Bitcoin LTHs Hit 5-Month High in Selling, but BTC’s Rally Stays Strong

Bitcoin is on the verge of breaking the $100,000 mark, but concerns about long-term holders taking profits could create short-term volatility. Despite this, the overall trend remains positive, with room for growth before any significant pullbacks.

Bitcoin is on the verge of reaching a historic milestone, with its price inching closer to the coveted $100,000 mark. This remarkable rally has fueled optimism among investors, signaling Bitcoin’s continued dominance in the cryptocurrency market.

However, despite the bullish outlook, Bitcoin is not entirely immune to potential bearish pressure. The backbone of Bitcoin’s price stability — long-term holders (LTHs) — appears to be wavering, raising concerns over possible downward movements in the near term.

Bitcoin’s Support Is Wavering

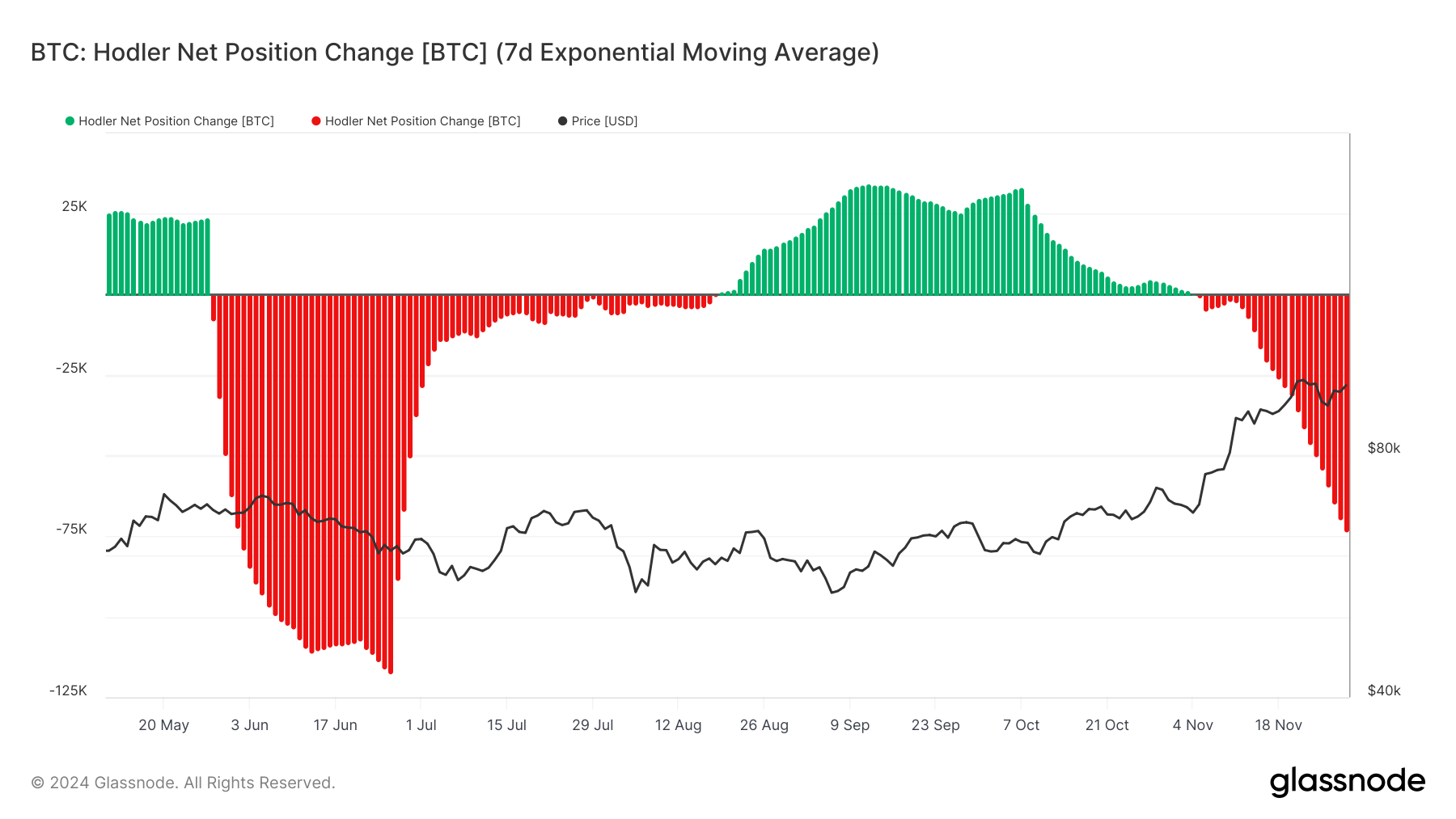

Long-term holders of Bitcoin have recently shown signs of bearish sentiment. The HODLer net position change indicator, which tracks the behavior of LTHs, has turned negative.

This shift indicates that a significant number of long-term investors are taking profits by selling their holdings. Negative values on this metric often signal a reduction in confidence, which could put pressure on Bitcoin’s price.

Since LTHs are considered the backbone of Bitcoin’s price, their selling activity has the potential to disrupt market momentum. These investors typically hold assets through market fluctuations, contributing to price stability.

When they begin to sell, it can lead to increased volatility, and if the trend continues, it could trigger a price correction. This potential selling pressure is something that Bitcoin investors are closely monitoring, especially with the $100,000 threshold so near.

