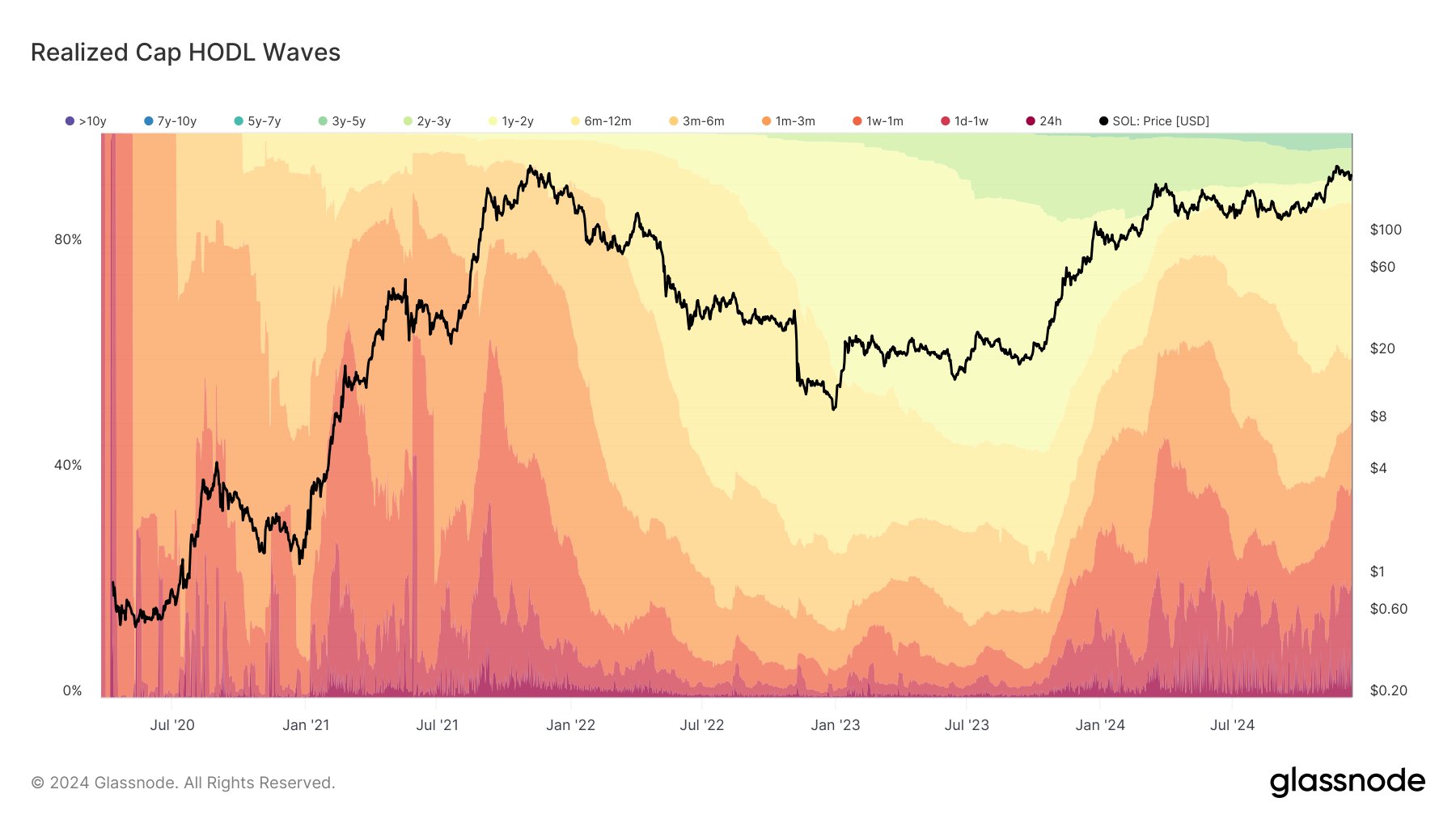

“Solana investors are HODL-ing (holding on for dear life) firm, expecting higher prices. Long-term holders’ share of wealth locked in the network is growing. The 6-12 month cohort now holds 27% of the supply, showing conviction from 2024 rally buyers.”

