-

Ethereum’s recent performance highlights the ongoing volatility within the cryptocurrency market, with trading activity revealing mixed sentiments among investors.

-

Key metrics indicate a potential resurgence of buying interest, despite overall lower trading volumes and whale activity.

-

“The current state of Ethereum reflects uncertainty in the market, yet the recent uptick in buy volumes indicates a possible shift in investor sentiment,” remarked a market analyst.

Ethereum’s market dynamics showcase ongoing consolidation, yet signs of renewed buying interest may emerge as election uncertainties wane.

Market Consolidation and Investor Sentiment Surrounding Ethereum

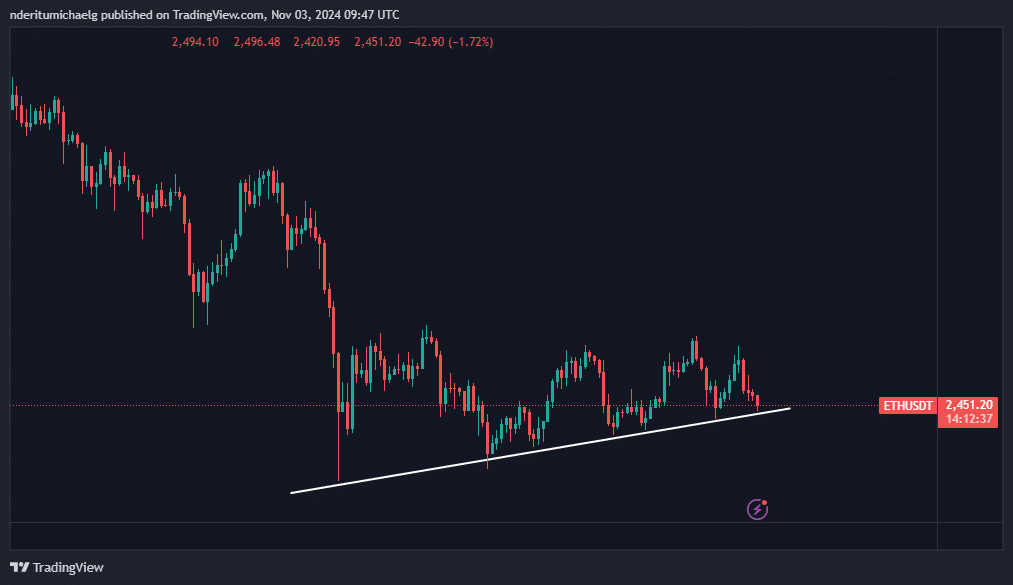

Over the past three months, Ethereum [ETH] has been predominantly characterized by a significant consolidation phase, struggling to maintain momentum above the critical $2,800 mark. This has prompted analysts to assess the underlying factors driving this stagnation.

Ethereum has shown a series of lower highs since August despite recent bullish expectations. This behavior hints at a possible accumulation phase where investors are strategically positioning themselves in anticipation of a breakout. However, the combination of declining whale activity and fluctuating trading volumes suggests that overall demand remains subdued.

Source: TradingView

The Decline in Whale Activity and Its Implications

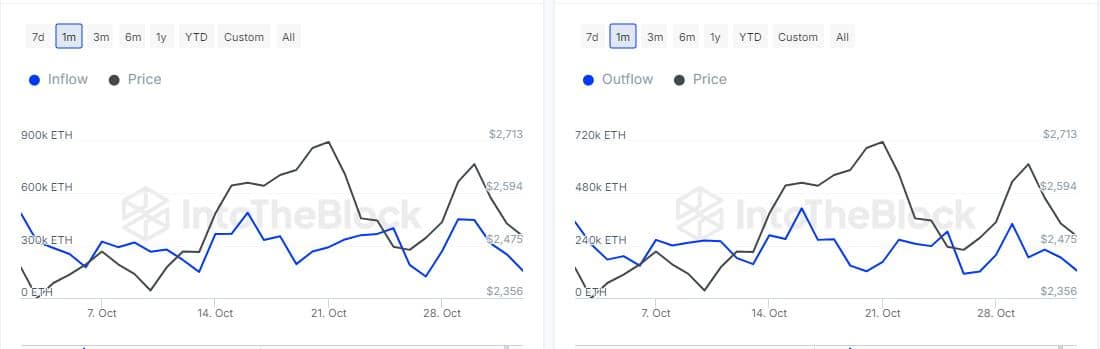

One of the significant observations in Ethereum’s< strong> performance is the decline in large holder activity. As of late October, large holder outflows have dipped considerably, suggesting a reduction in sell pressure from notable market players.

However, the inflows from whales have not indicated a resurgence in buying interest, perhaps reflecting ongoing concerns about market volatility. This investor restraint has led to a cautious atmosphere that reinforces the consolidation trend.

