XRP loses position 3rd largest crypto spot as Ripple confirms postponing stablecoin launch

Ripple confirmed that it has delayed the launch of its stablecoin. Meanwhile, the price of XRP has dropped, causing it to lose its recently-earned position as the third-largest cryptocurrency.

Ripple, widely known for its cross-border payments in the crypto space, has postponed the launch of its stablecoin, $RLUSD, as it awaits a final nod from the New York Department of Financial Services. In an official announcement on X, Ripple said, “$RLUSD isn’t launching today.” on Dec. 5.

Despite some speculation, $RLUSD isn’t launching today. We’re in lockstep with the NYDFS on final approval and will share updates as soon as possible.

— Ripple (@Ripple) December 4, 2024

We are fully committed to launching under the supervision of NYDFS and upholding the highest regulatory standards. Stay tuned…

The announcement coincided with a noticeable decline in Ripple’s native token’s (XRP) market price. XRP’s price dropped from $2.59 to $2.31 within 24 hours, as per CoinMarketCap. This sharp tail-off has pushed XRP away from the position of the third largest cryptocurrency by market capitalization, falling short of Tether’s (USDT) market cap of $135.8 billion.

XRP’s selling pressure increases

At press time, XRP’s market cap stands at $131.42B, a 12% drop seen in the last 24 hours. However, XRP continues to stay ahead of Solana (SOL) and Binance token (BNB) even as the latter reached its all-time high on Dec. 4. XRP’s 24-hour trading volume also plummeted to $26.02B, nearly 40% down from yesterday.

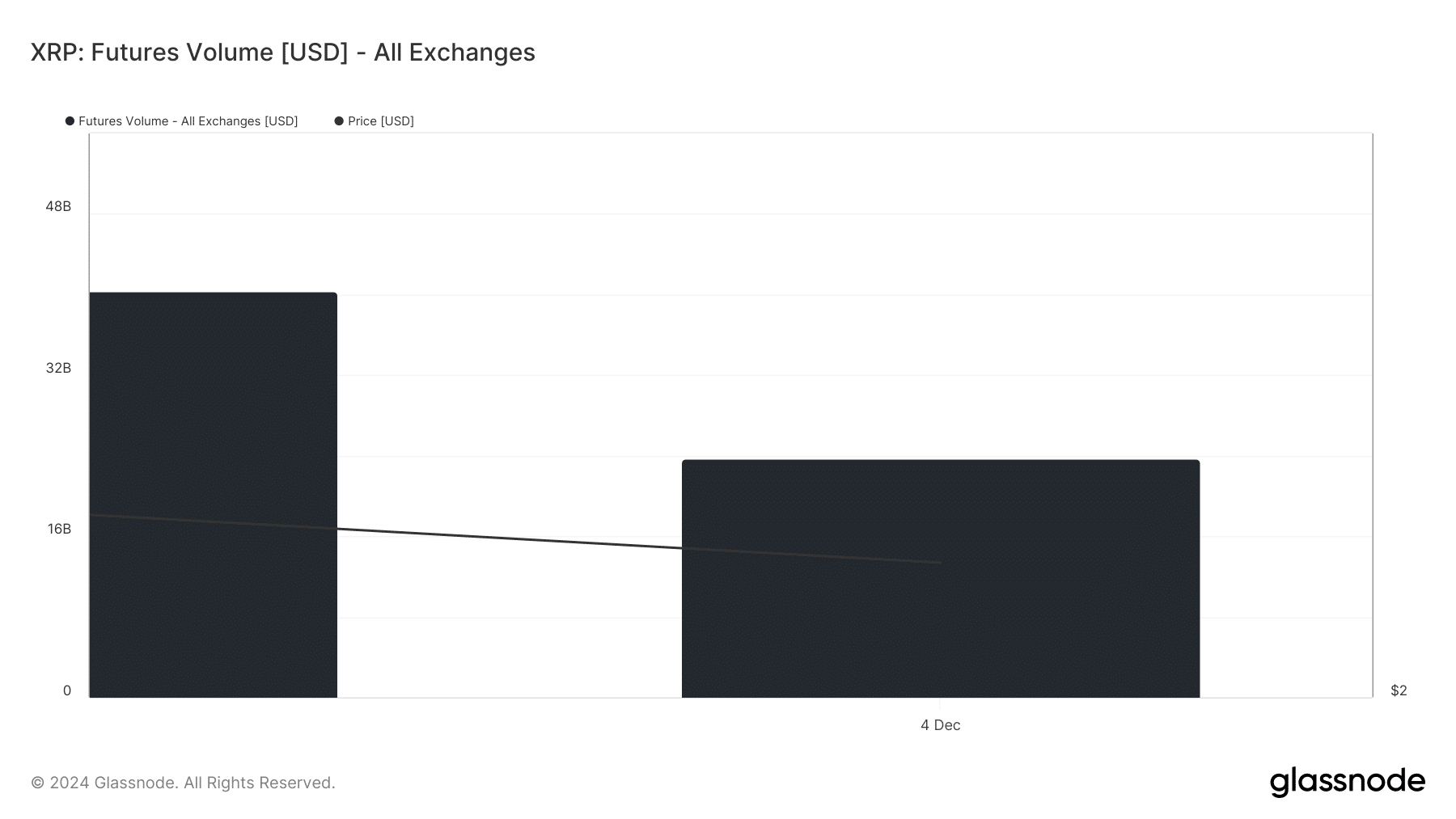

While the news of the postponement of RLUSD preceded the drop in price, speculations could be tied to the panic selling, as per Glassnode metrics. This is further highlighted in the increased selling pressure, where both price and trading volume has come down over $32 billion to $16 billion on Dec. 4, confirming that the market is in a cooling-off period at the moment. This could also have added to XRP’s ranking and its drop from the third largest crypto.