Bitcoin LTH Net Position Change. Source:

Glassnode

Bitcoin LTH Net Position Change. Source:

Glassnode

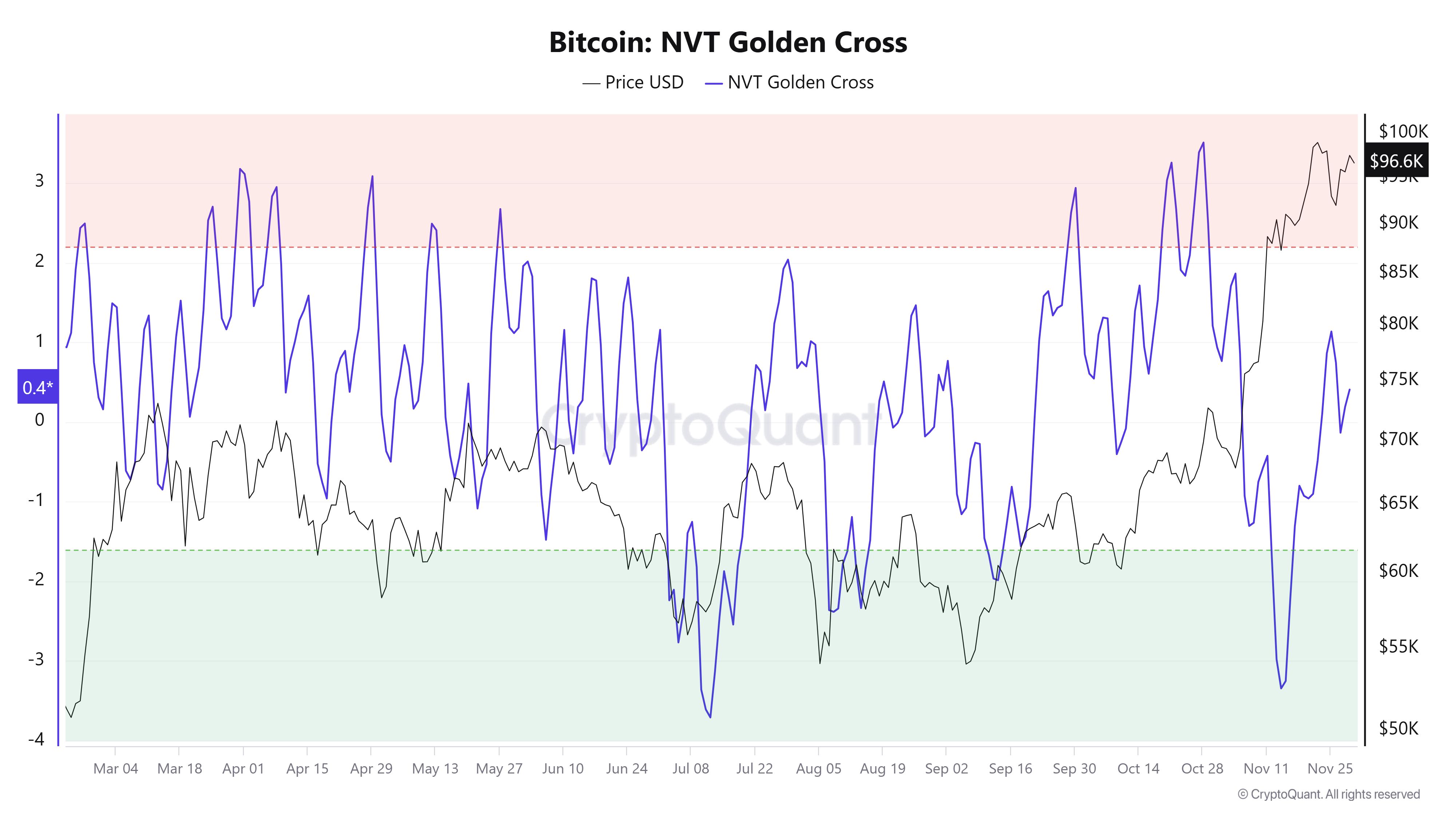

The broader macro momentum for Bitcoin remains strong despite the short-term bearish sentiment among LTHs. A key indicator to watch is the Bitcoin Network Value to Transactions (NVT) Golden Cross, which is currently sitting in the neutral zone.

While it’s not yet in the bullish territory (under -1.6), the NVT Golden Cross is an important signal for Bitcoin’s future price movements. Historically, when the NVT indicator enters the bearish zone (above 2.2), it has often been considered a short signal for the market.

However, Bitcoin has not yet reached this bearish zone, giving it room for further growth. The NVT Golden Cross is still a positive sign, indicating that Bitcoin has enough momentum to rise further before any potential downturn.

Bitcoin NVT Golden Cross. Source:

CryptoQuant

Bitcoin NVT Golden Cross. Source:

CryptoQuant

As long as the indicator remains in the neutral zone, Bitcoin has the opportunity to push towards $100,000 without facing immediate significant bearish pressure.

BTC Price Prediction: Making History

Bitcoin’s price is moving at $96,572, inching closer to the historic $100,000 mark. The cryptocurrency has seen significant upward movement in recent weeks, spurred by institutional interest and increased adoption. If the current trend continues, Bitcoin is poised to break through this psychological barrier, reaching a new all-time high of $99,595.

Should Bitcoin break the $100,000 mark, the next target could be $120,000. A successful push above $100,000 would likely trigger additional buying pressure from both retail and institutional investors. However, the potential for profit-taking from LTHs remains a concern, as any significant selling could cause a temporary pullback.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

Despite the short-term concerns, Bitcoin’s overall trend remains positive, and the recent NVT Golden Cross suggests that the path to $100,000 is still achievable. As long as Bitcoin maintains its position above key support levels, the long-term outlook remains bullish.

While LTH selling could create some volatility, Bitcoin is likely to continue its upward trajectory in the coming months, barring any major market disruptions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.