Source: IntoTheBlock

Analyzing Recent Trading Volume Changes

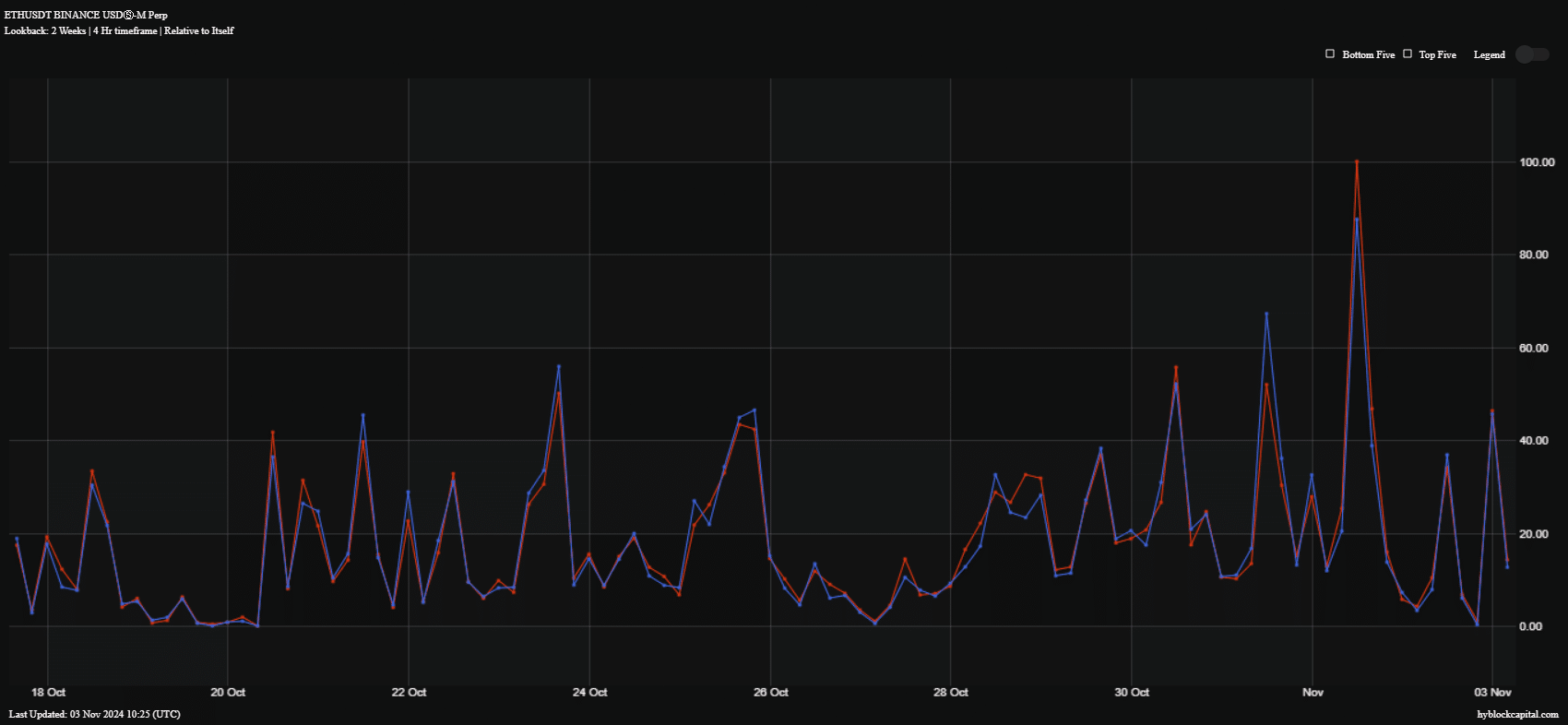

Despite the prevailing market conditions, a remarkable increase in trading volumes was recorded on November 1, where buying activity surpassed selling. This spike could be indicative of shifting sentiments among retail investors as they respond to the prevailing bearish trends.

Source: HyblockCapital

The Impact of Macro Events on Ethereum’s Outlook

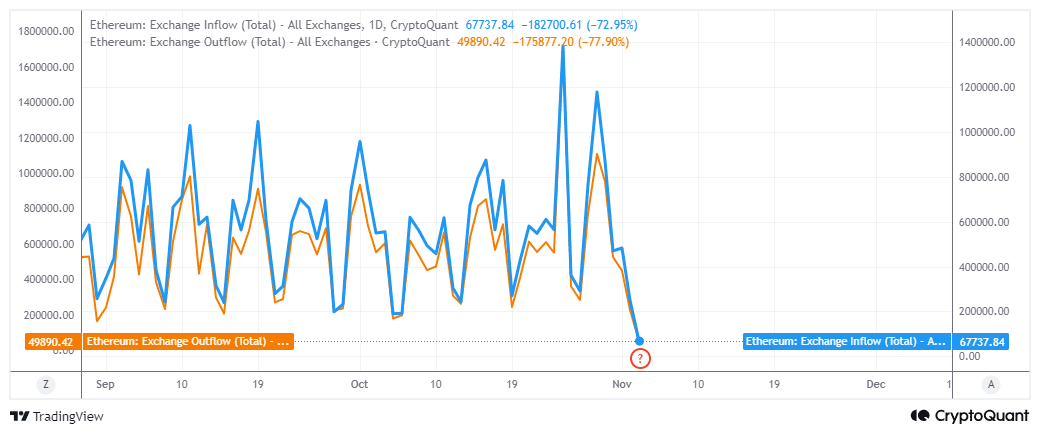

The uncertainty surrounding the upcoming U.S. elections has contributed to a notable drop in overall exchange flows, reaching levels not seen in 2024. Current data underscores a shift in market dynamics as investors appear to be waiting for potential indicators that might influence the broader economic landscape.

Source: CryptoQuant

Conclusion

In summary, Ethereum’s market behavior over the last three months encapsulates a landscape filled with uncertainty yet hints at potential recovery. With diminished whale activity and fluctuating volumes, the future of ETH may depend significantly on broader macroeconomic factors, especially the outcomes of the forthcoming elections. Investors remain cautious but are beginning to show signs of renewed interest as conditions evolve.