Futures Markets Fully Priced for 25 bps ECB Rate Cut

On Oct. 17, LSEG data showed that money markets were ready for a 25 basis point rate cut from the European Central Bank, which the market sees as 100 percent likely.Michael Brown, senior research strategist at Pepperstone, said the current backdrop is one of a faster-than-expected slowdown in inflation and a rapid loss of economic momentum. He wrote in a report, “Accompanying the rate cut is likely to be the now-familiar repetitive wording that policy will follow a ‘meeting-by-meeting’ and ‘data-dependent’ approach, with the MC not making any pre-set pre-commitment to a future interest rate path.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Treasury debt surpasses $30 trillion, doubling since 2018

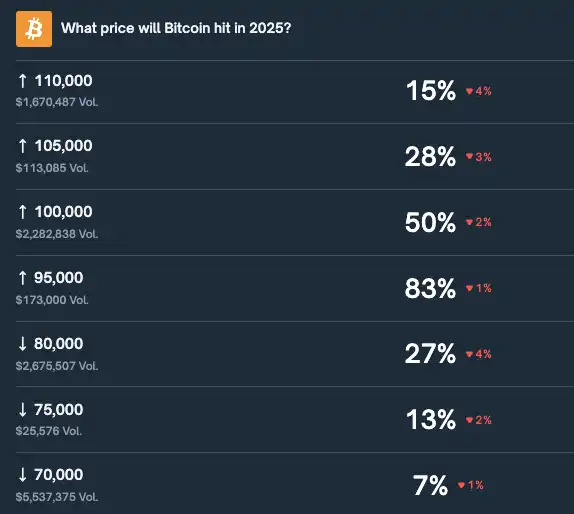

The probability of "Bitcoin reaching $100,000 again this year" on Polymarket is currently at 50%

Digital Asset completes $50 million financing, with participation from BNY Mellon, Nasdaq, and others