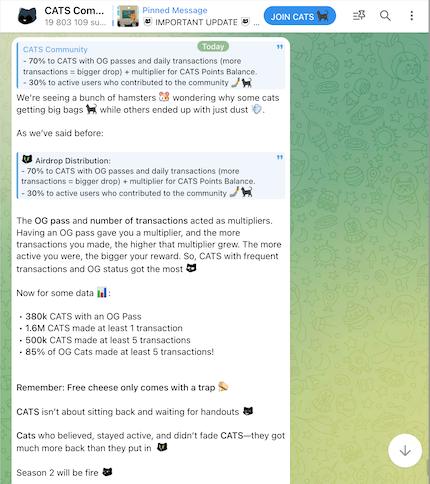

CATS on why some cats getting big bags while others ended up with just dust

We’re seeing a bunch of hamsters wondering why some cats getting big bags while others ended up with just dust.

As we’ve said before:

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

The OG pass and number of transactions acted as multipliers. Having an OG pass gave you a multiplier, and the more transactions you made, the higher that multiplier grew. The more active you were, the bigger your reward. So, CATS with frequent transactions and OG status got the most

Now for some data :

• 380k CATS with an OG Pass

• 1.6M CATS made at least 1 transaction

• 500k CATS made at least 5 transactions

• 85% of OG Cats made at least 5 transactions!

Remember: Free cheese only comes with a trap

CATS isn’t about sitting back and waiting for handouts

Cats who believed, stayed active, and didn’t fade CATS—they got much more back than they put in

Season 2 will be fire

P.S. We know that a small group of CATS still has issues with uncounted OG passes or transactions, even though most of the problems were handled and solved before the airdrop. We want to ensure that no cat receives fewer CATS than they deserve

Soon, we’ll be opening a CATS hotline for airdrop/balance issues to make sure every cat is taken care of

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0's Strategic Enhancement and Market Impact: Advancements in Blockchain Infrastructure and the Changing Landscape of DeFi

- Astar 2.0 redefines DeFi by addressing scalability, interoperability, and security through infrastructure upgrades like zkEVM and cross-chain protocols. - Strategic partnerships with Japanese web2 giants and innovations like dApp Staking v3 enhance real-world utility and community-driven governance. - By bridging Polkadot , Ethereum , and BSC ecosystems, Astar positions itself as a cross-chain hub, outperforming traditional DeFi's fragmented models. - Emphasis on security and compliance aligns with indus

DASH Aster DEX Listing: Could This Transform the Future of Decentralized Finance?

- Aster DEX, a hybrid DeFi perpetuals exchange, combines AMM and CEX features with multi-chain support (BNB, Ethereum , Solana) and a yield-collateral model offering 5–7% asset returns. - Post-TGE, its TVL surged to $17.35 billion within a month, driven by institutional backing (Binance, YZi Labs) and 1001x leverage in "Simple Mode," surpassing sector averages. - DASH token saw 1,650% TGE growth but stabilized at $1, reflecting speculative volatility, while institutional investors expressed cautious optimi

Vitalik Buterin's Promotion of ZK-SNARKs and the Transformation of Blockchain Infrastructure

- Vitalik Buterin advocates ZK-SNARKs optimization via modexp precompile removal, prioritizing Ethereum's ZK scalability over niche use cases. - Fusaka upgrade introduces PeerDAS, reducing data verification costs and doubling blob capacity to enhance L2 efficiency and attract enterprise adoption. - Zcash (ZEC) surges 400% while Immutable (IMX) and Hyperliquid gain traction, signaling ZK-SNARKs' expanding influence beyond Ethereum's ecosystem. - Investors face ROI potential in ZK infrastructure but must nav