Stella offers up to 78% ARB/USDC.e pool yield

比特老马2024/10/22 07:01

ALPHA is a leveraged strategy protocol with a borrowing cost of 0%. At Stella, borrowers (or "leveragers") can take advantage of supported DeFi strategies without paying any borrowing costs. Lenders can receive actual returns from leveragers, and as a loan APY, the more returns leveragers receive, the more income lenders earn. This is achieved through Stella's "Pay-as-You-Earn" (PAYE) model, which aims to help leveragers and lenders achieve the highest potential returns.

On October 21st, Stella announced a high-yield option for Arbitrum users in the Uniswap v3 pool. Users can earn up to 71% annualized returns in the ARB/USDC.e (0.3%) pool or up to 78% annualized returns in the ARB/USDC.e (0.05%) pool. Stella is currently the only DeFi protocol that allows users to use leverage for liquidity provision (LP) on Uniswap v3, bringing unique return strategies to investors.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Bitcoin market capitalization rebounds to surpass $1.7 trillion, rising to 8th place among global assets

Chaincatcher•2025/11/23 09:58

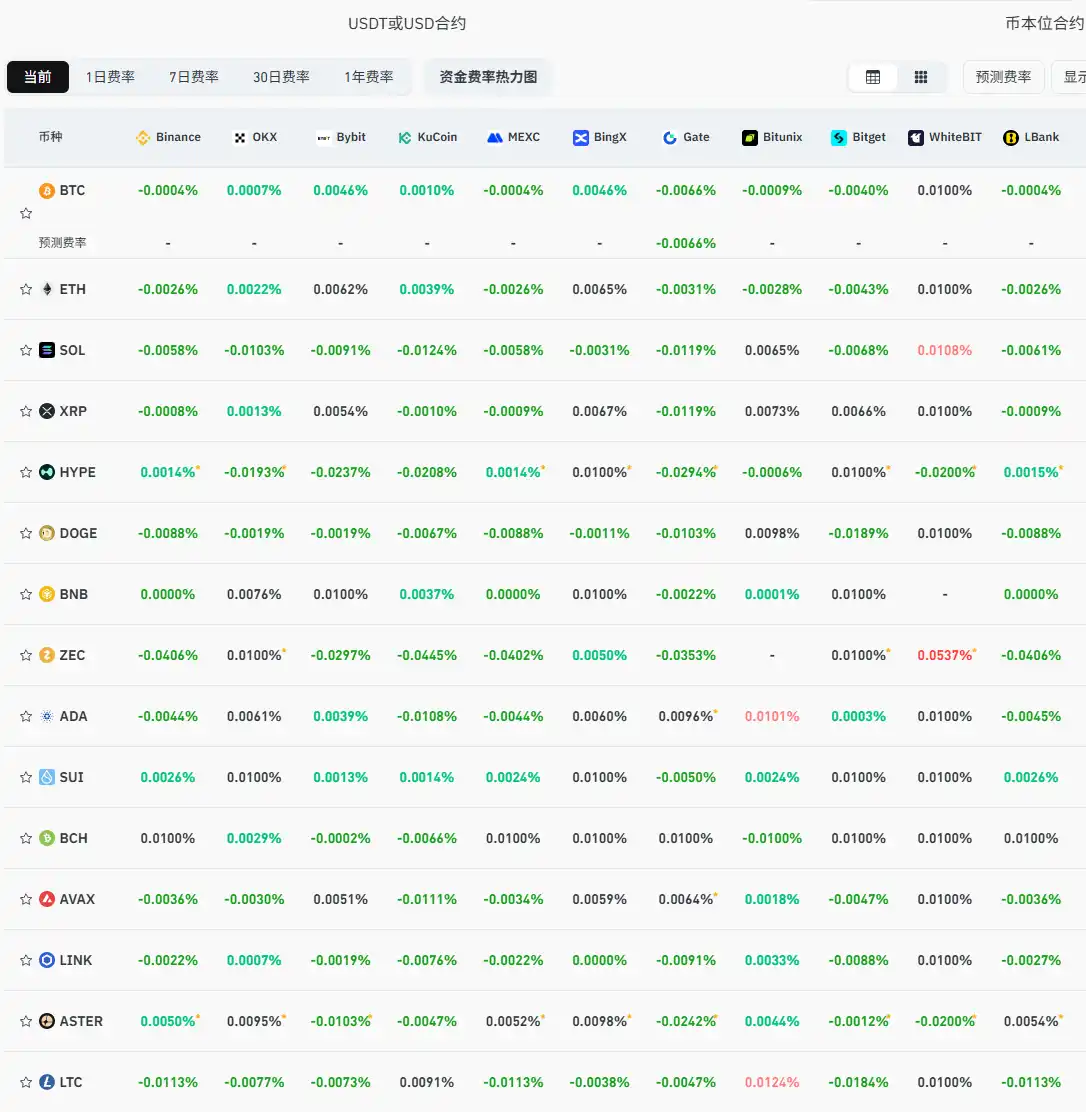

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

BlockBeats•2025/11/23 09:42

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$85,916.65

+2.57%

Ethereum

ETH

$2,808.68

+3.50%

Tether USDt

USDT

$0.9994

-0.00%

XRP

XRP

$2.03

+6.88%

BNB

BNB

$841.1

+2.36%

USDC

USDC

$0.9997

-0.02%

Solana

SOL

$129.71

+3.05%

TRON

TRX

$0.2746

+0.28%

Dogecoin

DOGE

$0.1439

+5.21%

Cardano

ADA

$0.4089

+2.55%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now