Grayscale has applied to the U.S. SEC to convert its mixed crypto fund, which includes BTC, ETH and SOL, into an ETF

According to reports, Grayscale Investments submitted an application to the U.S. Securities and Exchange Commission on Tuesday, requesting to convert its mixed crypto fund containing Bitcoin, Ethereum, Solana, XRP and Avalanche into an exchange-traded fund (ETF). The company has previously converted its Bitcoin and Ethereum funds into ETFs.

According to the company's website, Grayscale's cryptocurrency-based financial instrument - its Digital Large Cap Fund with trading code GDLC - is currently traded in over-the-counter markets with assets under management reaching $524 million. The fund is primarily composed of Bitcoin accounting for nearly 75%, followed by Ethereum at about 19%. According to company documents, the remaining portion consists of SOL, XRP and AVAX.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

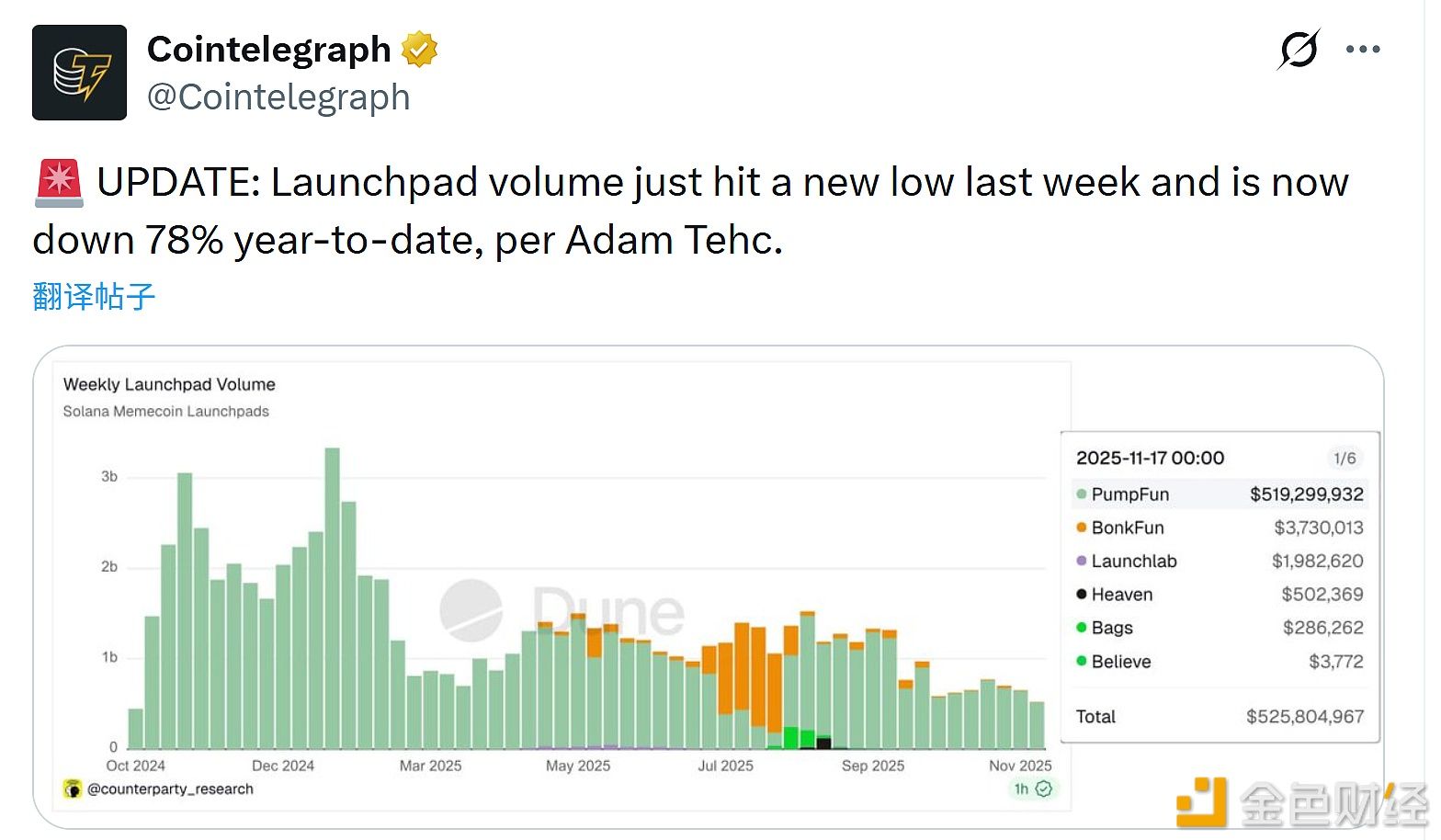

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93