What is next for XRP?

The price could also be influenced by the surge in stablecoins the market is witnessing reflected by the 24-hour volume at $317.13 billion. Ripple’s success with its stablecoin is key to enhancing its On-Demand Liquidity platform, which facilitates swift cross-border payments and could drive XRP prices higher.

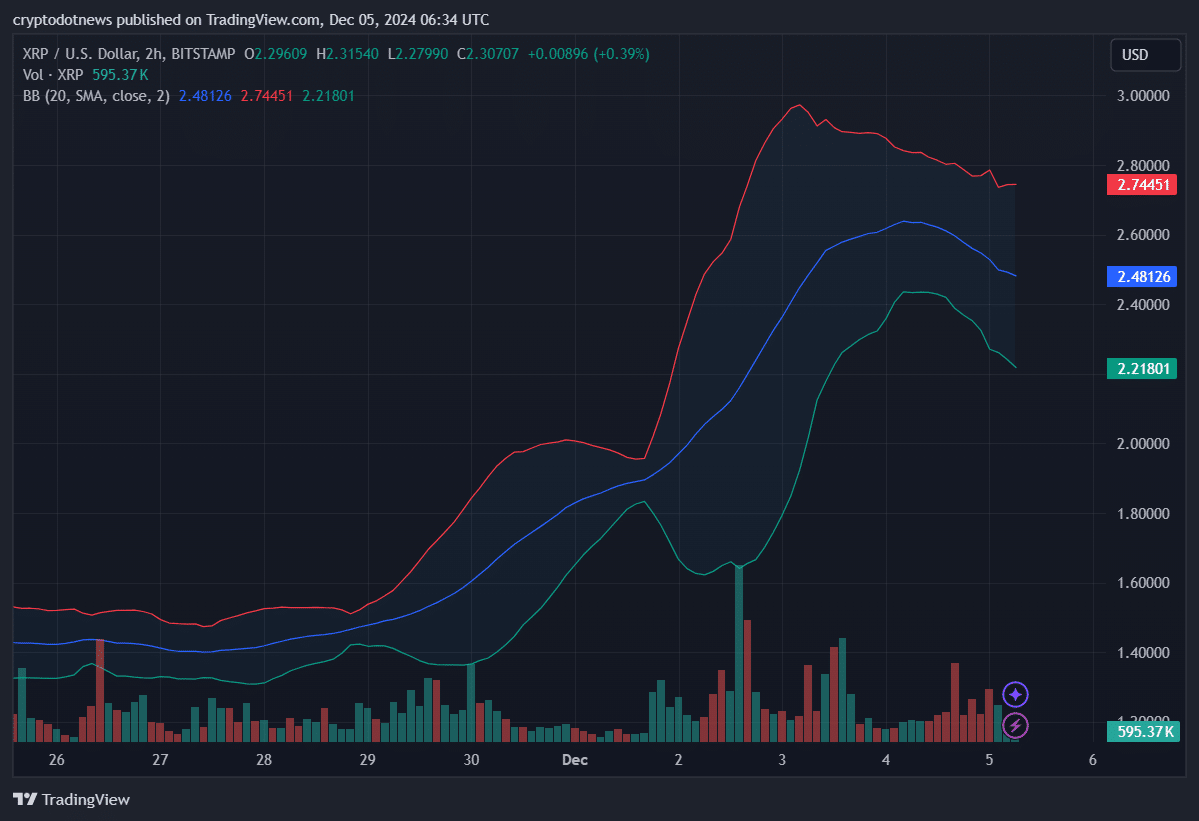

As a measure of XRP’s recent price action, Bollinger Bands can show where the price is and where it might be headed next.

After rising sharply up to its most recent resistance at $2.74451, the support low was just above the critical $2.2 level. At present, the narrowing of the bands implies diminished volatility, with market participants looking for either a breakout or breakdown to decide the next major XRP price move.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Fed’s hawkish rate cuts unveil the illusion of liquidity: the real risks for global assets in 2025–2026

The article analyzes the current uncertainty in global economic policies, the Federal Reserve's interest rate cut decisions and market reactions, as well as the structural risks in the financial system driven by liquidity. It also explores key issues such as the AI investment boom, changes in capital expenditures, and the loss of institutional trust. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content is still undergoing iterative updates.

Cobo Stablecoin Weekly Report NO.30: Ripple's Comeback with a $40 Billion Valuation and the Stablecoin Transformation of a Cross-Border Remittance Giant

Transformation under the wave of stablecoins.

Bitrace's Perspectives and Outlook at Hong Kong FinTech Week

During the 9th Hong Kong FinTech Week, Bitrace CEO Isabel Shi participated in the Blockchain and Digital Assets Forum...

20x in 3 months: Does ZEC’s “Bitcoin Silver” narrative hold up?

You bought ZEC, I bought ETH, we both have a bright future.