Source: Glassnode/X

Source: Glassnode/X

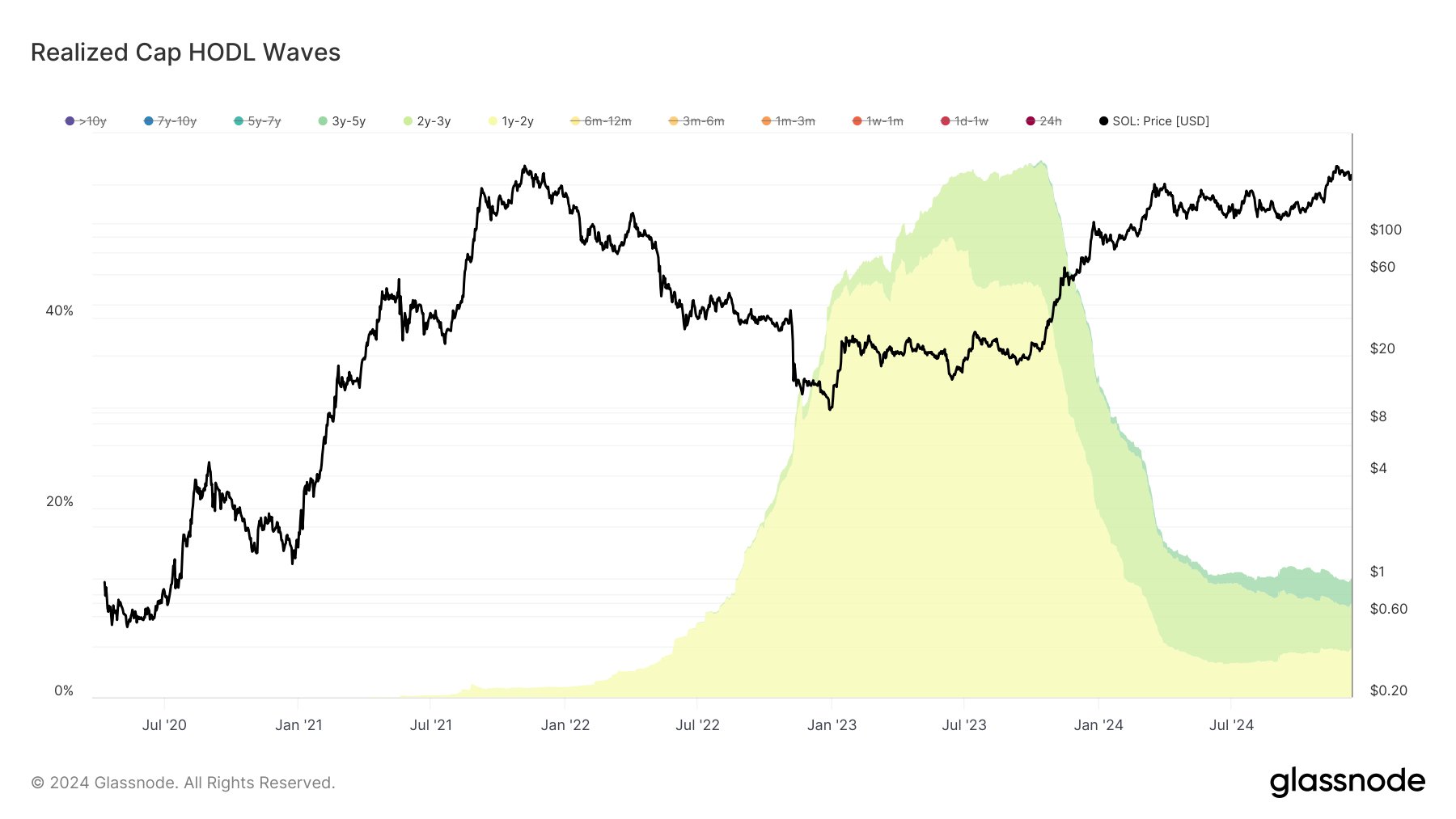

But the data analytics firm notes that investors who accumulated SOL toward the end of the 2022 market cycle have massively unloaded their holdings. According to Glassnode, the distribution of the 2022 investor cohort suggests that selling pressure for SOL is now weak.

“Meanwhile, the 1-2 year cohort has steadily diminished, dropping from 48% in June to just below 5% now. These were investors from the previous bull run who largely took profits during this year’s rally. For now, those who wanted to sell SOL have likely sold.”

Source: Glassnode/X

Source: Glassnode/X

Earlier this week, the co-founders of Glassnode predicted that Solana is due for a major rally.

“SOL hit the marked zone and rebounded toward $230. If it surpasses $235 on a daily timeframe, it could break the price compression, targeting the previous high of $264.

Key Signals: Daily RSI (relative strength indicator) is neutral, far from overbought territory – favorable for a move higher.”

Solana is trading for $224 at time of writing, a 3% decrease during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Fed’s hawkish rate cuts unveil the illusion of liquidity: the real risks for global assets in 2025–2026

The article analyzes the current uncertainty in global economic policies, the Federal Reserve's interest rate cut decisions and market reactions, as well as the structural risks in the financial system driven by liquidity. It also explores key issues such as the AI investment boom, changes in capital expenditures, and the loss of institutional trust. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content is still undergoing iterative updates.

Cobo Stablecoin Weekly Report NO.30: Ripple's Comeback with a $40 Billion Valuation and the Stablecoin Transformation of a Cross-Border Remittance Giant

Transformation under the wave of stablecoins.

Bitrace's Perspectives and Outlook at Hong Kong FinTech Week

During the 9th Hong Kong FinTech Week, Bitrace CEO Isabel Shi participated in the Blockchain and Digital Assets Forum...

20x in 3 months: Does ZEC’s “Bitcoin Silver” narrative hold up?

You bought ZEC, I bought ETH, we both have a bright future.